Mississippi General Bill of Sale Form

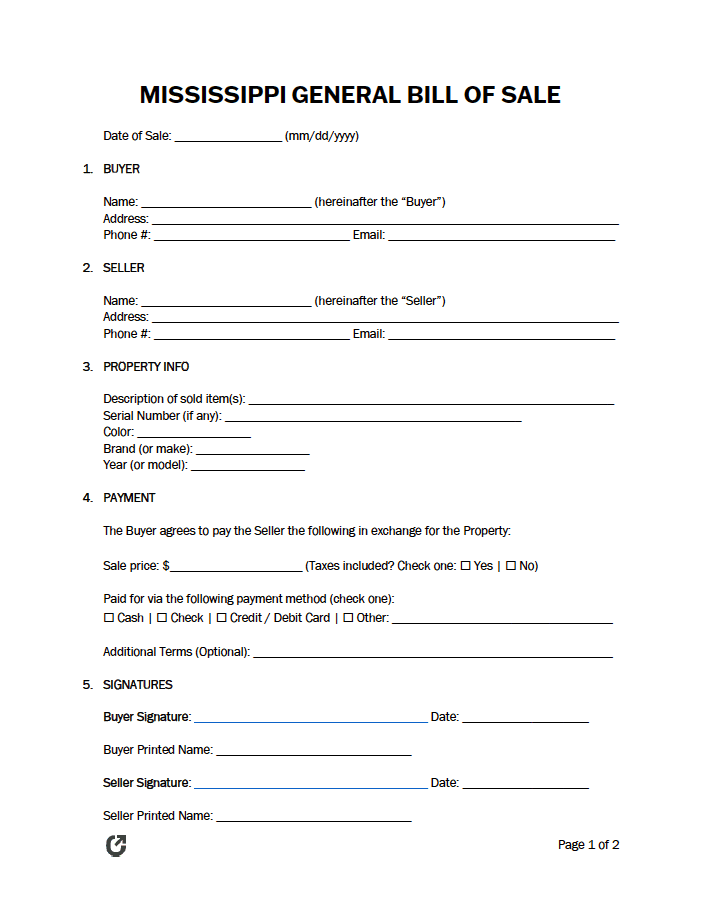

A Mississippi general bill of sale form allows a recorder to write specific details about an exchange between two (2) people. The transfer can involve money, although it can also happen by trade or gift. Regardless, the document stores information so that either person can review it in the future or prove the ownership change. The new owner benefits the most from the form as it allows them to show the item’s history if they decide to sell it again. It also shelters both parties from legal accusations if issues of possession or other matters arise.

| Signing Requirements: Anyone with involvement in the deal must sign their name in the appropriate area of the form. |

What is a Mississippi General Bill of Sale?

A Mississippi general bill of sale covers the basics of a transaction. It names all parties concerned in the deal and identifies the item through its main features. The state does not provide a general bill of sale, meaning the buyer and seller can use a template or create their own. Either way, the document must describe the personal property and have signatures from the buyer(s) and the seller(s). People commonly use this form for electronics, beauty products, family heirlooms, collector’s items, and other non-categorized objects.

Do I Need a Mississippi Bill of Sale?

Mississippi only requires a bill of sale when applying for a certificate of title. This mandate proves that the person possessing the vehicle owns it. Otherwise, buyers and sellers do not need to complete the document. However, many suggest conducting it to establish a permanent transaction record, which proves ownership and its subsequent changes.

Does the State Require Notarization?

No, Mississippi does not require owners to notarize their bill of sale forms unless the deal involves a rebuilt car. Under these circumstances, the owner must present a notarized bill of sale to the inspection facility for approval. If it passes, they can retitle the vehicle by making an appointment with the Department of Revenue (DOR).