South Carolina Rental Lease Agreement Templates

South Carolina rental lease agreements establish the terms and boundaries for a tenant occupying a landlord’s property. Landlords select the form according to the property type and the rental duration (i.e., monthly or yearly). Both parties sign to indicate their awareness of the form’s conditions and agree to the obligations listed. To prevent confusion, the landlord and tenant should discuss each lease section before officially entering their signature.

Commercial real estate properties allow for much negotiation as the lessor and lessee must determine their payment schedule and legal abilities. Residential properties are usually more standard as the tenant sets the rates and regulations before a tenant signs. However, negotiations are still possible, which can promote the landlord’s credibility and ratings.

Types (6)

Commercial Lease Agreement – Used for leasing property (buildings, rooms, floors, etc.) for a fixed period of time to a business tenant.

Commercial Lease Agreement – Used for leasing property (buildings, rooms, floors, etc.) for a fixed period of time to a business tenant.

Download – PDF, Word (.docx)

Lease to Own Agreement – Serves two (2) purposes: 1) allows homeowners to lease their property for a set number of years, and 2) provides them with a means of setting a home purchase price that the tenant(s) renting the property can choose to act on.

Lease to Own Agreement – Serves two (2) purposes: 1) allows homeowners to lease their property for a set number of years, and 2) provides them with a means of setting a home purchase price that the tenant(s) renting the property can choose to act on.

Download – PDF, Word (.docx)

Month-to-Month (Residential) Rental Agreement – Spans a single month at a time, renewing automatically until either party terminates it. A thirty (30) days’ notice is required before the agreement ends.

Month-to-Month (Residential) Rental Agreement – Spans a single month at a time, renewing automatically until either party terminates it. A thirty (30) days’ notice is required before the agreement ends.

Download – PDF

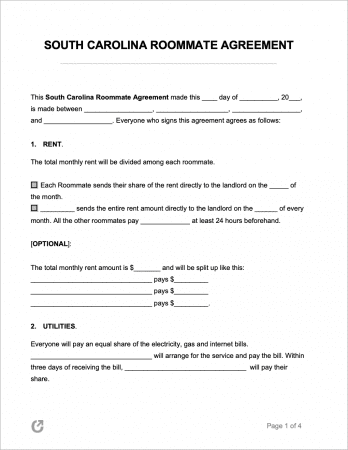

Roommate Agreement – Used by roommates to set a cooperative atmosphere by determining rules regarding guests, personal possessions, quiet hours, cleaning, dishes, and other relevant matters.

Roommate Agreement – Used by roommates to set a cooperative atmosphere by determining rules regarding guests, personal possessions, quiet hours, cleaning, dishes, and other relevant matters.

Download – PDF, Word (.docx)

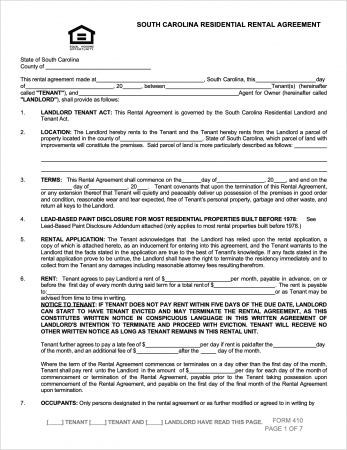

Standard Residential Rental Agreement – The most basic lease used for establishing yearly leases. Complies with all rental laws dictated by South Carolina.

Standard Residential Rental Agreement – The most basic lease used for establishing yearly leases. Complies with all rental laws dictated by South Carolina.

Download – PDF, Word (.docx)

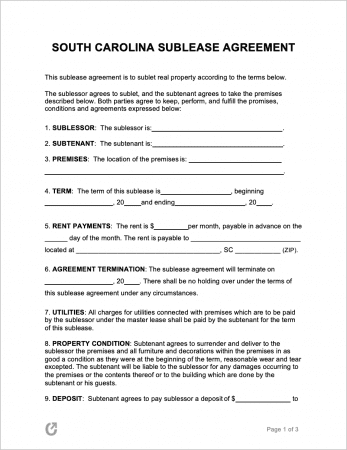

Sublease Agreement – Completed by tenants that need to vacate their rental, allowing them to legally introduce a secondary tenant to take over subsequent lease payments.

