Oregon Rental Lease Agreement Templates

The Oregon Rental Lease Agreements are documents that establish a legally binding relationship where consistent payments are exchanged for the right to use residential or commercial property. The contracts are formed between a landlord (the “lessor”) and tenants (the “lessee(s)”). The average rental term is twelve (12) months, although the agreement can be edited to reflect any length desired by the parties. The contracts cover several topics relating to both parties, such as rental payments, utility responsibilities, pets, furnishings, default, security deposits, landlord/tenant rights, and much more.

Types (6)

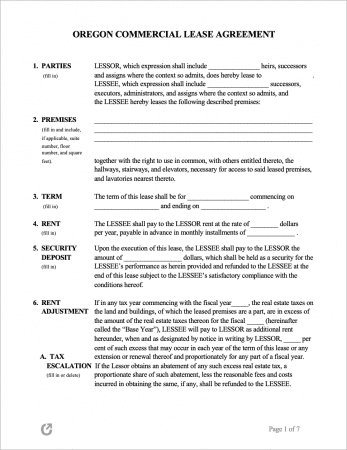

Commercial Lease Agreement – Consist of legal clauses/conditions that solely apply to the leasing of property to business-tenants.

Commercial Lease Agreement – Consist of legal clauses/conditions that solely apply to the leasing of property to business-tenants.

Download – Adobe PDF, MS Word (.docx)

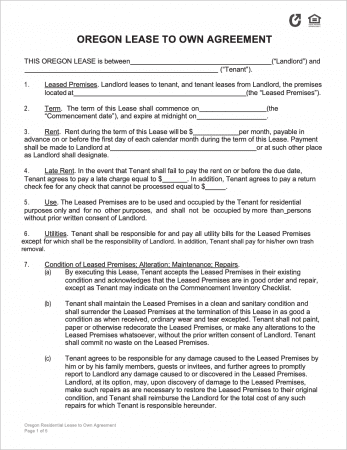

Lease to Own Agreement – Contains a clause that gives tenants the *option* to purchase the rented property at the end of the lease’s term.

Lease to Own Agreement – Contains a clause that gives tenants the *option* to purchase the rented property at the end of the lease’s term.

Download – Adobe PDF, MS Word (.docx)

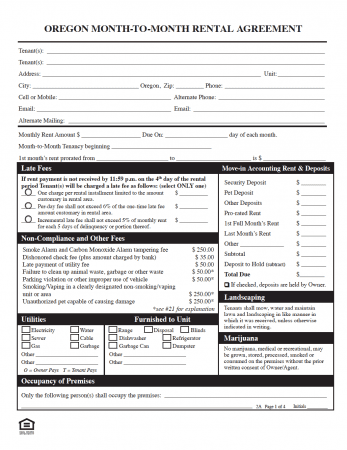

Month-to-Month Rental Agreement – Offers greater flexibility in comparison to a fixed-term rental contract. Either the landlord or tenant(s) can terminate the agreement so long they give one (1) month of notice.

Month-to-Month Rental Agreement – Offers greater flexibility in comparison to a fixed-term rental contract. Either the landlord or tenant(s) can terminate the agreement so long they give one (1) month of notice.

Download – Adobe PDF, MS Word (.docx)

Roommate Agreement – Used for establishing rental-wide rules on quiet hours, guests, pets, utility payments, and more. Goes a long way in preventing roommate conflict.

Roommate Agreement – Used for establishing rental-wide rules on quiet hours, guests, pets, utility payments, and more. Goes a long way in preventing roommate conflict.

Download – Adobe PDF, MS Word (.docx)

