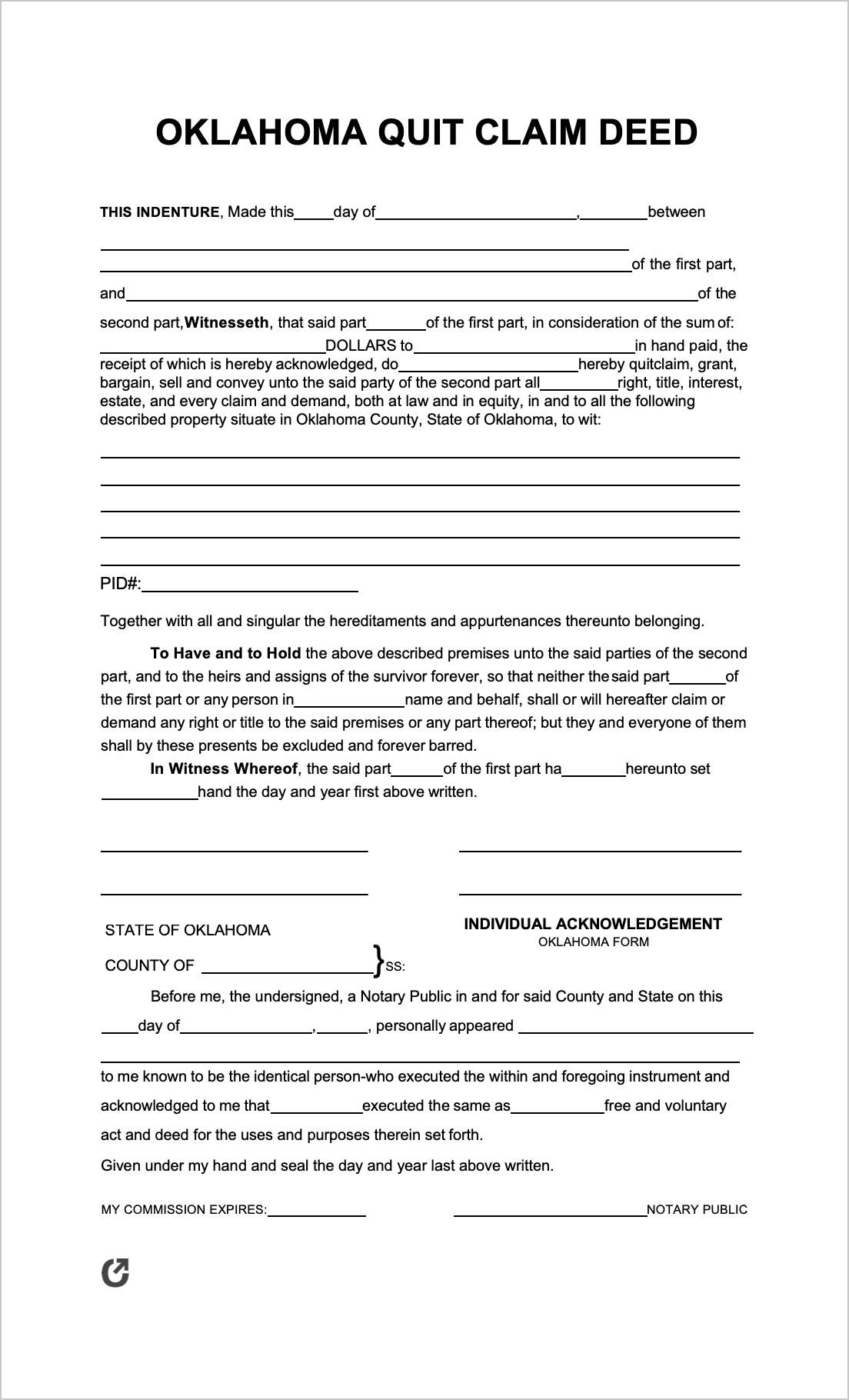

Oklahoma Quit Claim Deed Form

The official Oklahoma Quit Claim Deed is a one (1) page document that, once completed and filed, transfers property interest (ownership) from one person to another. The party that completes the form is known as the “Grantor”, and they transfer the property to one (1) or more people who are known as the “Grantee(s)”. What makes the Quit Claim deed unique in comparison to other types of deeds is that it offers no warranties to the quality of the title. Technically, if the property has other claims to it, the Grantee(s) would not be the true owners of the property. Because of the risk involved with the form, it should only be used by parties that can trust one another, such as family and close friends.

Download: Adobe PDF, MS Word (.docx)

Laws: Oklahoma Statutes, Title 16: “Conveyances” (§ 16-41)

Requirements

Deed tax (§ 68-3201, § 68-3203 and Chapter 30): A tax on the deed will be imposed if the consideration is in excess of one hundred dollars ($100.00). The tax must be paid for by the Grantor. The tax will be calculated using the following equation:

- Seventy-five cents ($0.75) for every five hundred dollars ($500.00) of the consideration or any fractional part thereof.

Documentary stamps must be purchased and attached to the form to pay for the tax. As Chapter 30; 710:30-1-10 explains, the only way to purchase documentary stamps is from the County Clerk located in the same county as the property. The clerk is only allowed to sell the stamps at the time the deed is presented for recording. In cases where the filer wishes to claim an exemption to the tax, per § 68-3202, they must state their reasoning on the front page of the form. An example of an allowable exemption is if the conveyance is without consideration (payment), such as when a property is conveyed as a gift.

Grantee (§ 68-3203): The Grantee’s name and address must be stated on the first page of the form.

Homesteads (§ 16-4): Any Deed involving a homestead must bear both the husband and wife’s signatures.

Wording (§ 16-41): Quit claim deeds are required to contain certain wording to differentiate them from warranty deeds.

- The deed needs to contain the following terms: “Do hereby quitclaim, grant, bargain, sell and convey.”

- In comparison, warranty deeds are worded as: “Do hereby grant, bargain, sell and convey, and warrant the title to the same.”

Signing Requirements (§ 16-33): Must be signed by the Grantor and notarized.

How to File: The completed deed must be filed with the Register of Deeds in the same jurisdiction/county in which the property is located. A fee will be charged for the recording.