Sublease Agreement – Completed by tenants that need to vacate their rental, allowing them to legally introduce a secondary tenant to take over subsequent lease payments.

Download – PDF, Word (.docx)

What is a South Carolina Lease Agreement?

A South Carolina Lease Agreement is a landlord-drafted form that contains the rules and obligations that the landlord and tenant(s) agree to follow until the lease’s end date. Creating a lease comes directly after the landlord has screened and identified a viable tenant via the use of a rental application.

State Laws & Guides

Laws: Title 27, Ch. 40 “Residential Landlord and Tenant Act”

Landlord-Tenant Guides / Handbooks

When is Rent Due?

According to § 27-40-310(c), tenants have to pay rent on the time and place as contained in the lease (typically in monthly installments at the beginning of each month). There is no grace period specified in the state’s landlord-tenant laws.

Landlord’s Access

Emergency (§ 27-40-530(b)(1)): Landlords do not need a tenant’s consent prior to entering the rental unit at any time in emergency situations.

Non-Emergency (§ 27-40-530(c)): Landlords need to give tenants a minimum of twenty-four (24) hours prior to making entry, and can only enter at reasonable times.

Exception: Notice does not need to be provided for regularly scheduled services, such as those relating to changing air filters or treating pests, as long as it has been clarified in the lease.

Landlord’s Duties

As outlined by § 27-40-440, landlords in South Carolina are obligated to comply with the following:

- Make any and all repairs to maintain that the rental is safe and fit for living;

- Maintain compliance with all building and housing codes (as applicable) that pertain to the health and safety of tenants;

- Ensure all appliances, plumbing, HVAC systems, and other utilities (as provided by the landlord) are in good working order;

- Provide tenants with constant running water and “reasonable” amounts of hot water, unless it is a public utility solely controlled by the tenants.

- Ensure all common areas around the rental premises are in a safe condition. In dwellings with four (4) or more units, landlords are also responsible for keeping common areas clean.

Tenant’s Duties

Section 27-40-510 states the duties/obligations of tenants as follows:

- Keep their rental unit clean and safe as reasonable;

- Throw away trash in a safe and clean manner;

- Keep plumbing appliances and systems located in the rental unit as clean as reasonable;

- Refrain from negligently or purposefully destroying, defacing, or removing, any part of the property (or permit a guest to do so);

- Comply with applicable building and housing codes (that relate to their health and safety);

- Use all electrical, plumbing, air-conditioning, and other appliances and utilities in the manner in which they’re meant to be used;

- Act in a way that does not disturb other tenants; and

- Comply with both the lease and the rules/regulations that are enforceable per § 27-40-520.

Required Disclosures

- Lead Paint Disclosure: To comply with federal law, landlords must disclose to tenants if they know of any lead paint hazards present in a rental property built before 1978. Further to this, they must furnish the tenant with a copy of a government-issued brochure on the topic.

- Names and Addresses (§ 27-40-420): Before the start of the lease, the landlord must disclose (in writing), the names and addresses of the owner, or the person(s) authorized to act on the owner’s behalf.

- Unequal Security Deposits (§ 27-40-410(c)): If a landlord rents more than four (4) dwelling units in a single location, and uses different standards for calculating each tenant’s security deposits, the landlord must post a statement on the premises (or where the rent is paid) that indicates the rules used to make the calculations, or provide each prospective tenant with a statement setting forth the standards.

Security Deposits

Maximum: No statute.

Returning to Tenant (§ 27-40-410(a)): Deposits must be returned within thirty (30) days after the termination of the lease. If the landlord intends to keep any portion of the deposit due to damages (or other costs), the landlord must provide the tenant(s) with an itemized list containing each deduction. The tenant must provide the landlord with a forwarding address or new address that the deposit should be sent.

Deposit Interest: No statute.

Uses of the Deposit (§ 27-40-410(a)): Deductions are permitted to cover:

- A tenant’s unpaid rent;

- Damages the landlord suffered due to the tenant(s) non-compliance with § 27-40-51.