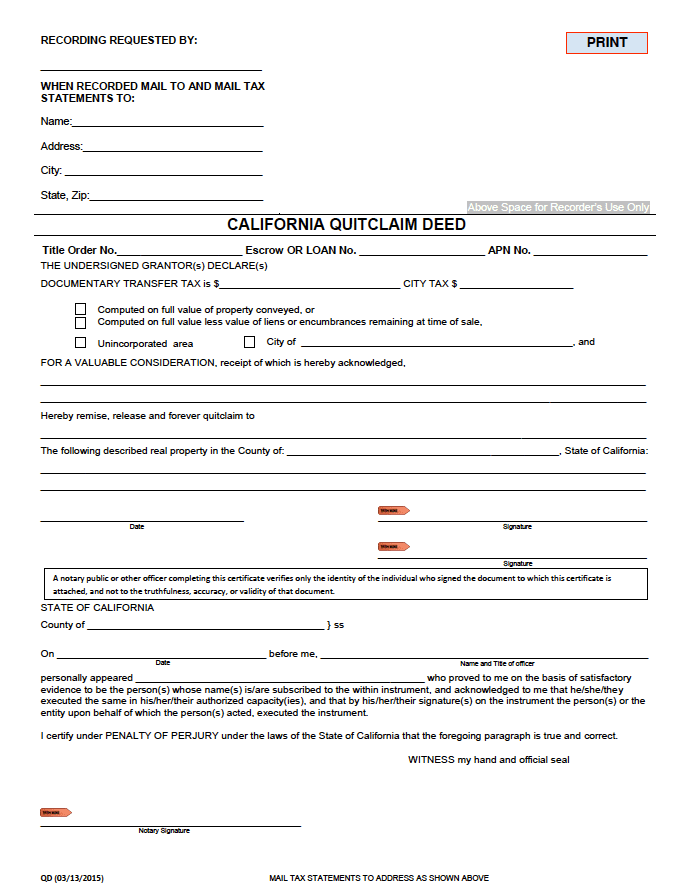

California Quit Claim Deed

A California quit claim deed (Form QD) conveys ownership in real property with no assurances or guarantees. The owner (and transferrer) is called the “grantor”, and the recipient the “grantee”. Because the form does not provide any guarantee to the grantee that there is no issues with the title (a lien, errors with the deed, other owners, etc.), it is ideal to use in situations where both parties are well aquatinted, such as between family or close friends.

Download: PDF, Word (.docx)

Laws- Assessor Parcel Number (APN): It is required that an Assessor Parcel Number (APN) is stated in the property’s legal description. An APN can be found on a property tax bill, or it can be obtained from the City/County Assessor.

- Documentary Transfer Tax: Needs to included in the deed prior to recording (see calculator).

- Preliminary Change of Ownership (BOE-502A): Must be completed and filed alongside the deed.

- Signing Requirements (§ 27280.5): The grantor(s) must sign the form in view of a Notary Public (who must also sign the deed).

- Recording (§ 1170): Completed deeds need to be recorded with the local county recorder’s office to go into effect.

|