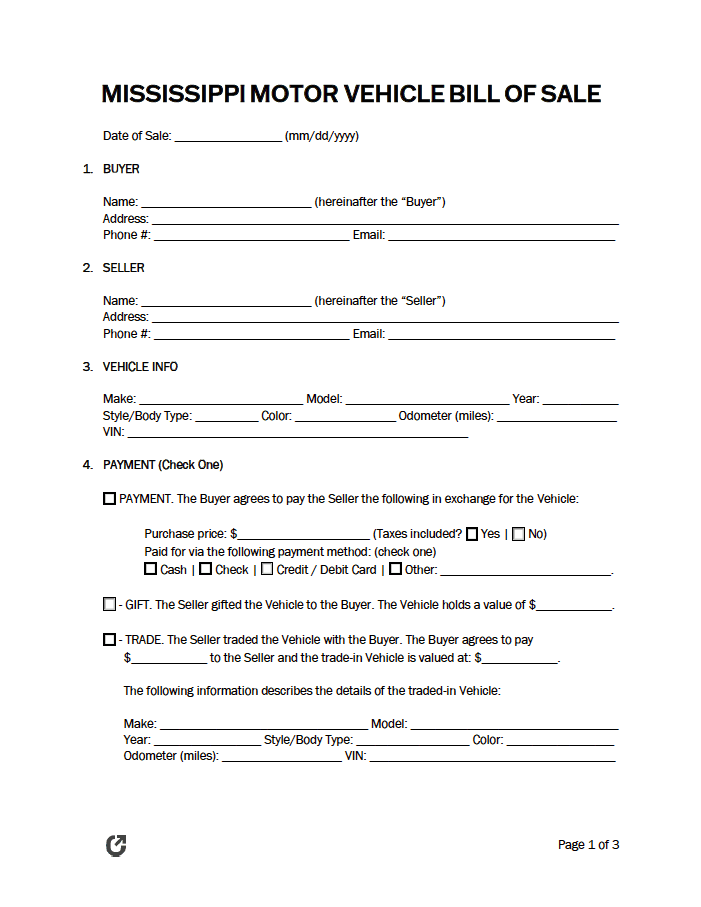

Mississippi Motor Vehicle Bill of Sale Form

A Mississippi motor vehicle bill of sale form helps others assimilate information about a car, truck, or van. More specifically, it focuses on the automobile’s condition and value. The buyer and seller must relay the transaction details, such as how they exchanged the property and how the new owner paid for it. Like a contract, either person can reference the form post-sale to learn about the deal. Although the title generally establishes ownership changes, the bill of sale, being a secondary resource, backs up the claims. It holds more power if the buyer and seller have it notarized by an official.

|

What is a Mississippi Car Bill of Sale?

A Mississippi car bill of sale provides the buyer and seller with a free transaction notice. The document, like a receipt, lists the contact information of both parties and describes the car available for purchase. Once the buyer decides to buy, the person filling out the form enters the automobile’s primary descriptors and the amount paid to the seller. Transfers that happen by gift or trade must include the original car’s value and the signifiers of the trade-in vehicle. The state does not recognize the form as “official” until both parties acknowledge each question and sign.

What are the Buyer’s Tasks?

When making a purchase, buyers should use caution to prevent scams and fraudulence. This fact remains especially true when buying a vehicle. Sellers can illegally alter information and make undocumented car changes before listing them for sale. Therefore, the interested party must research before transferring the title, particularly if they want to buy a used vehicle. In Mississippi, lemon laws and warranties only apply to new vehicles. If the buyer discovers mechanical or physical damage to a car post-sale, the state does not have a legal obligation to assist them. They cannot receive a refund or free part replacements and must handle and pay for the repairs themselves.

Luckily, buyers can utilize resources to help them learn more about the car’s history, thus preventing challenges after the transfer. The National Motor Vehicle Title Information System (NMVTIS) provides citizens with an educational video. It highlights the process and red flags to look out for when car searching. Individuals can also use the state’s title verification program for research purposes.

Buyers should never buy a vehicle without a title. Commonly, scammers tell individuals they cannot complete the title or that they plan to fill it out later. Individuals should not negotiate with sellers who do not want to hand over the title, provide inaccurate information, or make future promises. The Title Bureau requires that anyone who does not have a title contact them at (601) 923-7640.

Otherwise, if the buyer trusts the seller and decides to go through with the deal, they must enter their printed name and signature on the title. They cannot transfer their previous car’s license plate to the new vehicle per state law. Instead, they must surrender them to the county tax collector during registration.

What are the Seller’s Tasks?

Sellers should have the title in hand before listing their car for sale. The document must not have damages, tears, burn marks, or other mutilations. If it does, the person selling the vehicle must apply for a new title. After completing the application, they must wait ten (10) to fourteen (14) days to receive it by mail. If they wish to pay a $30 fee, they can fast-track the document to have it arrive within seventy-two (72) hours.

