Kentucky Rental Lease Agreement Templates

The Kentucky Lease Agreements are written contracts completed prior to a tenant (lessee) moving into a rental property. The forms ensure the parties understand their rights and obligations and hold the tenant(s) to their obligation to pay rent until the contract’s expiration date (monthly leases not included). Although technically negotiable, the terms contained with residential-based leases are often accepted by tenants without argument. In comparison, commercial leases are known to change significantly from the time the parties sit down to discuss terms to the moment they sign.

Types (6)

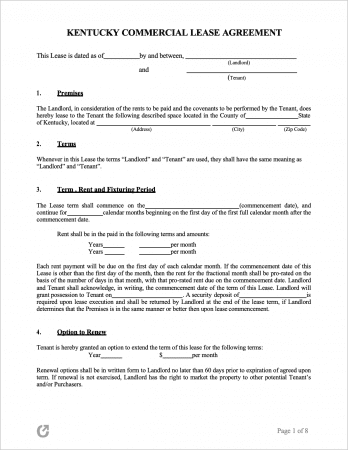

Commercial Lease Agreement – To be used solely for renting property to businesses for commercial use.

Commercial Lease Agreement – To be used solely for renting property to businesses for commercial use.

Download – Adobe PDF, Word (.docx)

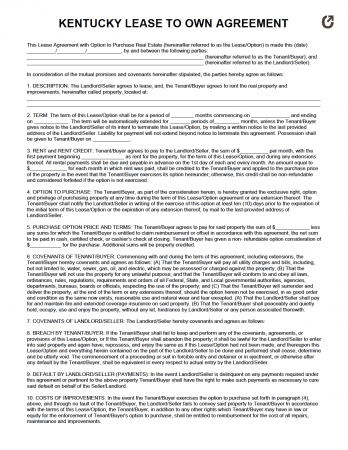

Lease to Own Agreement – Often referred to as a “Lease Option”, the document contains provisions for a tenant to *optionally* purchase the rented home from the landlord at the end of the lease.

Lease to Own Agreement – Often referred to as a “Lease Option”, the document contains provisions for a tenant to *optionally* purchase the rented home from the landlord at the end of the lease.

Download – Adobe PDF, Word (.docx)

Month-to-Month Lease Agreement – Similar to a standard lease with the major difference being that it doesn’t have a predetermined end date. Can be terminated by either the landlord or tenant(s).

Month-to-Month Lease Agreement – Similar to a standard lease with the major difference being that it doesn’t have a predetermined end date. Can be terminated by either the landlord or tenant(s).

Download – Adobe PDF, Word (.docx)

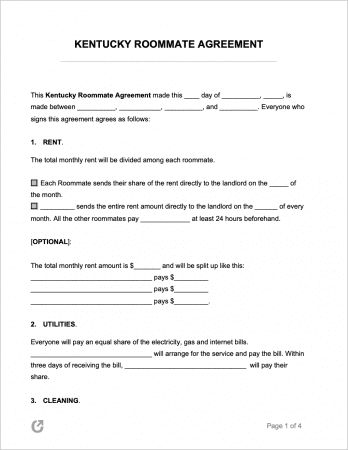

Roommate Agreement – A document completed separately to a lease that sets guidelines among roommates living in the same rented home, apartment, or college dorm.

Roommate Agreement – A document completed separately to a lease that sets guidelines among roommates living in the same rented home, apartment, or college dorm.

Download – Adobe PDF, Word (.docx)

