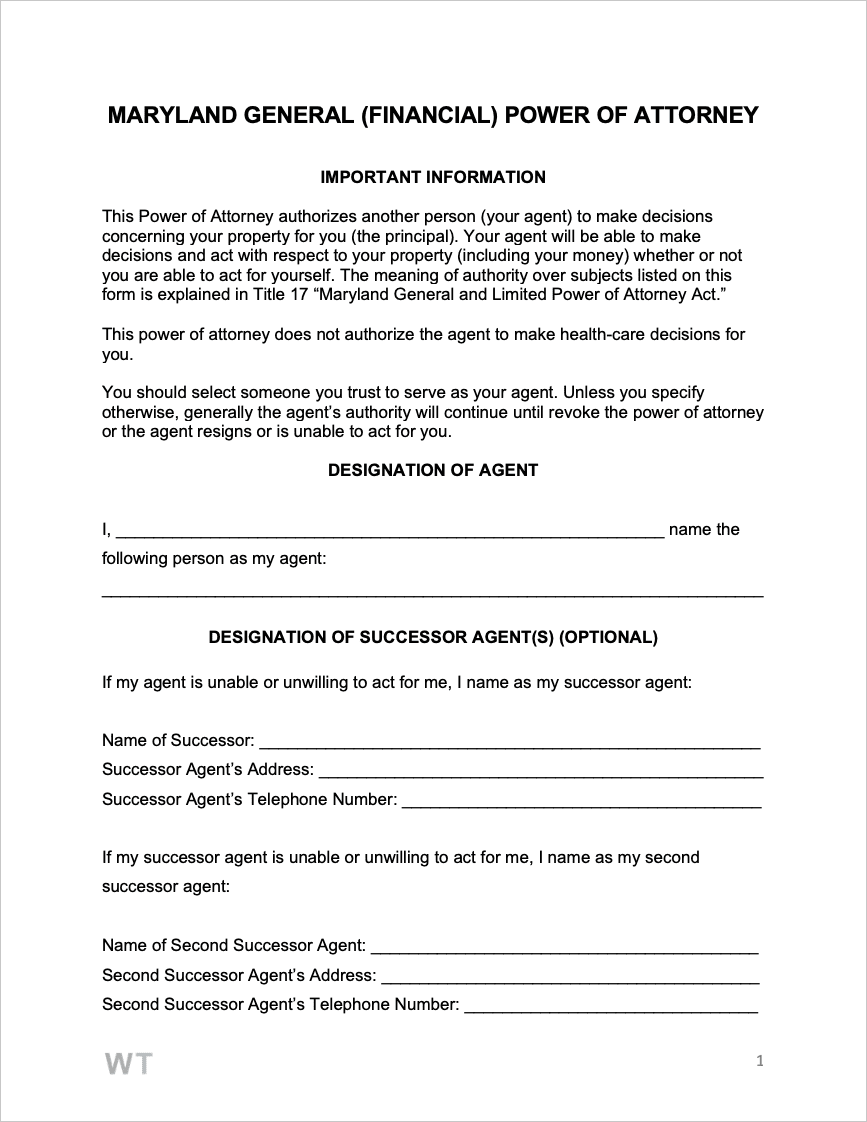

Maryland General (Financial) Power of Attorney Form

Complete the Maryland General (Financial) Power of Attorney (POA) to lawfully authorize a third party known as the “attorney-in-fact” to oversee and take care of your personal assets on your behalf. Prior to setting out and filling in the form, you (the principal) need to take the time to sort through potential agents, speak with them, and determine the person that best fits the requirements you have. While anyone can be chosen so long they’re of adult age, you should base your decision on their dependability, their knowledge of finances (and what it takes to manage them), their proximity in location (the closer to where you live, the better), and how much free time they have should an issue pop up. If you don’t have any close friends or family that fit these requirements, you can choose a professional and provide them due compensation for the tasks you need handled.

It’s crucial to recognize that this form is not durable in nature, meaning it will expire immediately if the principal becomes incapacitated. Incapacity is a state of being mentally inoperative, in which you cannot confidently convey your wishes to those around you. For those looking for a form with durable capabilities, the durable power of attorney should be used.

Laws: Estates & Trusts, Title 17

Signing requirements (§ 17-110) – Must be attested by a Notary Public and signed by two (2) witnesses. If the principal isn’t using remote notarization (such as Notarize.com), the Notary can serve as one of the two (2) witnesses.