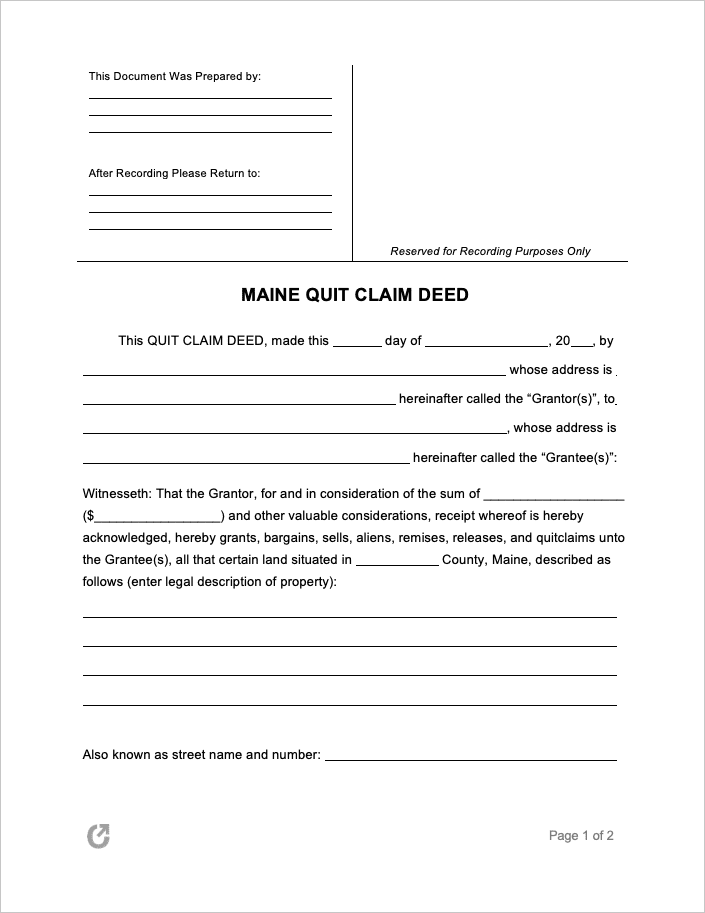

Maine Quit Claim Deed Form

The Maine Quit Claim Deed is the fastest and easiest option for transferring property interest in the state, at the cost of not being able to warranty that the property’s title is free of clouds and other encumbrances (issues). The form is entered into by a party called the “Grantor” who possesses an interest in a given property, and a party called the “Grantee(s)” who will be receiving interest in the property. In Maine, it is a requirement for all property conveyances to stated in writing and recorded with the applicable county’s Registry of Deeds. So long a property does not have any outstanding mortgages, the form can be used for both residential and commercial property types.

Download: Adobe PDF, MS Word (.docx)

Laws: Maine Chapter 7, “Conveyance of Real Estate”

Requirements

Conditions of Actual Notice (§ 201-A): In order to constitute “actual notice”, the form must contain:

- The volume and page of the registry or probate court record of the deed, and

- An adequate description of the property given either in metes and bounds (a method of describing the boundary lines of land).

Grantor and Grantee’s names (§ 651-A): The names of those that sign the form must be typed or printed under their respective signatures.

Grantee’s address (§ 456): Must include the Grantee’s address (state, street, city, and ZIP code).

Signing requirements (§ 162 and § 203): Signed by the Grantor(s) and notarized by a Notary Public.

Real Estate Transfer Tax (§ 4641): A Real Estate Transfer Tax Declaration (Online Form | Physical Form.pdf) must be filed in order to declare any real estate transfers, such as a Quit Claim Deed.

How to File

Maine state law provides two (2) main steps for filing a deed:

- After the deed has been completed, a “certificate of acknowledgment” or “proof of execution” must be endorsed on the form or annexed to it, and

- Both the deed and certificate must then be recorded in the Registry of Deeds located in the same county the property can be found.

The certificate/proof of execution is not optional; the deed will not be filed without one (1) of the two (2) documents.

Fees: Upon recording, a fee will be issued. The fee schedule is:

- First (1st) Page: Nineteen dollars ($19.00) plus a three dollar ($3.00) surcharge.

- Any additional pages: Two dollars ($2.00) per page.

- Any more than four (4) names to be indexed: One dollar ($1.00) per additional name. The names of all Grantors, Grantees, AKAs, trustees, DBAs, partners, and nominees are included in this name count.

- Any additional marginal reference after the initial one: Thirteen dollars ($13.00) each.

- A fee will also be imposed on any copies made.