Car Wash Invoice Template

A car wash invoice template is used by part-time and professional car washers and detailers to charge their customers for the services they provide. It can be used by anyone that cleans cars, truck, motorcycles, RVs, and even boats. This includes everyone from part-time washers to professional detailing companies. When using the invoice, it is important that each one is numbered consecutively from one job to the next. This makes tax time significantly easier, as past jobs can be located in a more efficient manner.

Common Car Wash/Detailing Services

While automated car washes commonly stick to services that are more automated and/or can be completed in a timely fashion, the services that are offered by a professional detailer can be hands-on and customizable. Some of the most common professional services include:

- Interior vacuum + deep clean,

- Seat cleaning,

- Headlight restoration,

- Wheel clean + polish, and

- Exterior hand wash and wax.

How to Write

Download: Adobe PDF, MS Word (.docx), MS Excel (.xlsx)

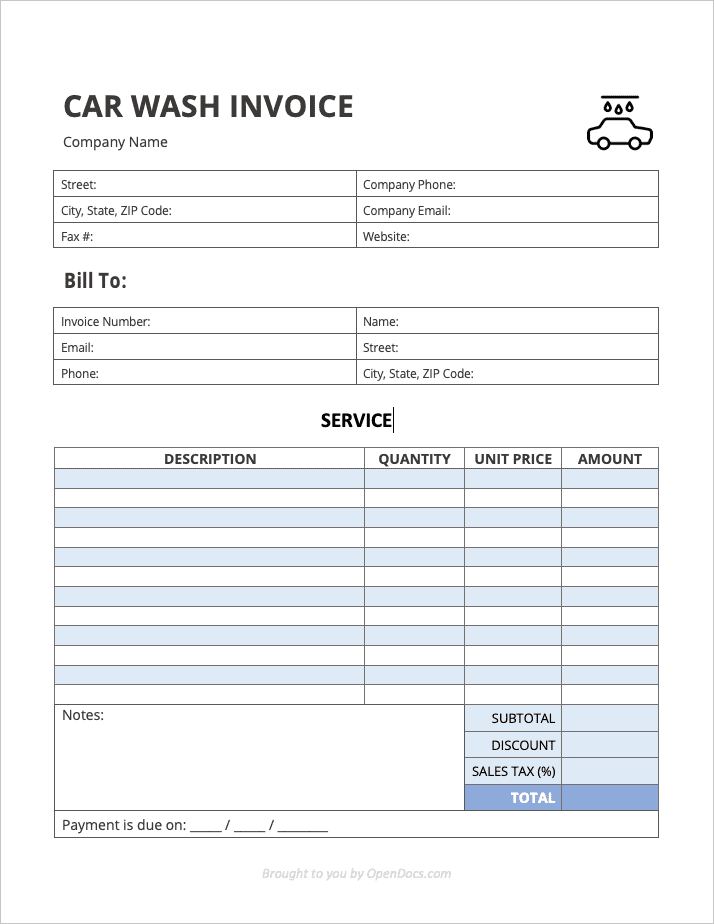

Step 1 – Company Info

The six (6) fields on the top of the form are used for specifying details on the company performing the clean. The information that will need to be written includes:

- Street address of the company;

- City, state, & ZIP code;

- Fax # (if applicable);

- Phone (land or mobile);

- Email address (can be a personal or business-dedicated email); and

- Website URL (if applicable).

Step 2 – Customer

The information that will need to be entered for the customer is very similar to that of the company. It includes:

- Invoice number (should be unique to each job performed – NOT for the customer themselves);

- Email address;

- Phone number;

- Name (first + last);

- Street address; and

- Their city, state, and ZIP code.

Step 3 – Services Performed

The table provides a place for the washer to list the services that were performed on the vehicle. Each unique service should be separated from the next. For example, if the client received a full wash and wax, tire polish, and had their seats dee-cleaned, each service should be listed on its own line.

If the washer charges for their services on an hourly-basis, they can edit the Word version to say “Hours” instead of “Quantity”, and “Rate ($/hr)” instead of “Unit Price”. Sum the “Amount” column and enter the result into the “Subtotal” field. Any amount entered in the “Discount” field should be subtracted from the “Subtotal”. Then add any sales tax (as a percent), and enter the amount ($) owed by the client in the “TOTAL” cell.

In the “Notes” field, the washer can include any random information they feel is necessary, or they can use the space to provide information on the types of payments accepted. Finally, if the washer accepts delayed payment, they should enter the payment due date on the bottom of the form. If payment is due immediately, the space should be left blank.