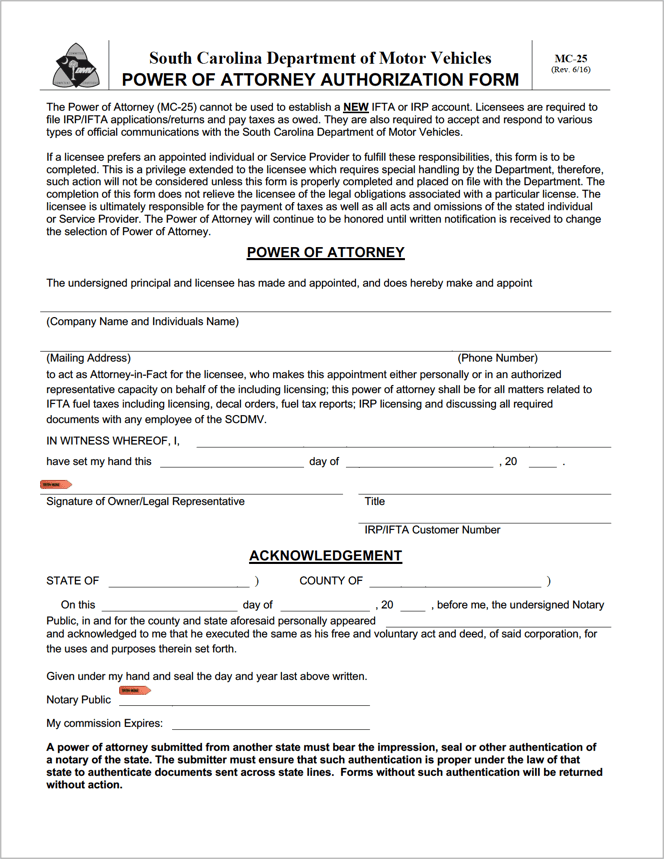

South Carolina Vehicle Power of Attorney (MC-25)

A South Carolina motor vehicle power of attorney (Form MC-25) is a form that a vehicle owner, or licensee, uses to give an individual the ability to manage and control paperwork relating to a car, truck, or van. The individual, also known as the attorney-in-fact, can sign forms, transfer a title, pay car taxes, and handle other vehicle-related tasks with a motor vehicle power of attorney. The licensee must sign and notarize the form, then file it with the South Carolina Department of Motor Vehicles (DMV).

Once filed, the attorney-in-fact can act on behalf of the owner, as long as they can prove their identity. The DMV requires government-issued identification (ID) cards, such as a driver’s license, passport, or military ID. This step prevents fraudulence and decreases the risk of completing a transaction for a stolen vehicle.

This form differs from a South Carolina state tax filing power of attorney, which gives an attorney-in-fact the ability to review, manage, and file the principal’s federal or state taxes. Instead, a motor vehicle power of attorney only allows the attorney-in-fact to make a one-time tax payment to the DMV. The assigned person may or may not have to pay additional fees, depending on the transaction type. When making payments for the owner, the attorney-in-fact must keep all receipts associated with the transaction. Both parties must reimburse one another as needed.

Signing requirements: Must be signed by the vehicle owner and a Notary Public.