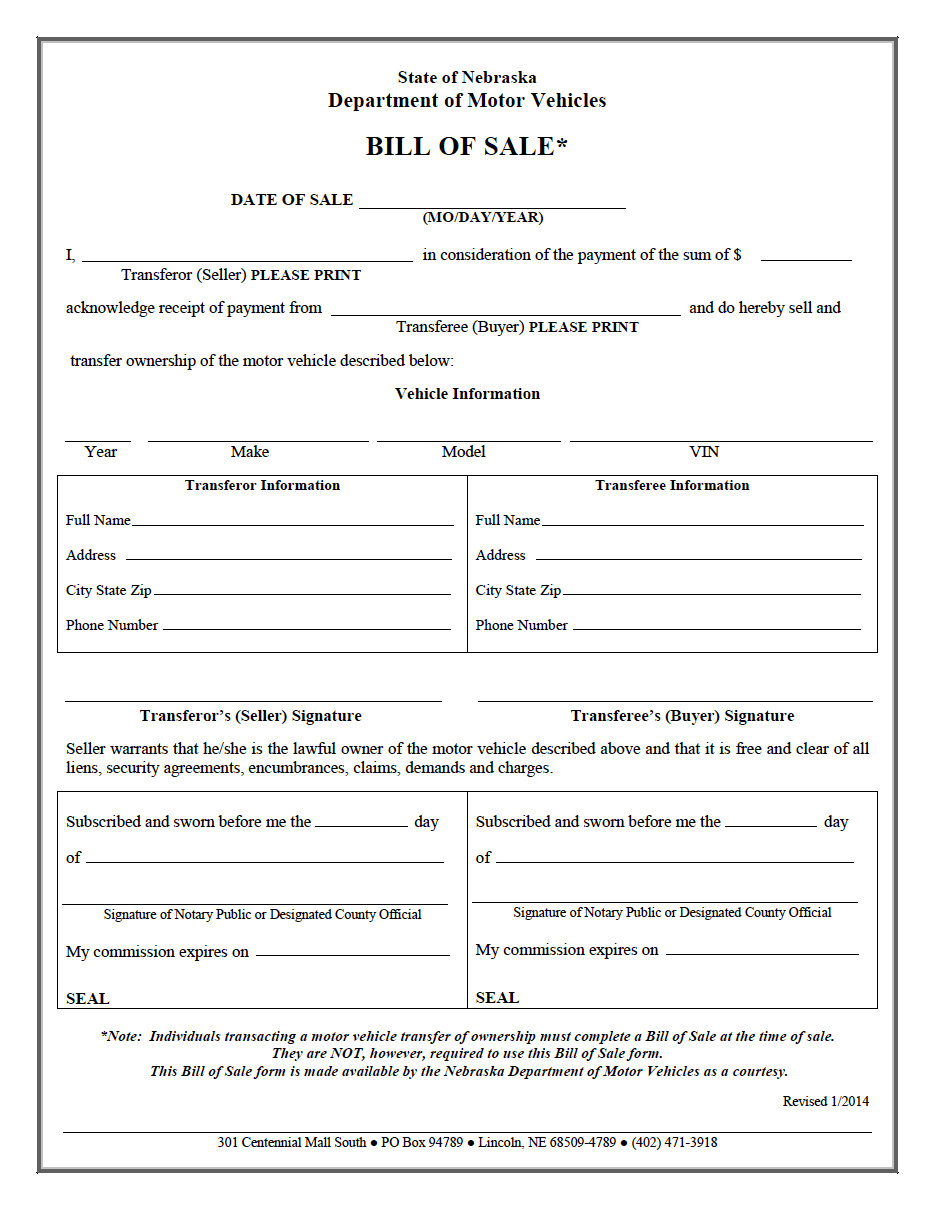

Nebraska Motor Vehicle Bill of Sale Form

A Nebraska motor vehicle bill of sale form exhibits the pertinent details of a car transfer. The document, made available through the Nebraska Department of Motor Vehicles (DMV), allows the transferor and transferee to enter their full name, address, phone number, and signatures. It also references the purchase amount, sale date, and the vehicle’s year, make, model, and vehicle identification number (VIN). Individuals can use the state-provided bill of sale, although it is not a requirement. All forms, regardless of origin, must have a notary seal of approval for authentication purposes.

|

What is a Nebraska Car Bill of Sale?

