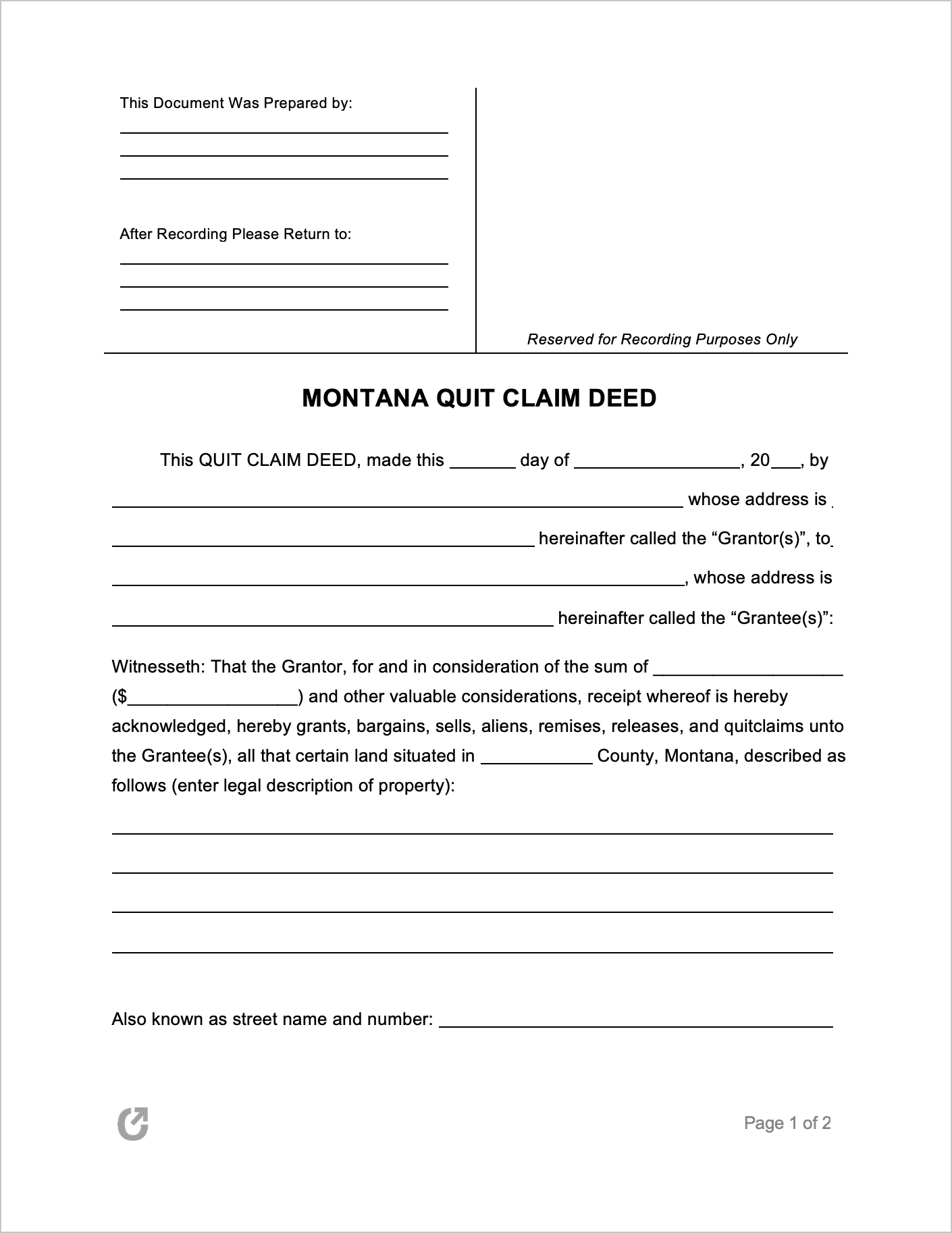

Montana Quit Claim Deed Form

The Montana Quit Claim Deed is a comprehensive two (2) page legal document used to transfer or add ownership to a property located in Montana. Unlike other deed forms, the quit claim is rather “bare bones”, referring to the fact that it includes no protections for the party receiving the property (the Grantee). However, at the cost of no formal protections, the document is both more straightforward and cheaper than alternatives.

There are many circumstances that may give rise to using this legal instrument. The Grantor may be a parent who wants to help set their child up by gifting them their family home. Or, the Grantor may be a newly married husband or wife who wishes to add their spouse to the title of a property they bought prior to marriage.

Download: Adobe PDF, MS Word (.docx)

Versions (4)

Download: Adobe PDF, MS Word (.docx)

Download: Adobe PDF, MS Word (.docx)

Download: Adobe PDF

Download: Adobe PDF

Requirements

Formatting & Mandatory Info (§ 7-4-2636(1)): The deed must:

- Be printed in blue or black ink (including any signatures) on white paper that is either

- Eight and a half inches (8.5″) by eleven inches (11″) OR

- Eight and a half inches (8.5″) by fourteen inches (14″),

- State the Grantor and Grantee’s names on the first or second page,

- Include a property description, and

- State the name and mailing address of the party the document should be returned to. The name should appear in the upper left-hand corner of the first page between the side margins.

Margins (§ 7-4-2636(1)(e)): The margins in the form must be clear of all markings except for page numbers, initials, or other designations.

Addresses (§ 7-4-2618): The post office address of the Grantee must be stated.

Joint Tenancy (§ 70-20-105): For a joint tenancy to be established, the names of the joint tenants must be stated in the form.

Signing Requirements (§ 70-21-203): The deed must be signed by the Grantor and notarized.

Additional Mandatory Document (§ 15-7-305): In line with the Realty Transfer Act, it is a requirement for a Realty Transfer Certificate to be provided at the time of recording. Download: Realty Transfer Certificate (Form 488).pdf

If the form is not filed, § 15-7-310 states that the clerk may impose one (or both) of the following penalties:

- A maximum of five hundred dollars ($500.00), and/or

- A maximum sentence of six (6) months imprisonment in the county jail.

How to File

The completed and signed deed must be presented to the County Clerk and Recorder for recording in the county where the property is situated. The clerk has set fees that they charge for recording the form, as stated in § 7-4-263. Along with the deed, the filer will need to complete and file a Realty Transfer Certificate, as stated above.