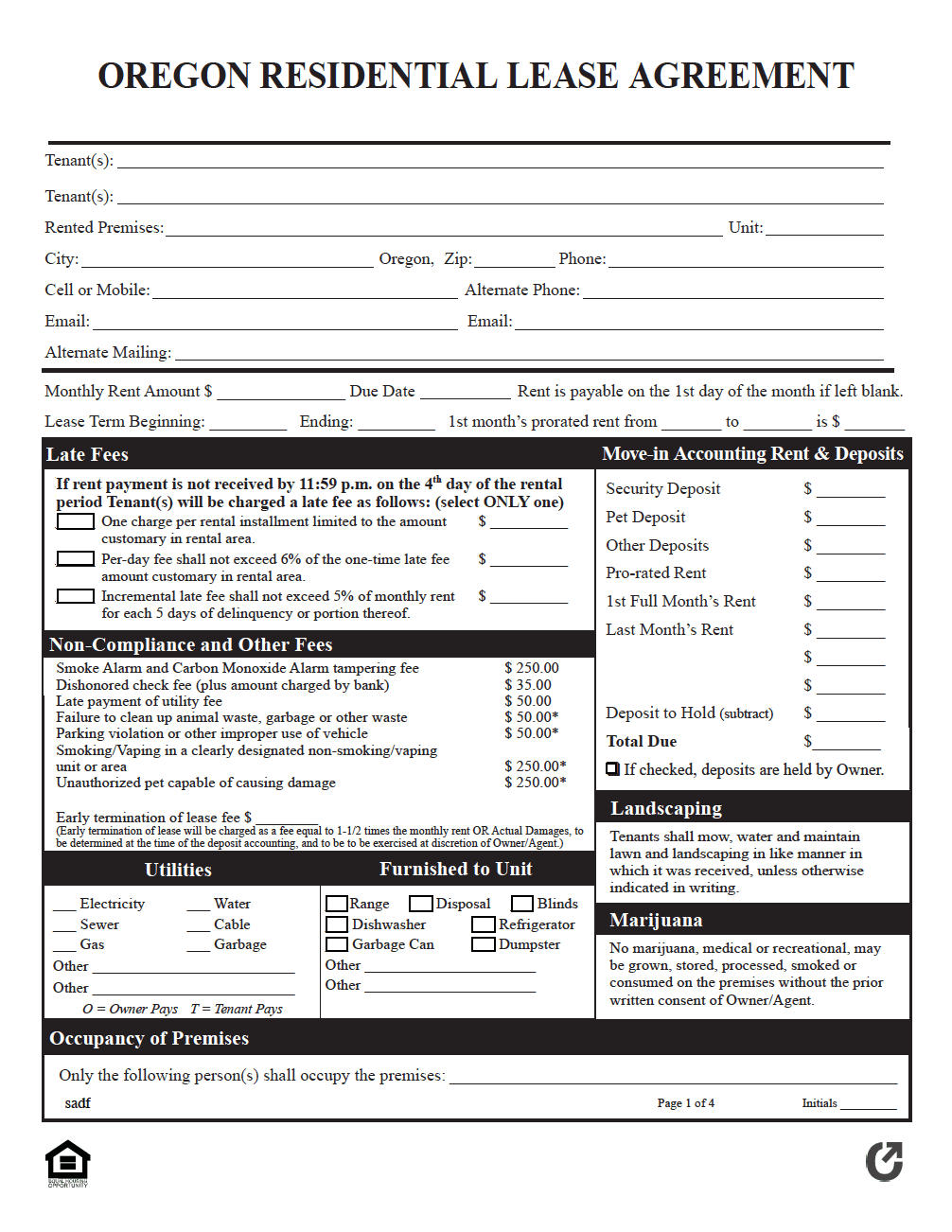

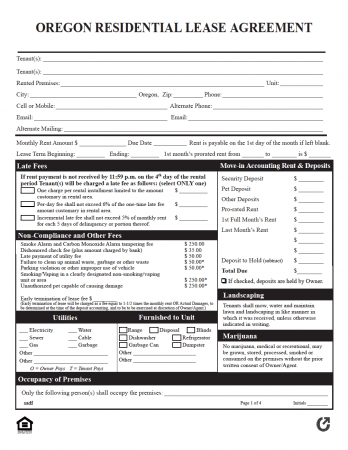

Standard Residential Lease Agreement – Once signed by all parties, locks tenants into a yearly (12-month) lease contract. The most commonly used rental form in the state.

Standard Residential Lease Agreement – Once signed by all parties, locks tenants into a yearly (12-month) lease contract. The most commonly used rental form in the state.

Download – Adobe PDF

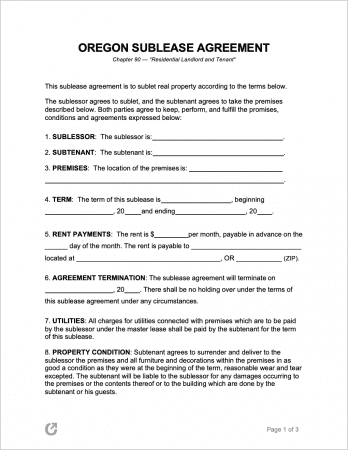

Sublease Agreement – Functions as a secondary lease, allowing a tenant to re-rent their leased unit to another tenant. The original tenant maintains all responsibility until the lease’s end.

Sublease Agreement – Functions as a secondary lease, allowing a tenant to re-rent their leased unit to another tenant. The original tenant maintains all responsibility until the lease’s end.

Download – Adobe PDF, MS Word (.docx)

What is an Oregon Lease Agreement?

