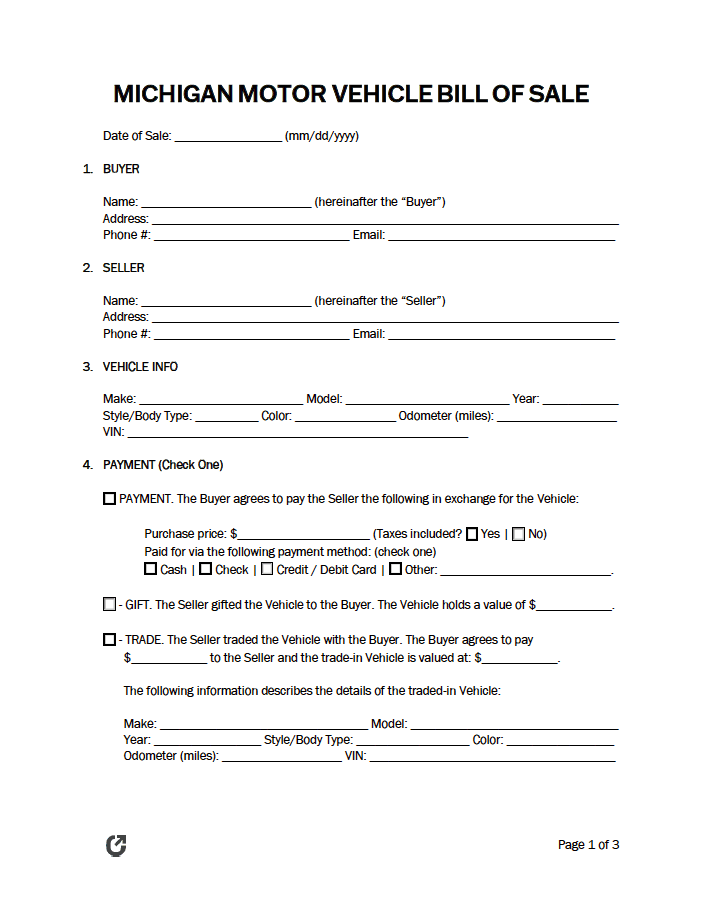

Michigan Motor Vehicle Bill of Sale Form

A Michigan motor vehicle bill of sale form depicts the details of a car transfer. It breaks down the information into easy-to-understand sections for others to review after the sale. The buyer and seller have the lawful duty of entering their full name, current address, phone number, email, and signature. They must also list the car’s description, including its make, model, year, body type, color, mileage, and vehicle identification number (VIN).

|

What is a Michigan Car Bill of Sale?

A Michigan car bill of sale elects the customer as the buyer and the merchant as the seller in a vehicle transaction. The person purchasing the car can pay in a standard format, such as cash, check, credit card, or debit card. They can also gift it to another person or discuss a trade deal with them. Regardless, both parties must refer to the “payment” section, check the box next to the most applicable option, and enter the car’s value. During a trade deal, they must describe the trade-in vehicle to establish a formal record.

What are the Buyer’s Tasks?

When purchasing or otherwise acquiring a vehicle, the interested party should take steps to ensure a fair deal. These measures include checking the car’s undercarriage, interior, equipment, and add-ons. For confirmation, a certified mechanic can examine it to determine its quality.

Potential buyers can order vehicle records online or by mail through the Michigan Department of State. They can request the current owner’s name, the car’s entire history, or archives between specified dates.

The buyer should only purchase the vehicle if the seller can provide the original, completed vehicle title. In other words, they cannot present copies or versions with alterations. Sellers must include the vehicle’s mileage, the sale date, purchase price, and signature. The odometer reading must match the speedometer, and the VIN must correspond with the sequence on the driver’s side dashboard.

Dealership

Buyers who purchase their vehicle from a dealership do not need to register and title it themselves. Instead, the dealer completes the forms with the customer, collects the fees and taxes, then sends the information to the nearest Secretary of State (SOS) office. The state must receive the paperwork within fifteen (15) days of the sale.

