Delaware Power of Attorney Forms

A Delaware power of attorney gives a person (the agent) the ability to represent another person over their healthcare and/or financial matters. So long the document is signed by the person executing it, notarized, and has the signature of one witness, it will be viewed as usable in the state. The forms range considerably in the amount of power they transfer and can be used for giving a tax preparer permission to file a person’s taxes, to assigning responsibility for a person’s medical treatment (when they are medically incapable of communicating their wishes).

Types (6)

| Ad. Directive | Durable | Springing | Guardian | Limited | Vehicle |

Which Form is Right for Me? | |

| Advance Directive | Use for recording the name and address of the person (agent) who will have the exclusive right to communicate your healthcare preferences to medical professionals should you be unable to yourself (the principal). Also includes a section for establishing your preferences for treatment, which prevents the agent from having to assume what you would want. |

| Durable (Financial) | Grants overarching powers regarding financial matters to a trusted individual. Does not terminate on the Principal’s incapacitation, which makes it useful as a long-term planning document. |

| Durable (Springing) | Similar to a standard durable POA, with the exception that it is “springing” which refers to the fact that it only goes into effect upon the principal’s incapacitation. |

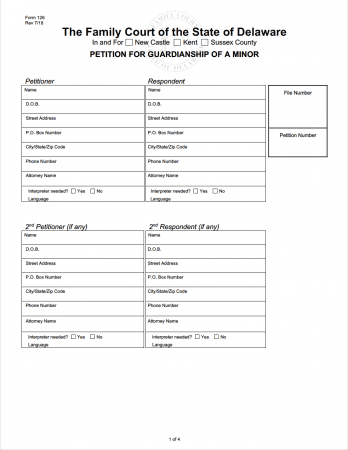

| Guardianship (126) | A legally-binding document that is used to assign temporary parental powers over one (1) or more children. |

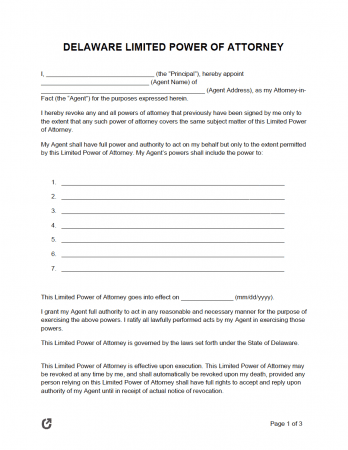

| Limited | Used for assigning highly specific powers to an agent, such as cashing a check or collecting rent. Terminates in the event the principal cannot make decisions on their own. |

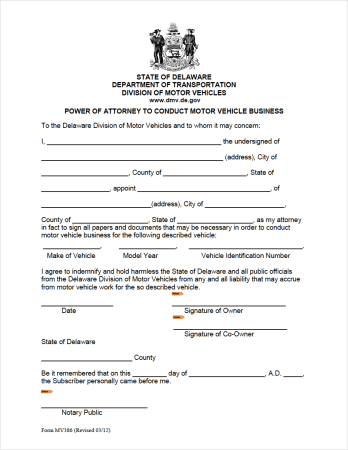

| Motor Vehicle (MV386) | Provided by the state, and gives motorists the ability to allow another party to handle matters relating to their car (registration, selling/buying, and more). |

Laws

- Statutes: Title 12, Ch. 49A

- Definition of Power of Attorney (§ 49A-102(10)): “means a grant of authority to an agent to act in the place of the principal, whether or not the term power of attorney is used, authorizing the agent to convey rights in property of the principal to the agent or any other person.”

- Signing requirements (§ 49A-105): Must be signed and dated by the principal, acknowledged by a Notary Public, and witnessed by one (1) witness.