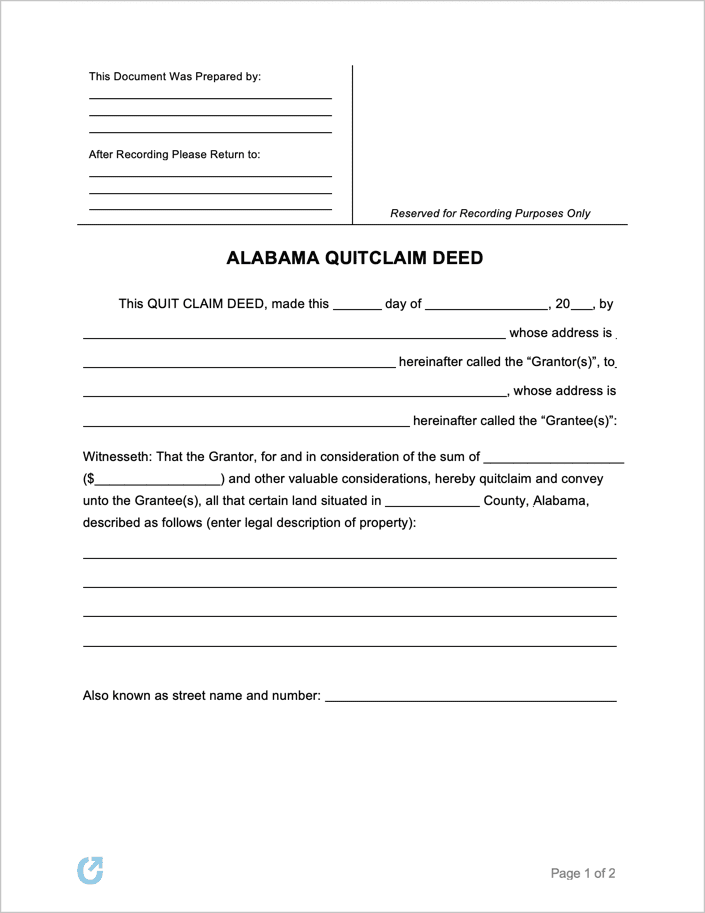

Alabama Quit Claim Deed Form

An Alabama quit claim deed is used for conveying a property’s title to another person. The person that owns the real estate is the grantor, and the entity receiving the property is the grantee. Unlike other deed types, the form does not provide the recipient with any promises as to the quality of the title. Because of this, the form is useful in situations where the grantee already has proof of the grantor’s ownership of the property, such as a parent transferring property to their child.

Download: PDF, Word (.docx)

Laws- Statute (§ 35-4-271): Because the form does not include a warranty of title, the following three (3) words should not be used in the section of the form that addresses warranties: “Grant”, “Bargain”, and “Sell”.

- Signing Requirements (§ 35-4-20): The grantor’s signature must either be notarized, or witnessed by one (1) other witness (who must also sign the form). If the grantor cannot sign themselves, the conveyance must bear the signatures of two (2) witnesses.

- Recording: The form be filed in the office of the County Probate Judge.

- Form RT-1: It is mandatory for the form, Real Estate Sales Validation (Form RT-1), to be filed at the same time as the deed. All relevant sections must be completed and subsequently signed by both parties.

|

Loading...

Loading...