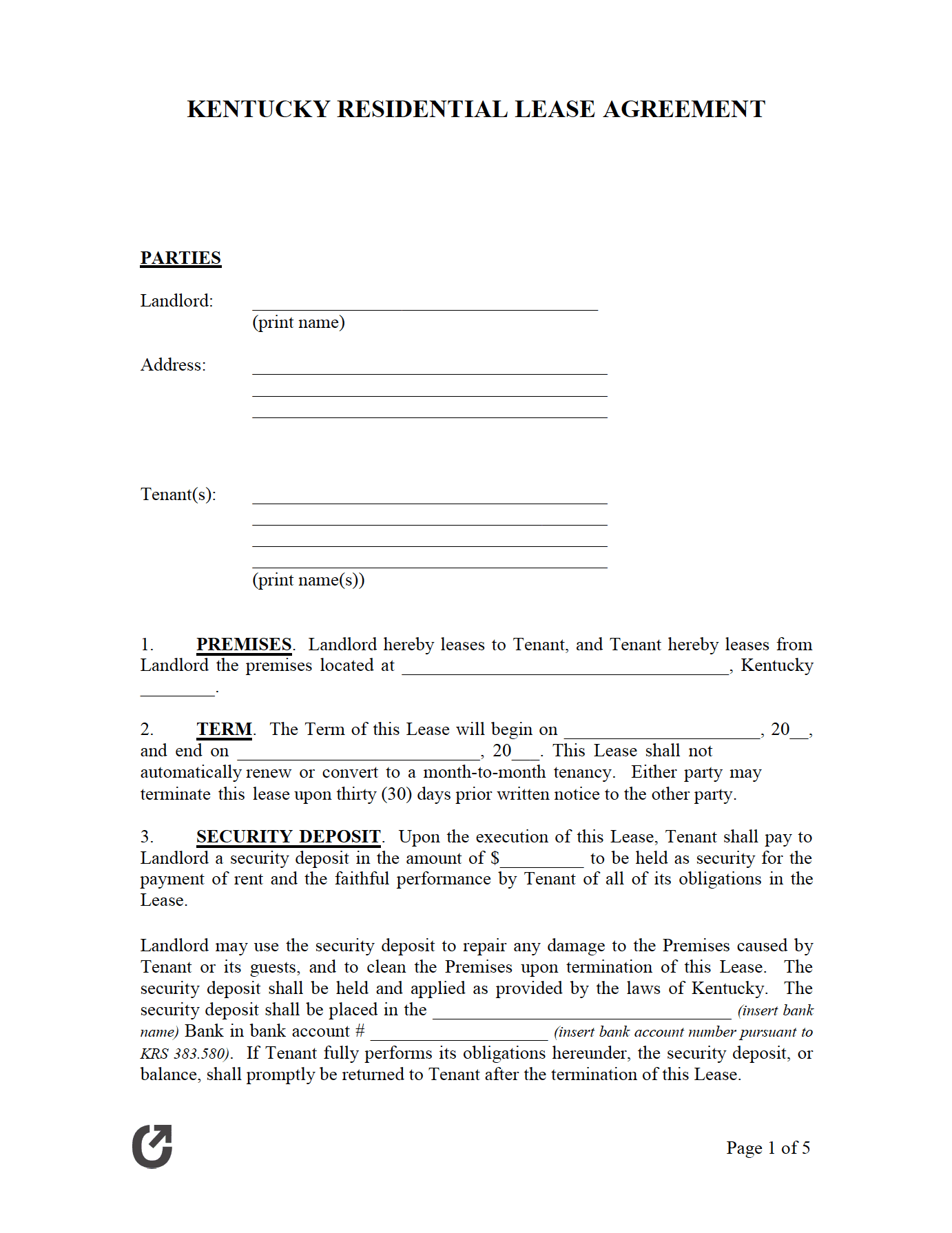

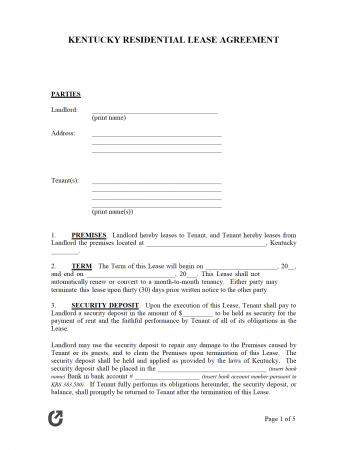

Standard Residential Lease Agreement – Used for the majority of renting situations – binds a landlord and tenant into a lease for an average length of one (1) year.

Standard Residential Lease Agreement – Used for the majority of renting situations – binds a landlord and tenant into a lease for an average length of one (1) year.