Whether transferring ownership by sale or gift, the seller must complete the title, and the buyer must inscribe their full name and signature. If the document does not have room for the purchase price or is illegible, both parties must fill out and sign a bill of sale. If the transfer occurs by gift to a parent, child, spouse, grandparent, or grandchild, they must also submit a completed Affidavit of Relationship, which they retrieve from a tax collector’s office.

After the transaction, the seller must remove the license plates from the vehicle. It is illegal to transfer plates from one car or person to another; therefore, the seller must bring them to their local tax collector’s office. The state cancels the plates, thereby releasing the previous owner’s liability.

As a result, the new owner assumes responsibility, meaning the buyer cannot blame the seller for accidents, tickets, or fines associated with the car afterward. For additional safety, the previous owner should make a copy of the front and back of the title and/or bill of sale to prove that the ownership changed.

How to Register a Car in Mississippi (4 Steps)

Residents must submit the registration forms and documents to their local tax collector’s office within seven (7) business days of the transaction. If they purchased it out-of-state, they have forty-eight (48) hours to bring the car to Mississippi and seven (7) more days to tag it. Out-of-state military personnel stationed in Mississippi, and full-time students, do not need to register their cars in the state.

New residents have thirty (30) days to register their vehicle in Mississippi if they have a valid out-of-state registration. Car owners who renew late must pay the associated fees, which include a $250 penalty. In addition, they are not allowed Legislative Tag Credit if they have an expired plate and/or have never registered their car in the state.

Owners of cars with a gross vehicle weight (GVW) of 10,000 pounds or less can register and title through their nearest county tax office. Vehicles weighing over 10,000 pounds that travel across state borders must go through registration at the Clinton Department of Revenue location. Mississippi does not require emissions testing or inspections unless the car has tinted windows.

Step 1 – Insurance

Mississippi law requires residents to have an insurance plan before registering and titling the vehicle in the state (§ 63-15-43). The car owner must choose a reputable insurance provider and ensure their program aligns with the local requirements.

Insurance policies operate on a per accident basis. It must provide coverage of $25,000 for the bodily injury or death of one (1) person and $50,000 for two (2) or more people. The plan must also include $25,000 of damage to property.

Step 2 – Title

Vehicle titling procedures depend on the type of transaction. For example, dealerships generally handle titling and registration for residents, whereas private sales require the owner to submit the documents themselves. People moving into Mississippi from another state also have rules to follow when submitting their information.

Incoming residents who purchased their vehicle in a foreign state must provide their current out-of-state title and odometer disclosure statement (Form 78015). If they bought it in Mississippi or the other state never titled it, they must submit the Manufacturer’s Statement of Origin (MSO).

In other cases, another state, leasing company, or lienholder possesses the title. The owner must give the tax collector’s office the out-of-state registration receipt or duplicate title. Then, the state discusses the matter with the title holder to retrieve the document. During this process, the registrar cannot operate the vehicle as they do not have a valid registration.

The processing time for titles falls between three (3) or four (4) weeks after submission. Vehicle owners receive the information by mail unless the state declares an issue with the data. Under these circumstances, they must submit the missing or incorrect forms or details. Individuals who need the title right away can pay an additional $30 for a fast-track title, which takes seventy-two (72) hours to receive.

Step 3 – Registration

Established and new residents must register their car for the first time at their nearest county tax collector’s office. The state does not accept initial registrations by mail or online. Therefore, the interested party must make an appointment with their local office and bring the required paperwork on the selected day. They must also have cash, check, or card for the general fees and taxes. Owners of cars weighing 10,000 pounds or less must pay 5% of the net purchase, whereas vehicles weighing over 10,000 pounds owe 3%.

Bring the Following:

|

Step 4 – Renew

Vehicle tags in Mississippi expire annually. The county office mails a renewal notice, which the owner can use to re-register their car online, in person, or by mail.

However, even if the individual does not receive the renewal notice, they still must send in the information on time. Otherwise, they receive fines and penalties. The state has a system in place that increasingly fines the resident. For example, they have a 5% minimum and 25% maximum on the amount owed. After the charges reach 25%, the resident forfeits legislative credit.

Penalties for Late Renewals

| DAYS AFTER EXPIRATION | PERCENTAGE OWED |

| Sixteen (16) to Thirty-One (31) | 5% (Minimum) |

| Thirty-One (31) to Sixty-One (61) | 10% |

| Sixty-One (61) to Ninety-One (91) | 15% |

| Ninety-One (91) to One-Hundred Twenty-One (121) | 20% |

| One-Hundred Twenty-One (121) to One-Hundred Fifty-One (151) | 25% (Maximum) |