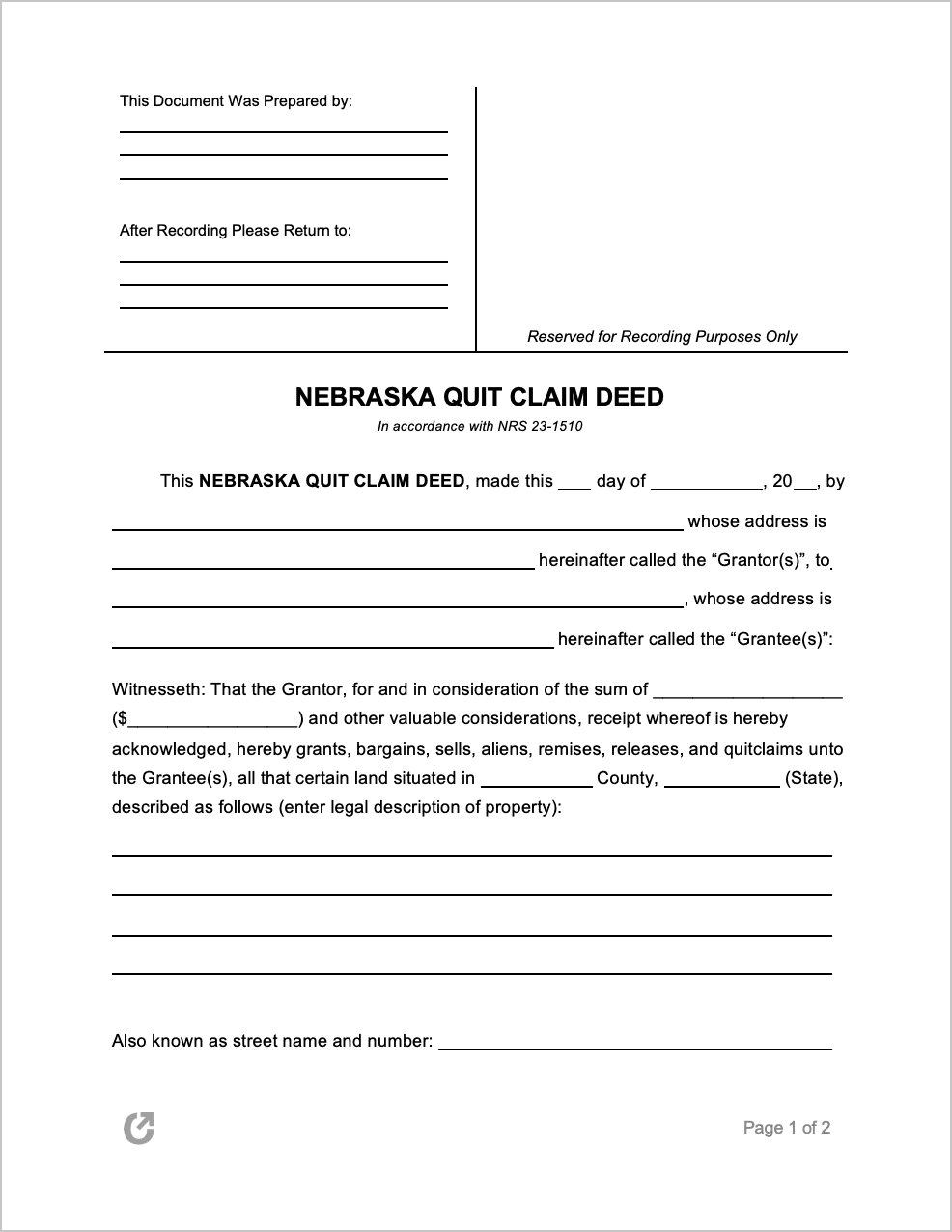

Nebraska Quit Claim Deed Form

The Nebraska Quit Claim Deed permits one party (called the “Grantor”) to sign over their interest in a property to another party (called the “Grantee”). It is the least complicated legal means of transferring property ownership. However, at the cost of being cheaper and simpler to complete, the assurances it offers Grantee(s) are very limited. Because of this, it is recommended that it is only used between those that know each other personally, such as family and friends.

Download: Adobe PDF, MS Word (.docx)

Laws: Chapter 76: “Real Property”

Requirements

Formatting (§ 23-1503.01): The NE Office of the Register of Deeds requires all deeds to comply with the following formatting requirements:

- Top margin: three inches (3″) by eight and a half inches (8.5″).

- Other margins: One inch (1″) side and bottom margins.

- Page size minimum: eight and a half inches (8.5″) by eleven inches (11″).

- Page size maximum: eight and a half inches (8.5″) by fourteen inches (14″).

- Colors: Blank ink on white background.

- Paperweight: Not less than twenty-pound weight.

- Font size: Minimum of eight-point (8 pt) font.

Mandatory Information (§ 23-1510): A return address and the title “Quit Claim Deed” must be evident on the first page of the form below the three-inch (3″) margin.

Grantor and Grantee Names (§ 76-118): The names of the Grantor and Grantee must be included in the form.

Homestead Properties (§ 40-104): The form must be executed and acknowledged by both spouses in cases where the deed will convey the homestead of a married person.

Signing Requirements (§ 76-211): The completed deed must be signed by the Grantor and acknowledged by a Notary Public. Electronic signatures are permitted.

Real Estate Transfer Statement: In addition to completing the deed, Form 521 (Real Estate Transfer Statement.pdf) must be completed and filed alongside the quit claim deed.

Filing: Upon completion, the form will need to be presented to the county-specific Recorder’s Office for filing alongside Form 521 (above).