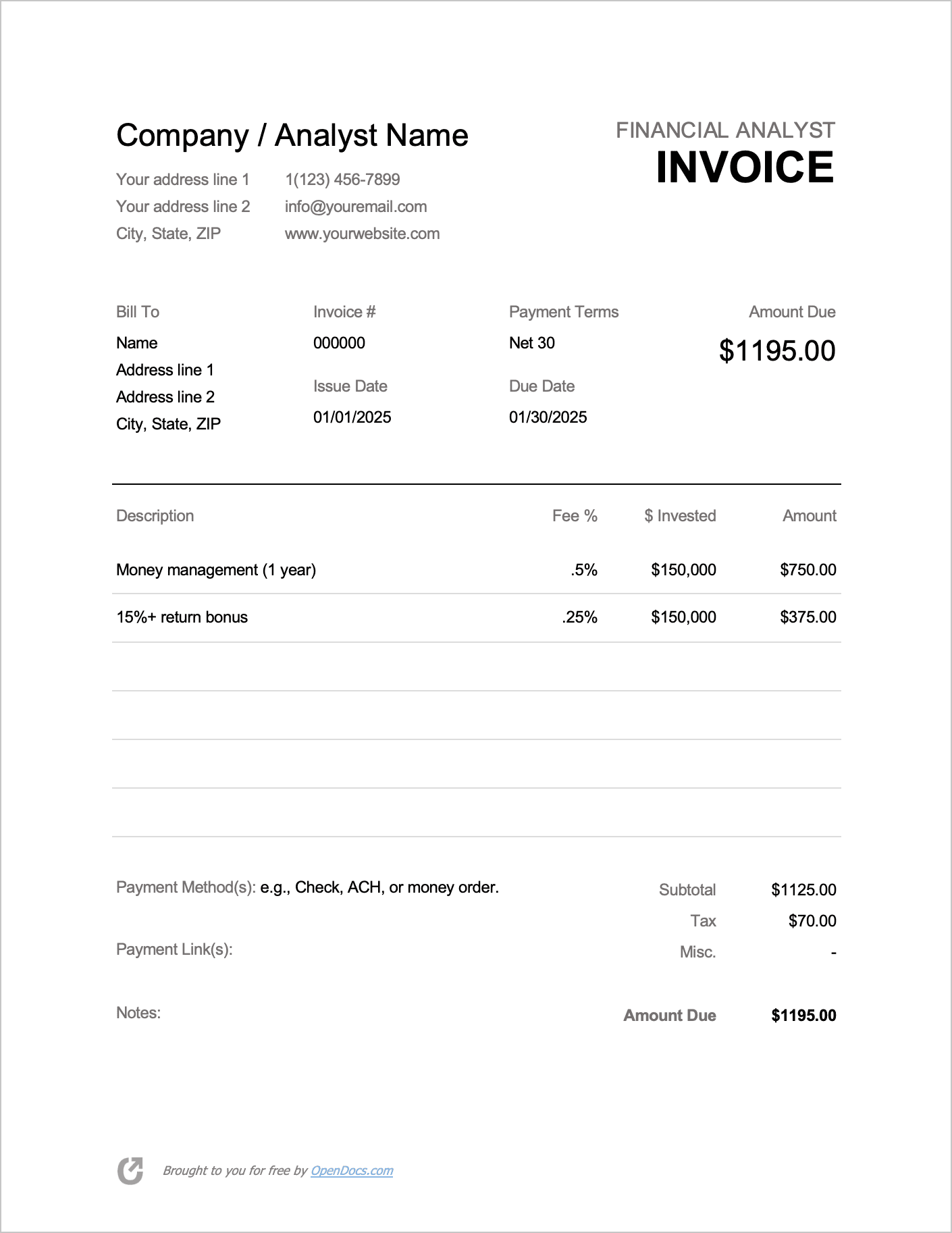

Financial Advisor Invoice Template

A financial advisor (analyst) invoice is for collecting payment for the managing of a client’s money, often on a yearly basis. Advisors typically charge a flat percentage fee of the total amount of money their client invests. For example, if a client were to invest $100,000 and the advsior has a .5% fee, they would charge $500/year for their services. Alternatively, some advisors charge on an hourly basis (anywhere from $100 to $400 an hour), whereas some issue a flat dollar-amount fee each time they are consulted.

The purpose of the invoice is to 1) inform clients of all the fee(s) they were charged, 2) to collect money promptly, and 3) to improve the organization and accounting of the advisor. By setting a date on the invoice, the financial advisor can require the client to pay before a specific time.

How to Invoice as a Financial Advisor

The financial advisor (or the person filling out the form) must include their personal information and the client’s credentials (i.e., phone number, email, website, address, city/state, and zip code of each person involved). They should enter the date and invoice number, as well, so that there is a clear record of the services.

A financial advisor typically charges based on the type of service provided and its duration. For instance, a meeting with someone who has personal investments would cost less than an appointment with a large company. The advisor’s level of experience impacts the price, as well. On average, the hourly rate is between $150 and $400. However, larger projects cost much more. In this case, the advisor and client(s) agree upon a set amount before the services start. The company can also charge a flat fee where the service determines the amount.