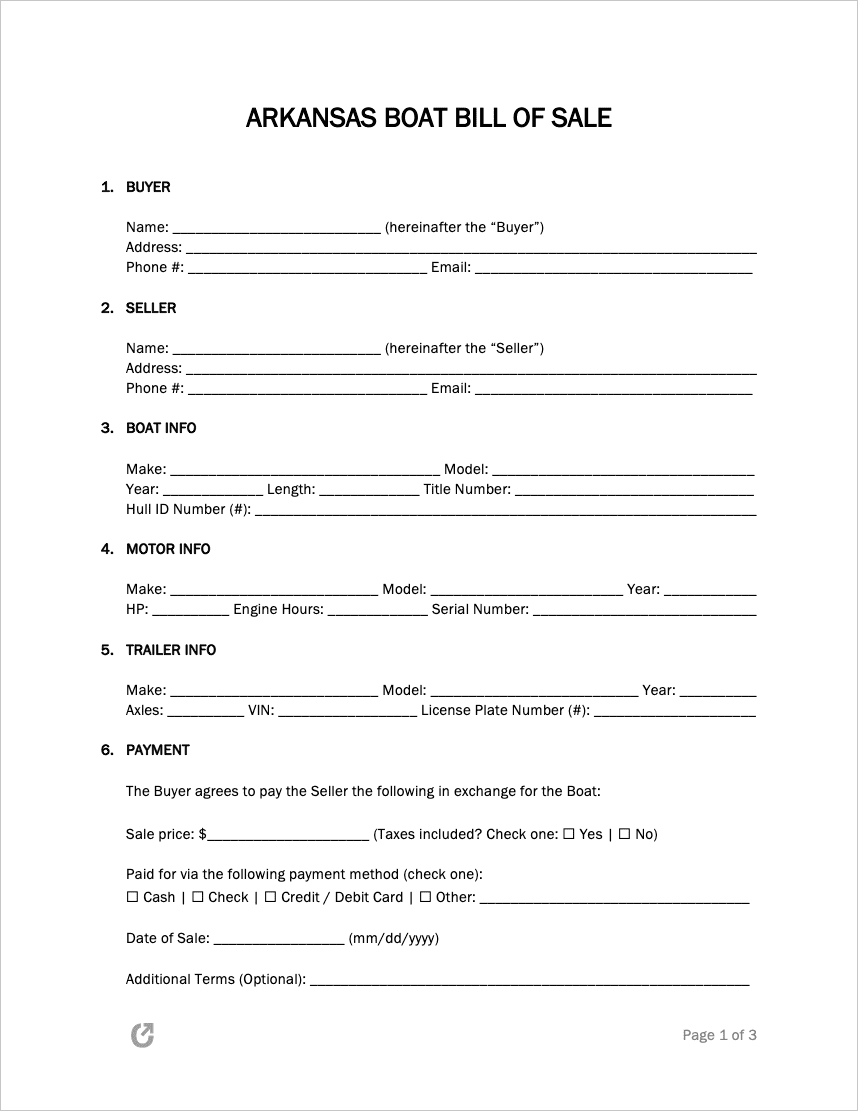

Arkansas Boat Bill of Sale Form

An Arkansas boat bill of sale form exemplifies the arrangement made to change watercraft ownership. It highlights the main points of the sale, such as the vessel’s value, selling price, and overall condition. If the deal involves a motor or trailer, the seller must include its information. Both parties can also decide to use a separate form, such as a trailer bill of sale.

|

What is an Arkansas Vessel Bill of Sale?

An Arkansas vessel bill of sale organizes the details of a private sale or dealership transaction for a boat. While the deal generally involves two (2) parties, it can include more if co-owners or co-buyers exist. Each named person must date and sign the form to convey their approval and transfer responsibility.

Vessel bill of sales in Arkansas do not need notarization, even though individuals can opt for it. A notarized document holds more weight in a court of law than a standard form. In addition, the owner(s) can use the bill of sale to verify the transaction, prove ownership, or handle specific matters relating to the boat.

Did You Know?Residents under the age of twelve (12) cannot operate a boat with a motor of ten (10) horsepower or more. Individuals born on or after January 1, 1986, need a boater education card to drive a vessel legally. The state offers instructor-led classes and online courses through “Boat Ed” and “ilearntoboat.” No one required by law to have a card can operate a boat without it present. Law enforcement gives citations to drivers who cannot show their ID (§§ 27-101-501 & 502). |

How to Register a Boat in Arkansas (4 Steps)

Arkansas boat owners must obtain a certificate of number (registration) for their vessel within thirty (30) days of acquiring ownership (§ 27-101-304). Non-residents can legally use their boat for up to ninety (90) consecutive days in the state before applying for registration and validation decals. Regardless of where they live, all boaters must have documentation to own and operate watercraft.

Step 1 – Check Requirements

Sailboats and motorized vessels need registration, whereas manually propelled boats and watercraft without an engine or sail do not. The document must include the make and model of the ship to identify it and confirm it needs registering. If the merchant sold a trailer with the vessel, they must provide the details on the bill of sale or a separate trailer bill of sale.

Step 2 – Submit Documents

Arkansas requires residents to visit a state revenue office to apply for registration. The individual must provide the paperwork in the requested manner for approval.

Bring the Following:

|

Step 3 – Apply Number + Decal

As mandated by state law, the registration card (certificate of number) must reside in a secure, readily accessible area on the boat, such as in a glovebox. Law enforcement officers can fine operators that cannot provide the information upon request.

Boats manufactured after November 1, 1972, must have a HIN assigned by the shipbuilder. If the vessel does not have a HIN, the owner must apply for it through the state. Once provided with the number, they must affix it to their boat.

After approving the application, the state provides the resident with an Arkansas certificate of number. The sequence of numbers and letters appears in the following manner: AR-8596-TJ or AR-395-JFU. Certificate holders must use bold, block-style letters (at least three (3) inches high) to display this number on the side of the boat permanently. They must attach the decal three (3) inches away from the registration number towards the back of the ship.

Step 4 – Renew

Renewals must occur every three (3) years. Applicants can turn in the paperwork by using the online portal, mailing it to the state office, or visiting a location (§ 27-101-306). If the individual decides to mail the renewal papers, they must send them at least fifteen (15) days before the expiration date.

The owner must provide the renewal notice (or current registration), the county assessment for the year, proof of paid property taxes, and proof of a liability insurance plan. The amount owed by the resident depends on the boat’s length and can range anywhere from $7.50 to $105.

| Mailing Address: |

| Department of Finance and Administration Office of Motor Vehicle P O Box 3153 Little Rock, AR 72203-3153 |