An Oregon Lease Agreement is a form used for securing one (1) or more tenants into an obligation to make regular rental payments, in exchange for giving them the right to live or work in the rental unit. The form is completed upon the successful screening of the tenants, which can be done via the use of an Oregon-specific rental application.

State Laws & Guides

Laws

Landlord-Tenant Guides / Handbooks

- Landlord-Tenant Law in Oregon.pdf

- Oregon Landlord-Tenant Handbook.pdf

- Rent Right – Landlord-Tenant Guide.pdf

- Oregon Renters’ Handbook.pdf

When is Rent Due?

As outlined by § 90.220(7)(a), rent must be paid at the time and place agreed upon by the landlord and tenant(s). Unless otherwise agreed in the lease, rent must be paid at in equal monthly or weekly installments at the beginning of each month or week, depending on whether the lease is structured as a month-to-month or week-to-week contract.

In accordance with § 90.260(1), tenants have four (4) days grace period before a landlord may charge a late fee for the late payment of rent.

Landlord’s Access

Emergency (§ 90.322(b)): In emergency situations, landlords are permitted to enter the rental dwelling at any time, without the consent of the tenant(s).

Non-Emergency (§ 90.322(b)): To access the property in non-emergency situations, the landlord must provide the tenant with at least twenty-four (24) hours’ notice of their intent to enter, unless there is an agreement between the landlord and the tenant to the contrary. Landlords can only enter at reasonable times.

Required Disclosures

- Flood Disclosure (§ 90.228): Should the rental dwelling be located in the 100-year Flood Plain, as determined by the National Flood Insurance Program of the Federal Emergency Management Agency, the landlord must disclose this fact to the tenant.

- Lead Paint Disclosure: Per federal law landlords are required to inform tenants of any known lead paint hazards in rental dwellings built before 1978. Additionally, landlords must provide tenants with a specific government-issued resource that details the matter.

- Outstanding Notices/Pending Suits (§ 90.310): If a rental unit is in a building containing no more than four (4) units, the landlord must disclose to the tenant in writing before the execution of the rental agreement if the dwelling is subject to any of the following:

- “Any outstanding notice of default under a trust deed, mortgage or contract of sale, or notice of trustee’s sale under a trust deed;”

- “Any pending suit to foreclose a mortgage, trust deed or vendor’s lien under a contract of sale;”

- “Any pending declaration of forfeiture or suit for specific performance of a contract of sale; or”

- “Any pending proceeding to foreclose a tax lien.”

- Names and Addresses (§ 90.305): Landlords must inform tenants (in writing), the name(s) and address(es) of any individual(s) authorized to manage the premises on behalf of (or in addition to) the owner.

- Recycling (§ 90.318): Landlords of five (5) or more residential dwelling units on a single or five (5) or more manufactured dwellings in a single facility that is located in an urban growth boundary must provide information about recycling processes to tenants.

- Smoking Policy (§ 479.305): The lease agreement must include a disclosure of the rental dwelling’s smoking policy. Namely, the disclosure must state “whether smoking is prohibited on the premises, allowed on the entire premises or allowed in limited areas on the premises.” If smoking is allowed in limited areas, the areas where it is must be indicated in the disclosure.

- Utility/Service Fees (§ 90.315(2)): Landlords must disclose any utility or service that a tenant directly pays that benefits the landlord or any other tenants. The disclosure must be made in writing before or during the start of the lease.

- Copy of the Lease (§ 90.220(3)): Landlords must provide all tenants with a copy of the signed lease.

Security Deposits

Maximum: State law does not specify a limit to the amount a landlord can require a tenant to pay for a security deposit. According to § 90.300, landlords cannot alter the rental contract to require the tenant to pay a new or increased security deposit during the first year of renting. If the landlord wishes to charge a new or increased security deposit after the first year, they may do so as long as they give the tenant at least three (3) months to pay the new deposit.

Pet Deposit (§ 90.300(4)): Landlords can charge tenants that have one (1) or more pets an additional pet deposit. The deposit is not applicable to tenants with service animals.

Returning to Tenant (§ 90.300(13)): Landlords must return security deposits no later than thirty-one (31) days after the tenancy ends and the tenant delivers possession of the rental to the landlord.

Deposit Interest: No statute.

Uses of the Deposit (§ 90.300(7)): Deductions made from security deposits must be for one (1) of the following two (2) reasons:

- To cover a tenant’s defaults in regards to the rental agreement (unpaid rent included); and

- To repair damages to the dwelling caused by the tenant(s) – does not include standard wear and tear.