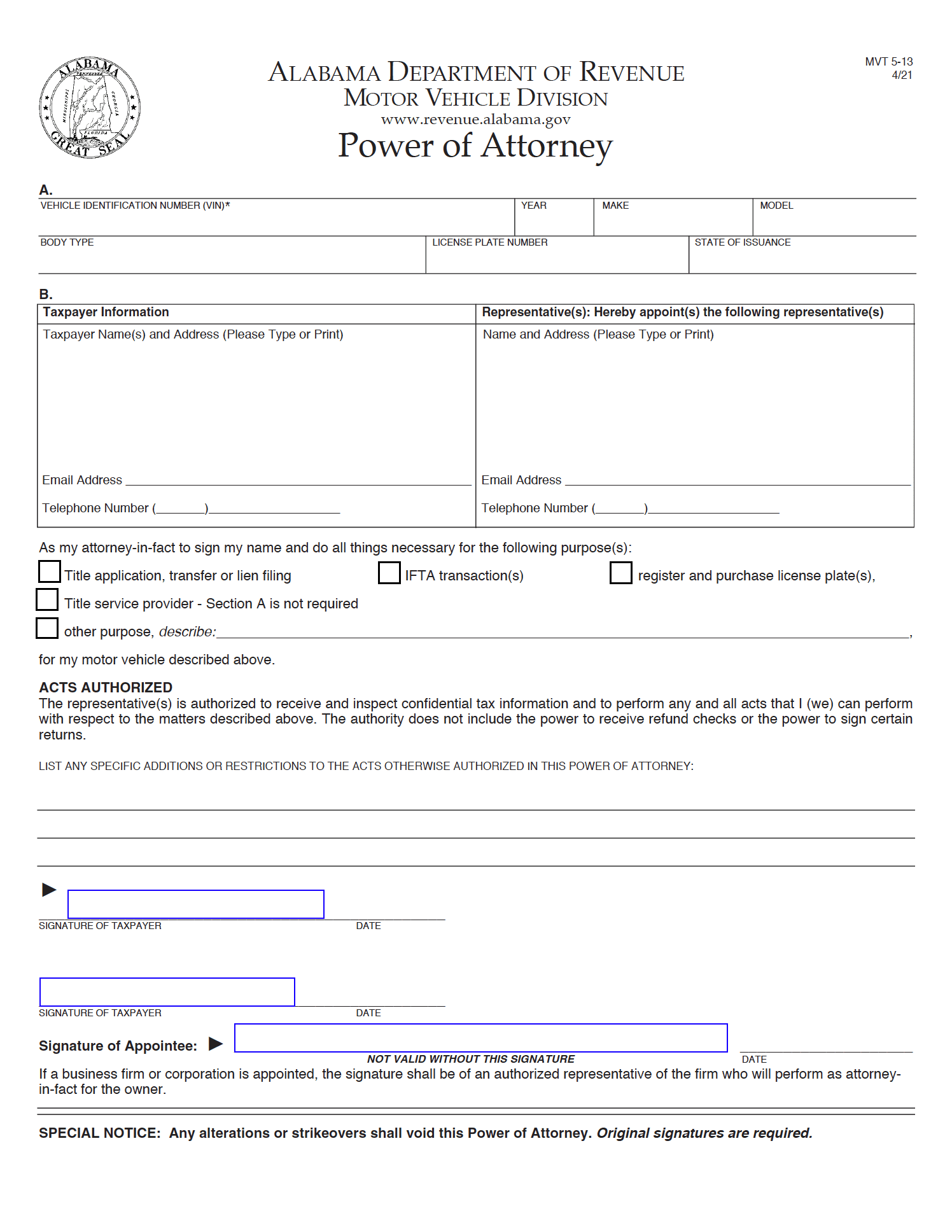

Alabama Vehicle Power of Attorney (MVT 5-13)

An Alabama motor vehicle power of attorney form (MVT 5-13) is a concise legal document used by a vehicle owner to authorize another individual, the representative, to manage tasks such as selling, registering, or repairing the car. While Alabama law does not mandate the notarization of the document by the vehicle owner, obtaining a notary public’s signature lends credibility and formality to the form. Notary services can be accessed online through eSign.com, typically at a $25 fee, or in person at government offices, libraries, post offices, and other establishments.

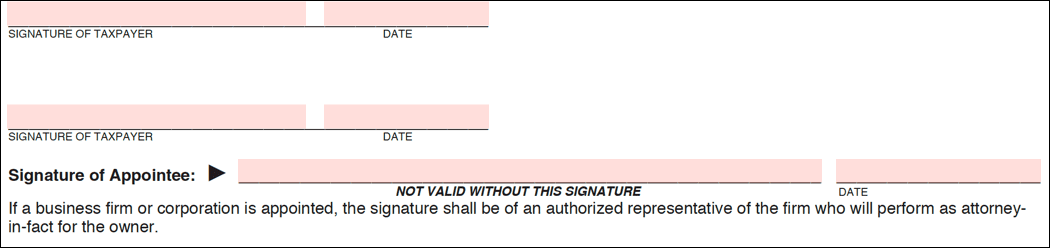

| Signing requirements: The state of Alabama requires the form to be signed by: 1) the taxpayer(s), and 2) the representative (also known as the “appointee”). |

What is an Alabama Motor Vehicle POA?