A Nebraska car bill of sale directs buyers and sellers to record data about vehicle transactions. The information written in the form remains permanent, with copies created for all parties to keep. Later, if needed, they can use the document to prove their obtainment or removal of ownership. Per state law, the bill of sale only holds significance if both parties signed in the presence of a notary public. Otherwise, legal offices and individuals can reject it since it does not formally verify that the transfer happened. Each person who signs is responsible for providing only truthful and valid information.

What are the Buyer’s Tasks?

Before completing a vehicle transaction, the buyer must enter their name, address, and signature into the appropriate sections of the title. If the seller discloses the information, but the buyer does not, the state considers “it an “Open Title,” which is considered illegal. As a result, county officials, the Department of Motor Vehicles (DMV), or law enforcement can take the document.

Purchasers must have the completed, signed title within thirty (30) days of buying the vehicle. Cars needing a new title require the buyer to send an application and $10 to the county treasurer within the same time frame.

What are the Seller’s Tasks?

The seller must fill out the applicable parts of the title, including the odometer certification, before giving it to the buyer. If liens exist, they need to provide release documents proving they have paid off the loan.

Per state law, the merchant has to fill out a bill of sale or a Nebraska Sales/Use Tax and Tire Fee Statement (Form 6) with the purchaser. This document supplements the title and allows the Department of Revenue (DOR) to determine the owed sales taxes properly.

How to Register a Car in Nebraska (5 Steps)

Owners must register their vehicles through their nearest treasurer’s office. Newly purchased cars require registration and payment within thirty (30) days of the sale.

Step 1 – Insurance

Cars within Nebraska state borders must have a valid insurance policy (§ 44-6408). The plan must include: 1) $25,000 for the bodily injury or death of one (1) person and $50,000 for two (2) or more persons, and 2) $25,000 for property damage per incident. Nebraska only registers vehicles with up-to-date insurance coverage.

Owners must ensure proof of insurance remains in a safe location within the vehicle. Acceptable evidence includes the certificate of insurance, bond, property bond, certificate of deposit, and/or certificate of self-insurance.

Step 2 – Title

When the car sale occurs, the owner must have the intact title in their possession. Individuals who do not have a title (or an illegible title) must apply for a duplicate before the vehicle transaction. They can apply for another title by submitting a notarized, signed application and $14 to their closest treasurer’s office. Buyers and sellers must sign the title in the appropriate places, or else the document becomes void.

Step 3 – Vehicle Inspection

Motor vehicles in Nebraska must pass inspection before registration. Owners must contact their local treasurer’s office to have their cars inspected. They must bring proof of ownership, such as the title, at the time of the appointment. It generally costs $10 to have this assessment completed.

The vehicle inspector compares the VIN to the number on the title and checks the mileage reading to ensure it matches the odometer certification. If it passes the review, the certified individual provides an official, signed inspection form, which lasts for ninety (90) days. Residents must give this document to their county treasurer with the current title and application.

Vehicle owners residing in another state can have their cars inspected at a State Police station in their current location. They must complete Nebraska Vehicle Inspection Form (NSP455) and send it with a payment of $10 to:

Nebraska State Patrol

Auto Fraud Division

4600 Innovation Drive

Lincoln, NE 68521

Step 4 – Registration

County treasurer offices in Nebraska handle first-time car registrations. Alternatively, residents can mail their paperwork and payment. They must submit proof of their insurance (original form only), proof of paid tax (sales or excise), and a copy of a signed lease agreement (for leased vehicles only).

Owners must pay their taxes during the first registration and each year after until the car reaches fourteen (14) years old. The state calculates the base taxes according to Manufacturer’sturer’s Suggested Retail Price (MSRP). As the vehicle ages, the annual tax amount decreases.

Motor vehicle fees depend on the car’s value, weight, and use; they qualify for adjustments over time. On the other hand, registration fees are at the state’s discretion and, as of 2022, cost a flat rate of $15.

Bring the Following:

|

Step 5 – Renew

Nebraska car registrations run on a staggered, monthly basis. The expiration date depends on the purchase month of the vehicle. However, if a person owns two (2) or more cars, they can register from January to December or annually starting on the month selected by the owner. Individuals can find more information about this process on their registration receipts.

Renewals can occur online, in person through their local treasurer’s office, or by mail. They must provide their expiring registration document and the original copy of their insurance plan.