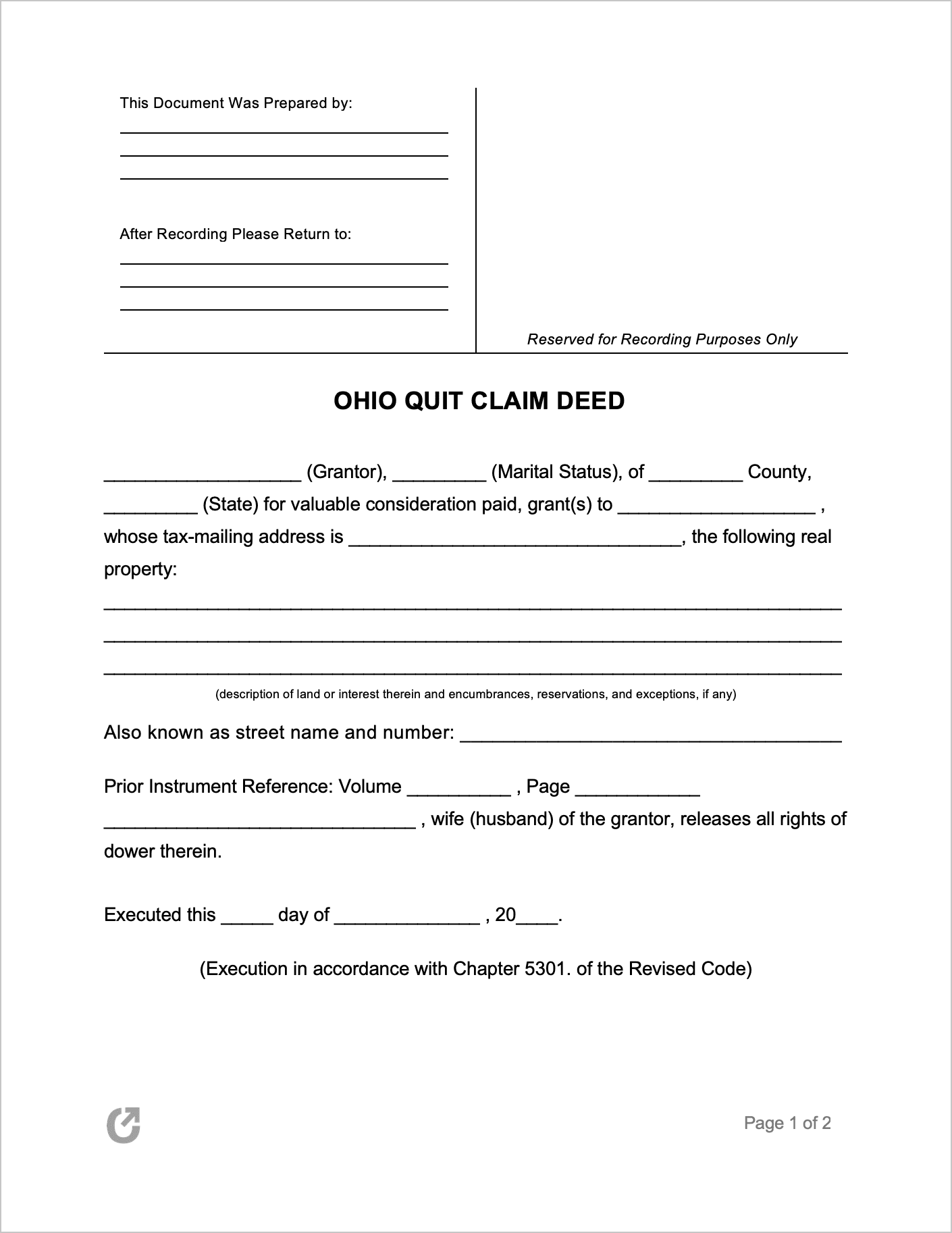

Ohio Quit Claim Deed Form

The Ohio Quit Claim Deed is the fastest means of transferring interest in residential property to another individual, who is typically family. With the benefit of being both fast to complete and cheap, it does not offer any warranties to the quality of the title being transferred. This results in increased liability for the Grantee (person receiving the property). However, so long the Grantee(s) personally know and trust the Grantor (the person doing the transferring), the form is a safe and convenient means of granting property ownership.

Download: Adobe PDF, MS Word (.docx)

Laws: § 5302.11

Requirements

- Dower Rights (§ 2103.02): Ohio is one of the few states that has retained “dower rights.” Ohio’s dower rights allow a spouse to be, “endowed of an estate for life in one-third of the real property.” In other words, a spouse is required by law—for the rest of their life—to receive one-third (1/3) of any profits from the property owned by their spouse.

- Non-resident Alien Grantees (§ 5301.254): If the Grantee is a “nonresident alien” (defined in § 5301.254(A) as “any individual who is not a citizen of, and is not domiciled in, the United States”) and they acquire property interest that a) is more than three (3) acres in size or b) has a market value of over one hundred thousand dollars ($100,000), they are required to submit specific information about themselves to the secretary of state, as listed in § 5301.254(B). The submission must take place within thirty (30) days of acquiring the property interest, and a filing fee of five dollars ($5.00) must be paid at the time.

- Signing Requirements (§ 5301.01(A)): The form needs to have the notarized signature of the Grantor in order to be successfully recorded.

How to File

Prior to recording the deed at the County Recorder’s Officer, § 319.20 establishes the need for the Grantor to submit the deed to the County Auditor’s Office. Once this has been done, the Grantor will need to file the deed in the Recorder’s Office that is located in the same county as the property being transferred. Fees will apply for the recording.