An Alabama motor vehicle power of attorney grants legal authorization for a trusted individual to manage vehicle-related tasks on behalf of the owner. In addition to the primary functions of an Alabama motor vehicle power of attorney form, vehicle owners must understand the importance of selecting a trustworthy representative. This individual will have the authority to make crucial decisions and execute transactions related to the vehicle, making their integrity and reliability paramount. When completing the form, it is advisable to specify the scope and duration of the representative’s authority, further protecting the vehicle owner’s interests.

How to Write an Alabama Motor Vehicle POA

Download: PDF

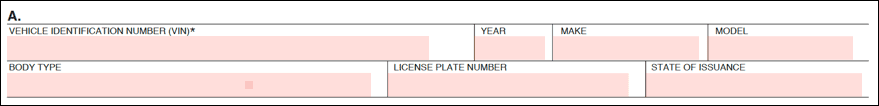

Step 1 – Vehicle Details

In section A, write the following information about the car:

- Vehicle Identification Number (VIN)

- Year (e.g., 2005)

- Make (e.g., Ford)

- Model (e.g., Focus)

- Body type (e.g., sedan)

- License plate number

- State of issuance (i.e., the state issuing the license plate)

Note: If filling out this form as a title service provider, skip Section A.

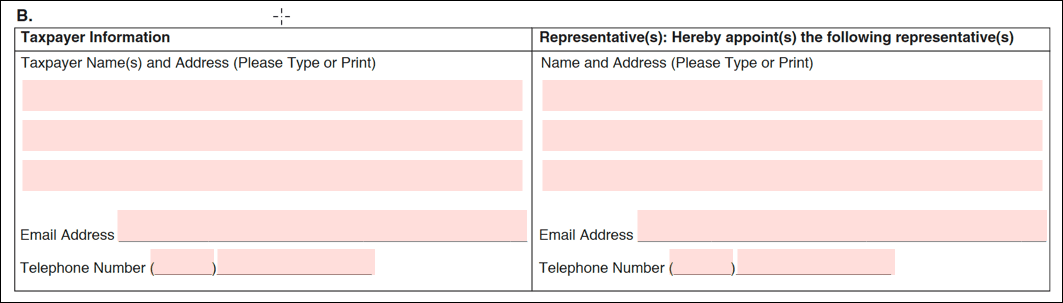

Step 2 – Owner and Representative Information

Provide the personal information for the car owner (taxpayer) and the representative (the person authorized to act on the taxpayer’s behalf).

In Section B, include the following:

- Taxpayer name(s) and address

- Taxpayer email address

- Taxpayer phone number

- Representative name(s) and address

- Representative email address

- Representative phone number

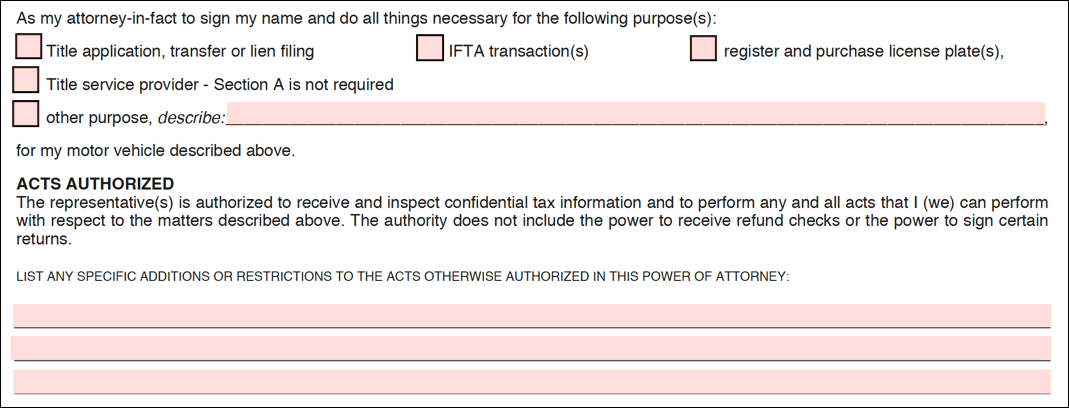

Step 3 – Select Authorized Acts

Under Section B, place a checkmark next to the acts the taxpayer authorizes the representative to perform.

Optional: Write, on the lines provided, any specific additions or restrictions for the representative.

Step 4 – Sign

The taxpayer and representative must both sign and date the form.

Note: the representative will sign on the line indicated with “Signature of Appointee.”