Per state law, the dealer must give the buyer a copy of each signed document. These forms include the application for title (Form RD-108), written warranties, odometer mileage statements (new vehicles only), buyer’s guide window stickers (used cars only), and finance contract lease agreements.

When purchasing a new vehicle, the dealer must present the former owner’s title to the person potentially buying it. This individual should review the title carefully to ensure it contains the required fields.

The dealership must issue the client temporary 15-day license plates and tags, which they must attach to the rear window until they receive the official ones. If they want to transfer their plates from a previous vehicle, the dealer must assist. The new owner must also note it on the application for title.

Private Seller

Buyers must take care of registration and titling after purchasing a vehicle through a private vendor. Michigan requires the new owner to transfer the title within fifteen (15) days of the sale. They must bring the completed title, insurance proof, and driver’s license for consideration.

The seller should go to the appointment with the purchaser to ensure a successful transaction. Individuals who cannot attend should ensure they have completed their section of the title, inputted the correct odometer reading, and provided their signature. If a lien exists, they should also give the buyer a lien termination statement or have the lien holder sign the title to indicate a loan release.

At the appointment, the SOS reviews the required paperwork and collects payment. The owner receives registration, license plates, and tabs if the vehicle passes. Residents who sold or disposed of a previous car can transfer their old plates to the new automobile. The title takes additional time to process; therefore, the state mails it to the owner once available. If a lienholder exists, they ship it to the financial institution or send it digitally through the electronic lien and title system (ELT).

Relative

The state follows the same procedure for private sales as it does when a relative gifts a car to a loved one or someone inherits the property. However, the recipient does not need to pay the 6% sales tax under certain circumstances. The donor can transfer the license plates to the new owner in this case.

Individuals who qualify for tax exemption and license plate transfers include spouses, parents, children, siblings, grandparents, grandchildren, and in-laws (i.e., mother, father, brother, sister, daughter, son, child, grandparent).

Out-of-State

New residents must visit an SOS office to transfer their out-of-state title to Michigan. They must provide the original title and registration, their driver’s license, proof of in-state insurance, and a lien termination statement or a signature from the lienholder on the title (if applicable).

If the lienholder lives outside of Michigan, the owner must also provide a photocopy or fax of the out-of-state title, a memo title, a validated title application, and a vehicle record printed on issuing Department of Motor Vehicles (DMV) letterhead. This information proves the vehicle has a title in the specified state.

What are the Seller’s Tasks?

The seller must take steps to ascertain the title transfers properly. Otherwise, the buyer can attempt to make legal accusations. As a result, the previous owner can be responsible for paying for tickets, fines, and other penalties caused by the new owner.

Dealership

Residents who do not wish to sell their vehicle privately can bring it to a dealership. The dealer assesses the car’s value based on its condition, then lists it. Since the business carries out most of the work, they take a percentage of the deal, meaning the owner does not collect as much money as a private sale.

Dealerships do not allow trade-ins if a lien exists on the title. If one previously existed, the owner needs a statement from the lienholder confirming they paid the loan.

The customer must remove their license plates from the vehicle before leaving the dealership. However, if they trade in the car, the dealer can transfer the plates to the new automobile if desired.

Private Sale

When selling a vehicle or giving it to a relative, the owner must complete the applicable section of the title. They must provide the car’s mileage, sale (or transfer) date, purchase price (or value), and signature. Next, they give the title to the buyer, who signs the document and enters their name, address, and signature. Sellers with illegible, lost, or destroyed titles must apply for a duplicate before transferring the vehicle.

The previous owner should accompany the buyer to their registration and titling appointment. They must bring photo identification and, if a lien exists, a termination statement or signature from the lienholder on the title. The person selling the vehicle must remove their license plates unless they transfer the car to an immediate family member.

Sellers who cannot join the purchaser at the SOS office should keep a copy of the title for no less than eighteen (18) months. This document protects them from potential legal claims or wrongful accusations. The previous owner is not responsible for violations of the law or damages if the title did not transfer, but they have proof of the sale.

