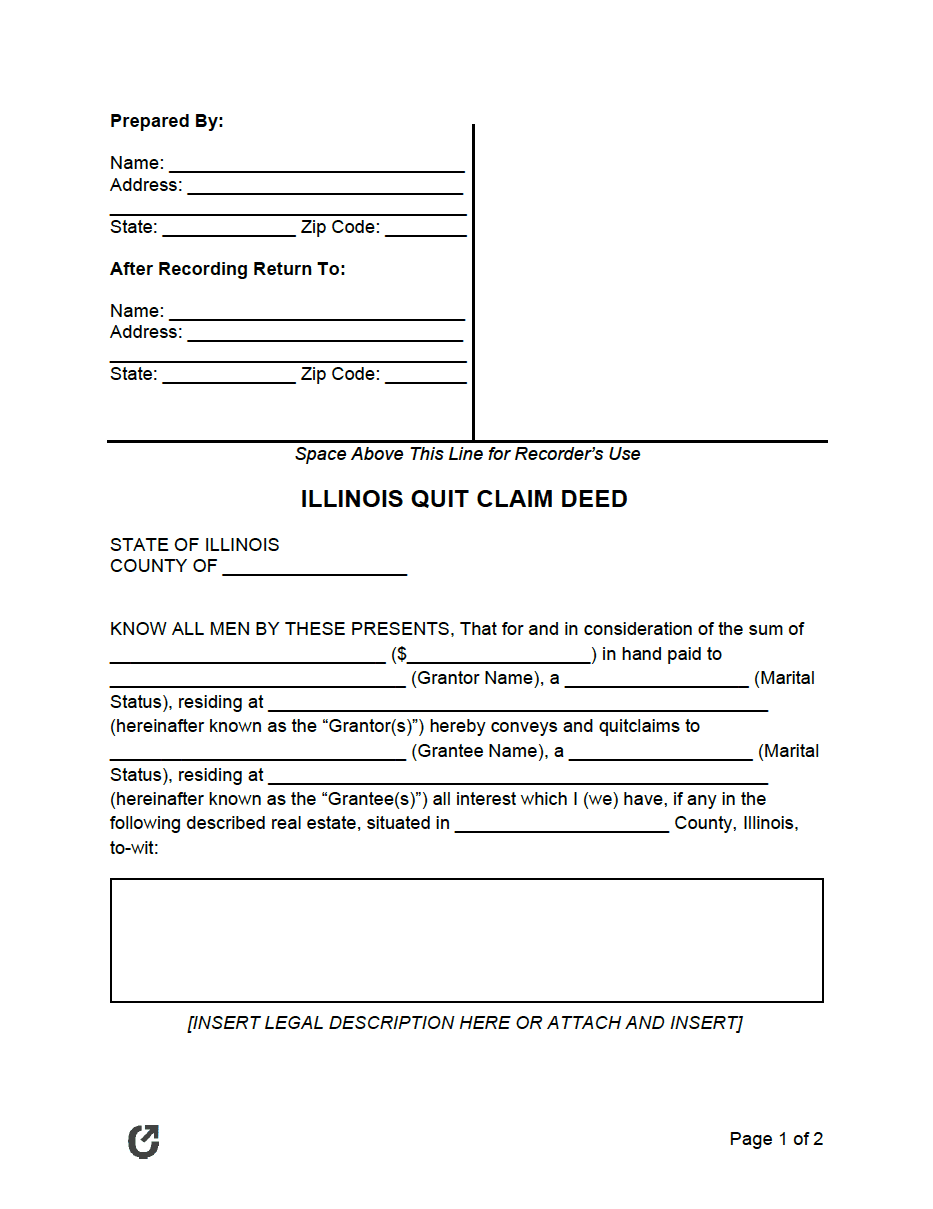

Illinois Quit Claim Deed Form

An Illinois quit claim deed conveys ownership interest in land, buildings, and real property from one person or entity to another.

Compared to general or special warranty deeds, quit claim deeds offer the grantee (buyer/recipient) with no title warranties. A warranty is a type of guarantee given from the grantor (seller) to the grantee in that the property is free of issues. For real estate transactions of high value, most parties will require a warranty deed to be used. This ensures the grantee has a means of recovering damages if the property ended up having an outstanding lien (for example).

Because a quit claim deed doesn’t include any warranties, it’s useful for low-value transactions such as gifting real estate to family, or removing one’s ownership after a divorce. The document can also provide the parties with tax benefits and savings that would not be possible using other deed types.

Laws

|