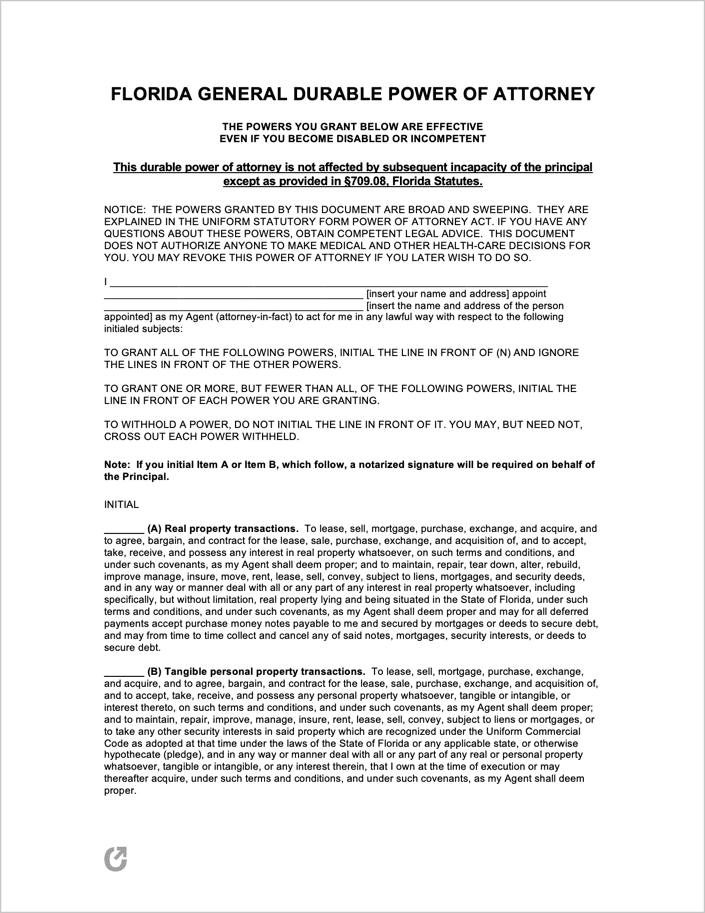

Florida Durable Power of Attorney Form

A Florida durable power of attorney is a legal instrument used to transfer decision-making powers about financial matters to another person (the surrogate or agent). The person transferring powers is known as the principal. Because the form is “durable” it will continue unabated in the event of the principal’s incapacity (a situation in which the principal can no longer make decisions on their own).

In Florida, all durable POAs must accommodate the state’s statutes regarding the form; specifically § 709.2104.

General Power of Attorney – Similar to the durable POA, but differs in that it terminates upon the principal’s incapacitation.

Laws: Powers of Attorney (§§ 709.2101 to 709.2402)

Signing Requirements (§ 709.2105): As set out by state law, the Florida-specific POA requires the signature of the principal, two (2) witnesses, and acknowledgment by a licensed Notary Public.

What Powers can be Designated?

With the POA, the principal can designate one (1) or all of the following TRANSACTION powers to the elected surrogate:

- Real property

- (Tangible) personal property

- Stock and bonds

- Commodity and options

- Banking + other financial institutions

- Business operations

- Insurance & annuity

- Estate, trust, & beneficiaries

- Claims & litigation

- Personal and family maintenance

- Benefits from: social security, Medicare, Medicaid, military service, & other government programs

- Retirement plan

- Tax matters

Additionally, the principal can use the spaces provided on the third (3rd) page to grant unique/special powers to the surrogate.