Texas General (Financial) Power of Attorney Form

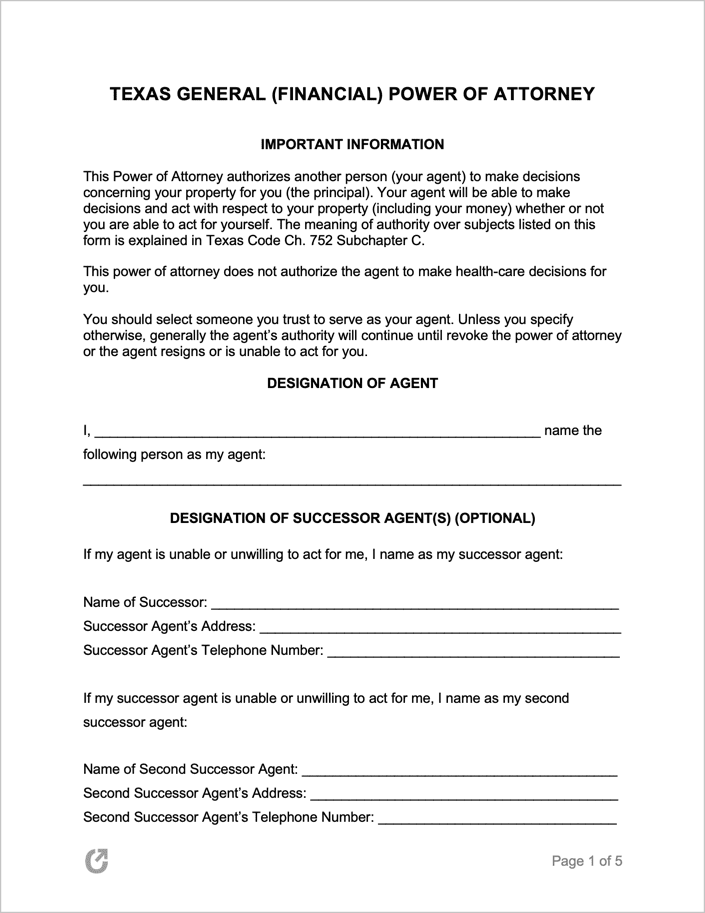

The Texas General (Financial) Power of Attorney is a non-durable contract that involves two main parties—one who wishes to delegate decision-making power over one or more of their financial affairs (the “principal”), and another who agrees to take on the responsibility of making the decisions (the “agent”). The form is commonly used in situations where the principal is out of state and needs someone to sign a contract, remove money from their savings account, or another action that would otherwise require them to be present. The form, which was created in accordance with Texas law, does not give the principal the option to make the form durable. If the principal is looking for a form with said properties, the durable-specific POA should be used.

State Laws & Signing Requirements

State Laws: § 751.0021 (“Requirements of Durable Power of Attorney”)

Signing Requirements: Texas law requires that the principal sign the general POA before a Notary Public.

Additional Information: When completing the form, the principal should be sure to nominate both a successor agent and a second successor agent. Although optional, doing so protects the principal in the case that the original agent can no longer do their duty, whether it is out of choice, they are medically unfit, or they didn’t follow the duties required of them by Texas law.

The form cannot be used for declaring a representative over medical matters. If the principal is looking to assign someone to make medical decisions for them in the case they no longer can, a medical power of attorney should be used.