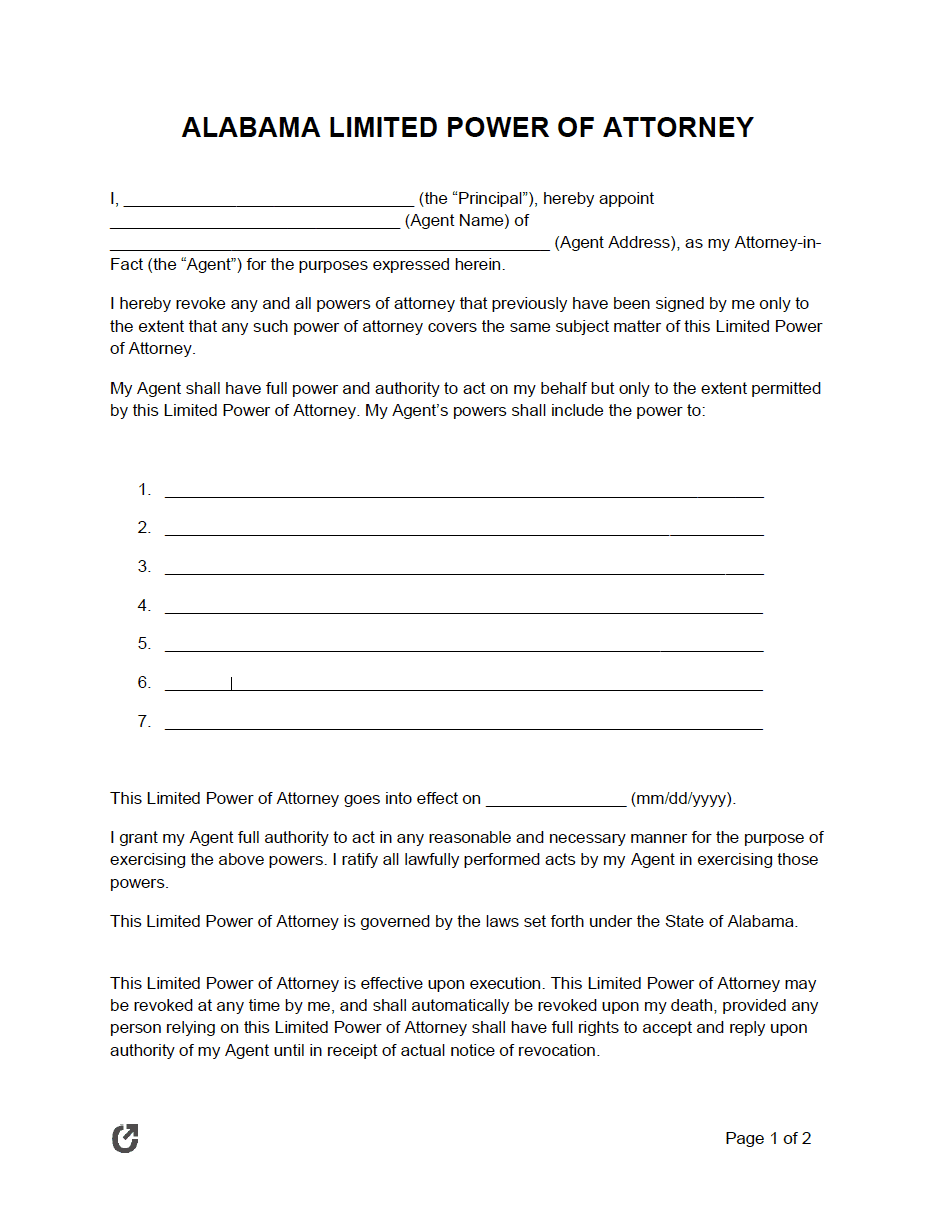

Alabama Limited Power of Attorney Form

An Alabama limited power of attorney form enables a person, known as the principal, to appoint another individual, called the agent, to perform specific tasks or make decisions on their behalf. Often relating to business or personal life matters, the agent’s assigned duties may include buying or selling personal property, cashing checks, or signing paperwork for the principal. Each document should outline tasks with corresponding deadlines to ensure clarity and organization. The principal must complete separate limited power of attorney forms for unrelated responsibilities or duties with specific due dates.

|

What is an Alabama Limited Power of Attorney?

An Alabama limited power of attorney form is a legal document that grants an agent specific, restricted authority to act on behalf of the principal. Being short-lasting and narrowly defined, it ensures that the agent’s power remains limited, requiring them to adhere to the written instructions provided by the principal.

Should the principal decide to terminate the agreement, they may complete a revocation form and distribute it to the agent, businesses, banks, or other involved parties. Consequently, the agent loses the ability to execute tasks using the limited power of attorney, effectively ending their representation.

Who Uses Limited Power of Attorney Forms?

Individuals or entities often use limited power of attorney forms to assign specific, time-bound, or restricted authority-related tasks. Some typical users of limited power of attorney forms include:

- Individuals who require someone to manage their affairs during a temporary absence, such as military deployment, extended travel, or medical treatment.

- Business owners who need a representative to handle specific business transactions, sign contracts, or manage financial matters in their stead.

- People facing medical procedures or health-related issues who designate an agent to make healthcare or financial decisions for a limited time.

- Principals who want an agent to handle a single transaction, such as real estate closings, vehicle sales, or investment decisions.

- Elderly individuals requiring assistance with day-to-day financial or personal matters for a defined period or specific tasks.

These forms provide a clear, concise scope of authority, ensuring the agent can act only within the limits specified by the principal.