Download – Adobe PDF, Word (.docx)

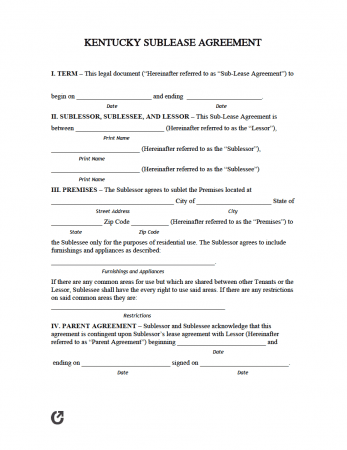

Sublease Agreement – So long the landlord permits its use, a sublease is a secondary rental contract that is formed between a tenant and subtenants, who will “take over” the lease from the original tenant.

Sublease Agreement – So long the landlord permits its use, a sublease is a secondary rental contract that is formed between a tenant and subtenants, who will “take over” the lease from the original tenant.

Download – Adobe PDF, Word (.docx)

What is a Kentucky Lease Agreement?

A Kentucky Lease Agreement is a legal form that formalizes a deal where a property is leased for residential or commercial purposes. In order to abide by the stipulations contained within the contracts, both parties should thoroughly read through each page before signing. Prior to signing a lease, landlords should make use of a rental application, which they can require prospective tenants to complete as a means of vetting them.

State Laws & Guides

Laws: Kentucky Uniform Residential Landlord and Tenant Act (§§ 383.505 to 383.705)

Landlord-Tenant Guides / Handbooks

When is Rent Due?

In line with KRS § 383.565(2), rent must be paid at the time and place agreed upon by both the landlord and tenant. Unless there is some agreement to the contrary, rent should be paid in equal monthly installments at the beginning of each month at the dwelling unit. Periodic rent must be paid at the beginning of any term of one (1) month or less.

Landlord’s Access

Emergency (§ 383.615(2)): In an emergency, landlords can enter an occupied rental property without the consent of the tenant(s).

Non-Emergency (§ 383.615(3)): Landlords must give tenants at least two (2) days’ notice of their intent to enter unless it is impractical to do so. The entry must only take place at reasonable times.

Landlord’s Duties

Landlords need to uphold the following duties, as required by statute 383.595:

- Provide tenants with a constant supply of water, a generous amount of hot water, and heating (unless the property doesn’t require it per state law);

- Maintain common areas (clean and in good condition);

- Ensure the rental property is in a condition that is habitable by making any necessary repairs;

- Comply with building/housing codes relating to the health and safety of tenants;

- Maintain all facilities and systems (HVAC systems, for example).

Tenant’s Duties

Per Kentucky statute 383.605, tenants are obligated to uphold the following:

- Comply with building codes relating to their health and safety;

- Maintain their rented dwelling by keeping it clean and “picked up” as reasonable;

- Throw away trash and rubbish in a safe manner;

- Keep landlord-supplied fixtures/appliances in the unit as clean as possible;

- Use all appliances and facilities in the manner they are designed to be used;

- Keep from purposely (or negligently) altering, damaging, or destroying the rental property and included amenities.

- Act in a way that doesn’t disturb nearby tenants.

Required Disclosures

- Lead Paint Disclosure: Under federal law, all landlords who lease a residential property built before 1978 must provide tenants with this pamphlet on lead hazards in the home. They are also legally required to disclose any known paint hazards in the property to tenants.

- Move-In Disclosure (§ 383.580(2)): Before a security deposit is tendered, landlords must provide prospective tenants with a list of any existing damage to the rental unit and the estimated cost of repairing such damage.

- Names and Addresses (§ 383.585(1)): At or before the commencement of a lease, the landlord must provide the names and addresses of whoever is authorized to manage the rental dwelling, in addition to that of the owner of the premises or a person authorized to act for and on their behalf.

Security Deposits

Maximum: There is no state law specifying a maximum security deposit amount landlords may charge tenants.

Returning to Tenant (§ 383.580(7)): Must send a notice to the tenant’s last known address stating their refund owed. If the landlord doesn’t receive a response within sixty (60) days after sending the notification, the landlord can keep the deposit.

Deposit Interest: No statute.