Colorado General Power of Attorney Form

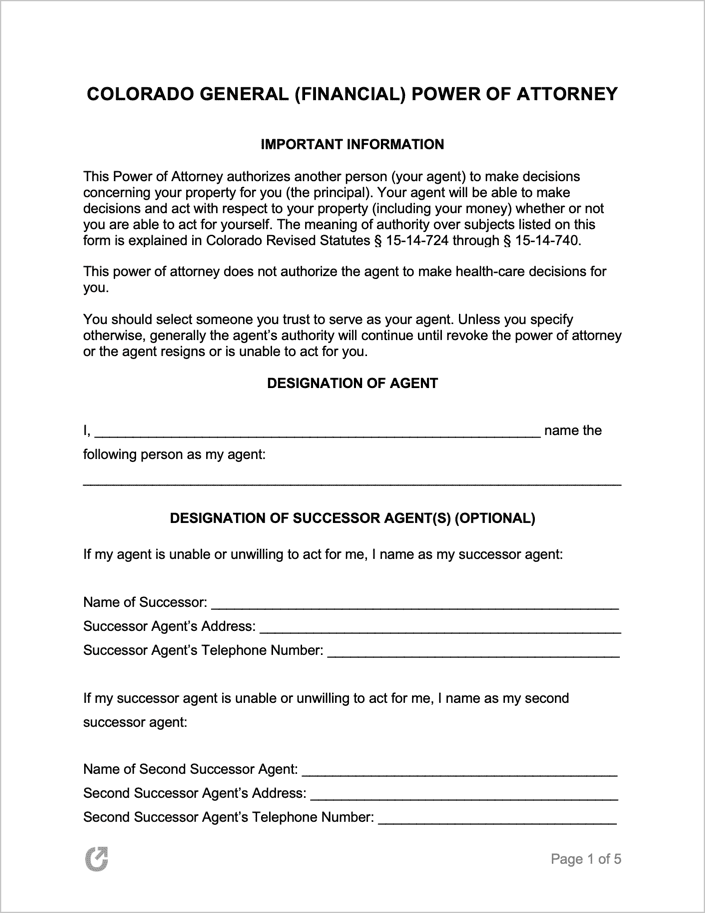

A Colorado general (financial) power of attorney form is a document that legally enables one party to act as an agent for another party, known as the principal.

|

What is a Colorado General Power of Attorney?

A Colorado general power of attorney form allows an individual, called the principal, to appoint another person or entity, the agent, to manage their financial affairs. This type of power of attorney covers various financial matters, such as managing bank accounts, handling real estate transactions, and dealing with investments. The agent is legally obligated to act in the principal’s best interests and must follow the terms outlined in the document.

A general power of attorney differs from a durable power of attorney because it automatically ends if the principal becomes incapacitated. In this mindset, the individual cannot make decisions on their own. The principal must have a sound mind and be legally competent when drafting and executing the document. Overall, the form is helpful for short-term financial management or when the principal does not require the agent’s authority to continue in case of incapacitation.

When to Use a General Power of Attorney

The principal uses a general power of attorney form in various financial circumstances. They delegate decision-making authority in situations including:

- Commodities and options

- Personal property (both tangible and intangible)

- Real property (although a real estate power of attorney is preferable for such cases)

- Retirement benefits and programs

- Bank accounts

- Modifying survivorship rights

- Altering an inter vivos trust