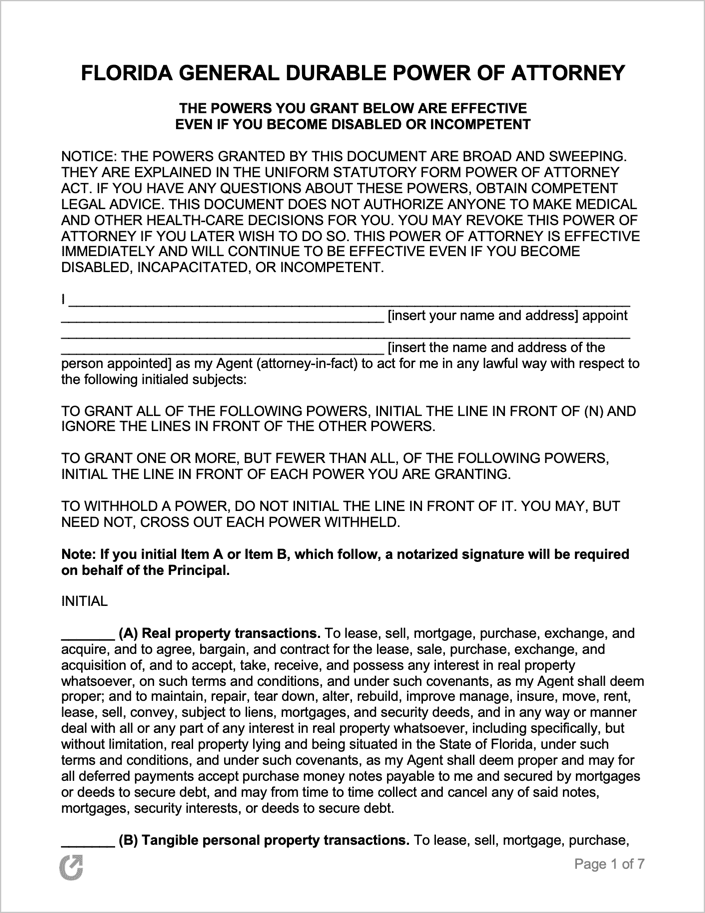

Florida General (Financial) Power of Attorney Form

The Florida General (Financial) Power of Attorney is a seven (7) page document that binds an individual (the “principal”) and a party of their choosing (the “agent”) into a formal agreement in which the agent will carry out financial tasks on behalf of the principal. Examples of tasks the agent may be required to complete include those related to banking, investments, and government benefits. The primary difference between a general and a durable POA is that the general POA will automatically terminate in the event the principal becomes incapacitated, whereas the latter will continue unaffected.

Signing Requirements (§ 709.2105): Two (2) witnesses + Notarized.

Florida requires that the following be true in order for a POA to be valid in the eyes of the law:

- The agent is at least eighteen (18) years or older, OR

- The agent is a financial institution that has trust powers, is permitted to do business in FL, and has a place of business in the state.

If, for any reason, the principal cannot sign their name on the POA, the Notary Public who is acknowledging the signature on the form can sign the principal’s name for them. However, this only applies so long the situation falls in line with § 117.05.