Finance Templates

A finance template is a form used to handle matters involving money. Individuals use finance templates to create budgets, monitor spending, or track transactions. The documents also act as a record of items purchased, transferred funds, and money owed.

Individuals improve their financial health by regularly using a finance template. Overall, they have more economic freedom and less financial burden by reserving money for the future. For example, a person who puts money away each week can retire much earlier than someone who does not save. As a result, they feel less stressed about their future financial situation.

In addition, using a finance template for budgeting allows individuals to cut back on spending in certain areas, such as groceries, entertainment, or takeout. If they budget correctly, they can use the extra money to go on vacation, attend an event, or enjoy a special occasion.

Types (1)

What is a Finance Template?

A financial template is a form that allows an individual to regulate their monetary spending and saving. It gives people more control over their finances to establish budgets for spending. They can also start or maintain a savings account for emergencies, retirement, trips, and much more.

Individuals focusing on budgeting must decide the limits feels best for them. Depending on the information they track, they may have one or many budget(s). For example, people create family, business, household, and special occasion budgets for personal matters. They might also have a daily, weekly, or monthly budget that they closely follow.

Finance templates can help people discover ways to minimize spending, handle their savings account, and compare prices. For example, people often focus on grocery spending and saving. Using a template, individuals can compare prices between stores and items. With this information, they can make the most economical food choices.

In addition to budgeting and saving, a person can use a finance form for the following:

- Daily transactions;

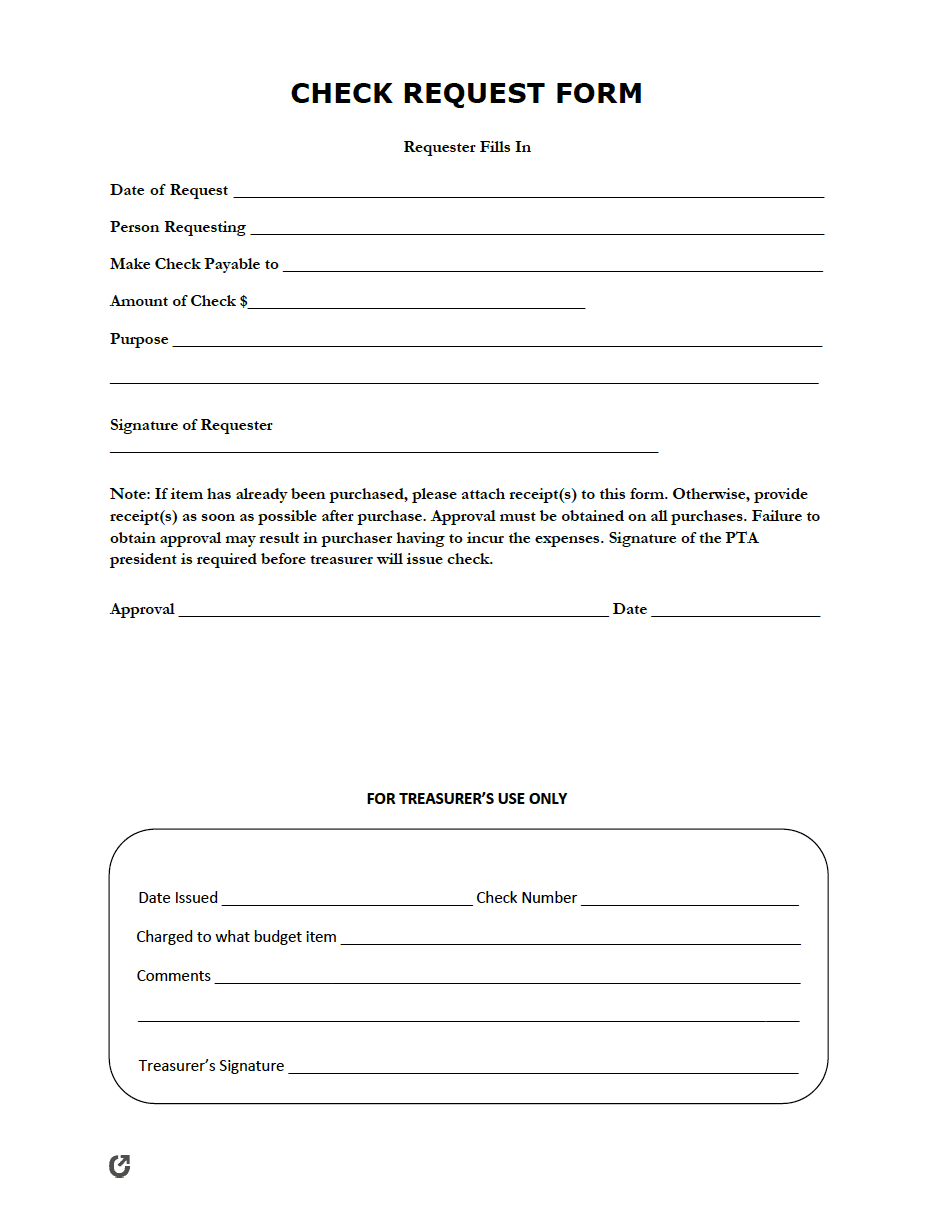

- Keeping a receipt of payments;

- Managing debts (i.e., student loans, mortgages, credit cards, checkbooks, etc.)

- Loan payoff calculators;

- Investments;

- Bank statements; and/or

- Monitoring gross and taxed income.