Salvage/Scrap

The state replaces a standard title with an orange “salvage” title if the insurance company deems the car as “distressed.” Residents cannot operate vehicles with salvage titles on public roads. Instead, a police officer must recertify and title it as a regular automobile.

Cars with one (1) or more wrecked, destroyed, damaged, stolen, or missing significant components become “scrap.” The value of the repairs must meet or exceed 91% of the car’s pre-damaged cost. In this case, the SOS office exchanges the regular title for a scrap title, which prohibits its use on public or private property. The state cannot retitle the vehicle or approve it returning to the road with its current vehicle identification number (VIN).

How to Register a Car in Michigan (4 Steps)

Michigan requires vehicles to have a current registration, valid license plate and tab, title, and an insurance plan that abides by the “Michigan No-Fault” standards.

Established and new residents have fifteen (15) days to transfer the title into their name after purchase. If they miss the deadline, the state imposes a $15 late fee on top of the set fees.

Step 1 – Insurance

Before registering and titling a vehicle in their name, the owner must obtain insurance from a licensed agent. The policy must cover $20,000 for the bodily injury of one (1) person, $40,000 for the bodily injury of two (2) or more people, and $10,000 for property damage. It also must include $1,000,000 for property protection insurance (PPI) and does not have a maximum for personal injury protection (PIP).

Step 2 – Title

Titles prove ownership and record information about a vehicle. New owners must obtain a car title from a dealership or apply for a transfer at a local SOS office. Reassigned titles cannot have white-out marks, crossed-out words, or other alterations. The state does not accept tampered forms, meaning the seller must provide a duplicate to the buyer in this case. It costs $15 to transfer the title, plus an additional 6% sales tax.

The original title must contain the following information: 1) the correct odometer reading, 2) the completed “seller’s section” and signature, 3) the completed “buyer’s section” and signature, 4) the sale date, and 5) purchase price.

Step 3 – Registration

Registration must occur at an SOS office location. Buyers and sellers should choose an appointment date so both parties can attend. If the previous owner cannot come to the visit, the buyer should ensure they have the required documentation. The transaction cannot go through without the proper signed forms and payment. Instead, they would need to make another appointment, thus causing delays in their ability to drive the car.

| Bring the Following: |

Step 4 – Renewal

Michigan car registration tabs and license plates expire yearly on the owner’s birthday. However, residents can renew up to six (6) months before the expiration date. The state imposes a $10 late fee if they do not reapply on time. Law enforcement can give tickets and fine drivers who have an out-of-date registration.

Individuals can renew online, through the mail, at a self-service station, or by visiting an SOS office. If the insurance agency participates in the electronic insurance verification (EIV) program, the owner can renew online or at a self-service location. Companies that do not take part require the owner to mail their forms or visit the office to provide physical proof of the policy.

Online

Quick Renewal, Michigan’s online renewal system, requires the applicant to provide their license plate number, the last four (4) digits of the VIN, email address, and electronic payment (i.e., debit card, credit card, or bank account number). The individual should print their vehicle registration after completing the requested forms and sending in the required information. The state sends the new tabs by mail to the address on file.

When renewing by mail, the owner must present their vehicle registration renewal notice, payment (i.e., a check or money order made payable to the State of Michigan), and proof of insurance (if required). They can send the information using the pre-addressed return envelope found with the renewal notice.

Self-Service Stations

The state also provides self-service stations for residents to renew their registration conveniently. To use this option, they must have their renewal notice or license plate number, the last four (4) digits of their VIN, and payment (i.e., debit card, credit card, or cash). The individual receives their new tabs instantly; however, they receive their registration by mail.

SOS Office

Residents can also visit the office to send their renewal paperwork. They must give the staff their notice, current vehicle registration, or license plate number. In addition, the state requires their driver’s license, proof of insurance (if applicable), and payment (i.e., cash, check, money order, debit card, or credit card).

| Mailing Address: |

| Michigan Department of State Internal Services Section 7064 Crowner Drive Lansing, MI 48918 |