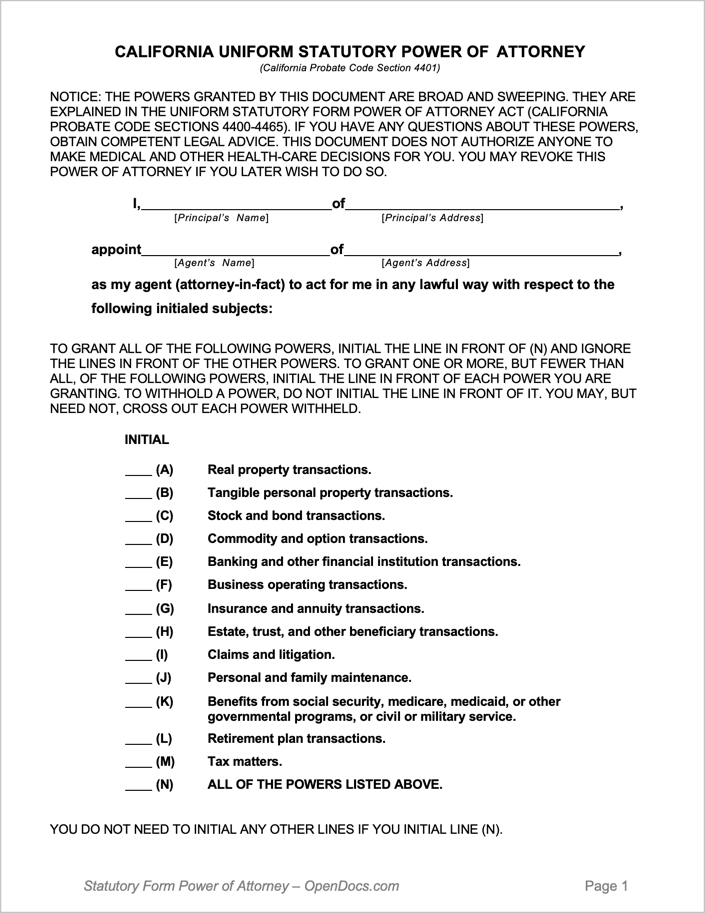

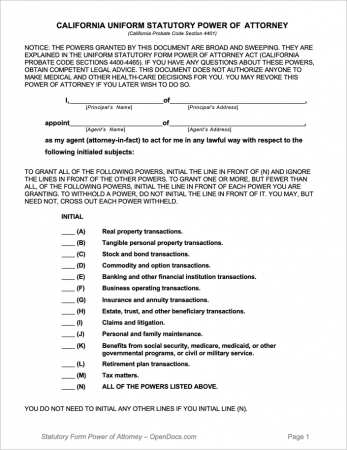

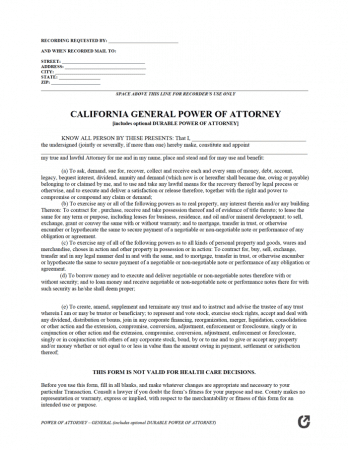

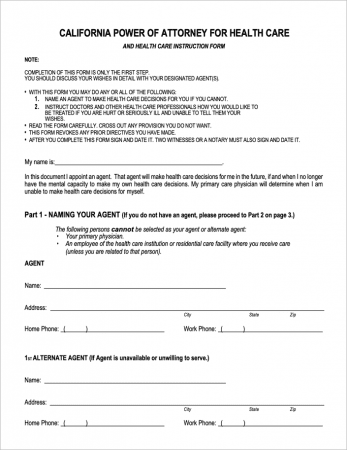

California Power of Attorney Forms

California power of attorney forms grant narrow or wide-ranging powers to a representative known as an “agent”. The forms must be completed by a person (known as the “principal”) who is of sound mind. POAs generally come in 2 main types, known as a durable and general. A form is durable if it remains in effect after if the principal were to no longer be able to act for themselves. The principal can select anyone as their agent, although choosing a trusted individual, such as a family member or close friend, is recommended.

- Laws: Division 4.5, “Powers of Attorney”

- Definition (§ 4022): “‘Power of Attorney’ means a written instrument, however denominated, that is executed by a natural person having the capacity to contract and that grants authority to an attorney-in-fact. A power of attorney may be durable or nondurable.”

Types (6)

| Durable | General | Limited | Medical | Minor | Vehicle |

Which Form is Right for Me? | |

| Durable | Used for assigning power regarding finances. The “durable” nature of the document means it continues to stay in effect should the principal become incapacitated (unable to communicate). |

| General | Unlike the durable POA, the general type terminates if the principal can no longer make decisions on their own. It is used for granting power over one’s finances, which can include banking, estate, property, and other related topics. |

| Limited | Used for granting power for only specific circumstances. Generally a non-durable form. |

| Medical | For nominating a person (such as friends or family) with the duty of communicating one’s health care preferences to medical providers, should the patient no longer be able to communicate themselves. |

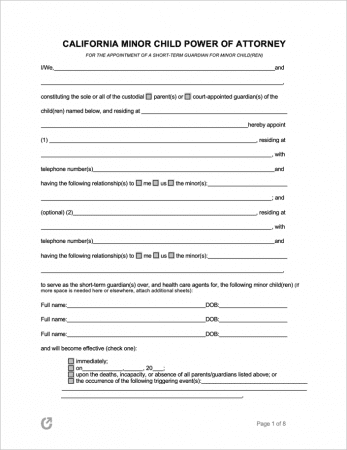

| Minor Child | If parents are not able to make decisions regarding the care of their child due to military active duty, prison, or for other reasons, they use the form to nominate a trustworthy individual to take care of their child (with full parental rights). |

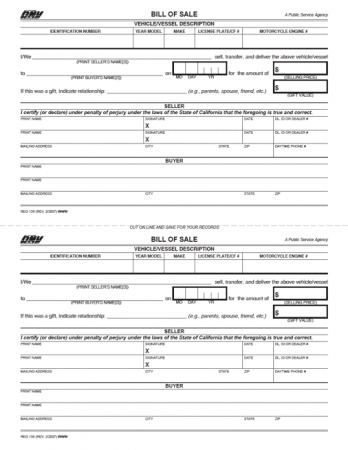

| Motor Vehicle | Created by the California DMV to provide residents a way of allowing another person to handle tasks such as selling or registering their car. |