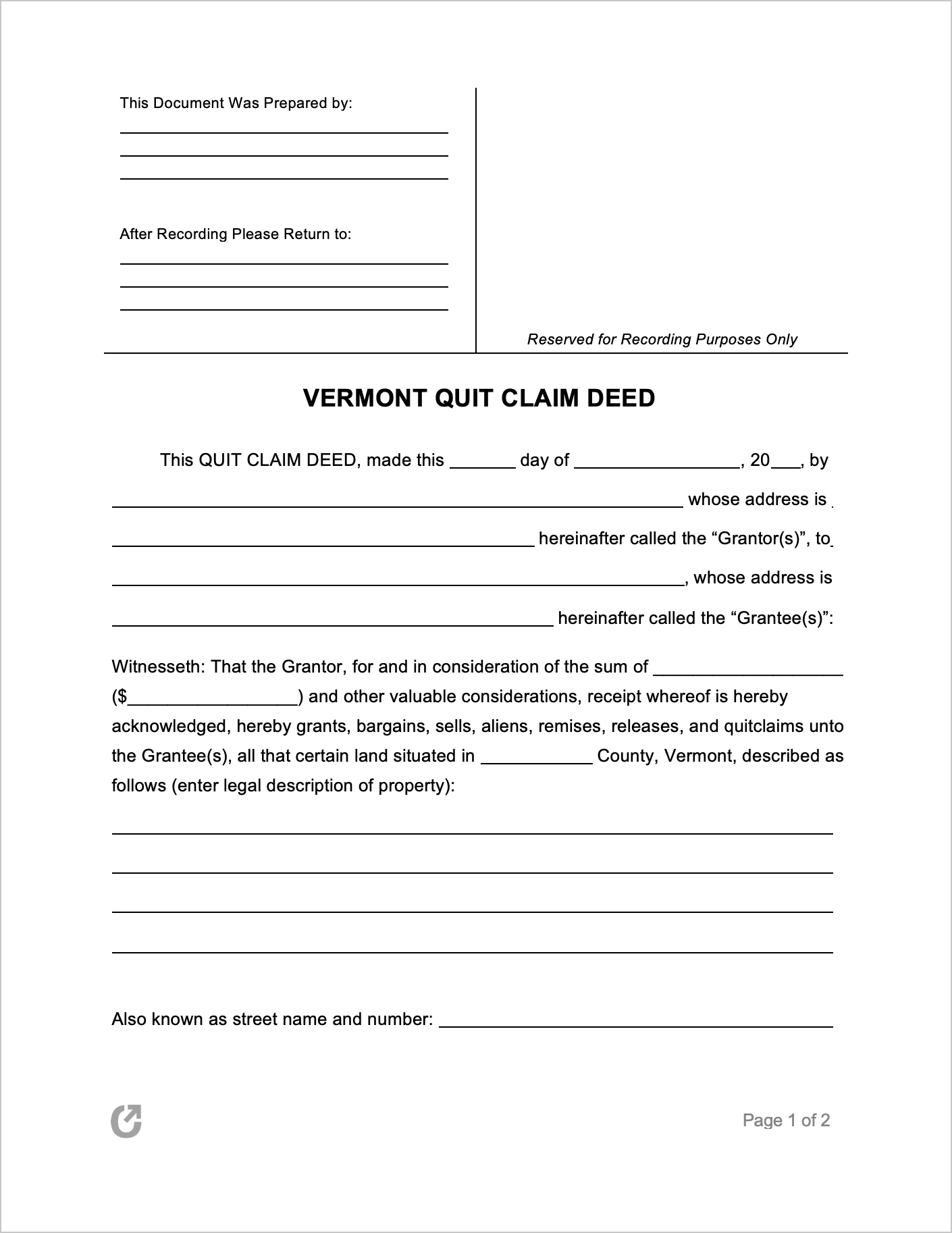

Vermont Quit Claim Deed Form

A Vermont Quit Claim Deed is a document used for conveying (transferring) interest in a property from one party to another. Compared to other property deeds, the quit claim is significantly simpler to put into effect. However, it should not be used without careful consideration, as the form comes with no guarantees or warranties of title. Because of this, Grantees should only agree to use one if they personally know and trust the Grantor.

Download: Adobe PDF, MS Word (.docx)

Laws: VT Title 27 “Property”

Requirements

Survey (§ 341(b)): If a deed refers to a survey that was prepared or revised after July 1, 1988, the survey must be included in the form, or the deed needs to contain the volume and page in the land records in which the survey had been recorded must be cited.

Property Transfer Tax Return: At the time of filing the completed deed, a property transfer tax return (Form PT-172) must be filed with the town clerk.

- Download: Form PT-172 “Property Transfer Tax Return”.pdf

- How-to: Form PT-172 Instructions.pdf

- Further Information: Contact tax.rett@vermont.gov, or call (802) 828-6851

Signing Requirements (§ 301): Signed by the Grantor in the presence of a Notary Public. Alternatively, it can be acknowledged before a master or county clerk.

Note: Prior to July 1, 2019, acknowledgment could only take place before a Notary Public. Since July 1, 2019, the law has been expanded to include acknowledgment before a master or county clerk as well.

How to File

Per statute 402, once both the deed and form PT-172 have been completed in-full, they need to be brought to the town clerk’s office in the same town that the real property is situated. There, it will be recorded by the county clerk. The Grantor should come prepared to pay for any filing fees.

Recording type (§ 342): Vermont is a “notice statute” state.