Iowa General (Financial) Power of Attorney

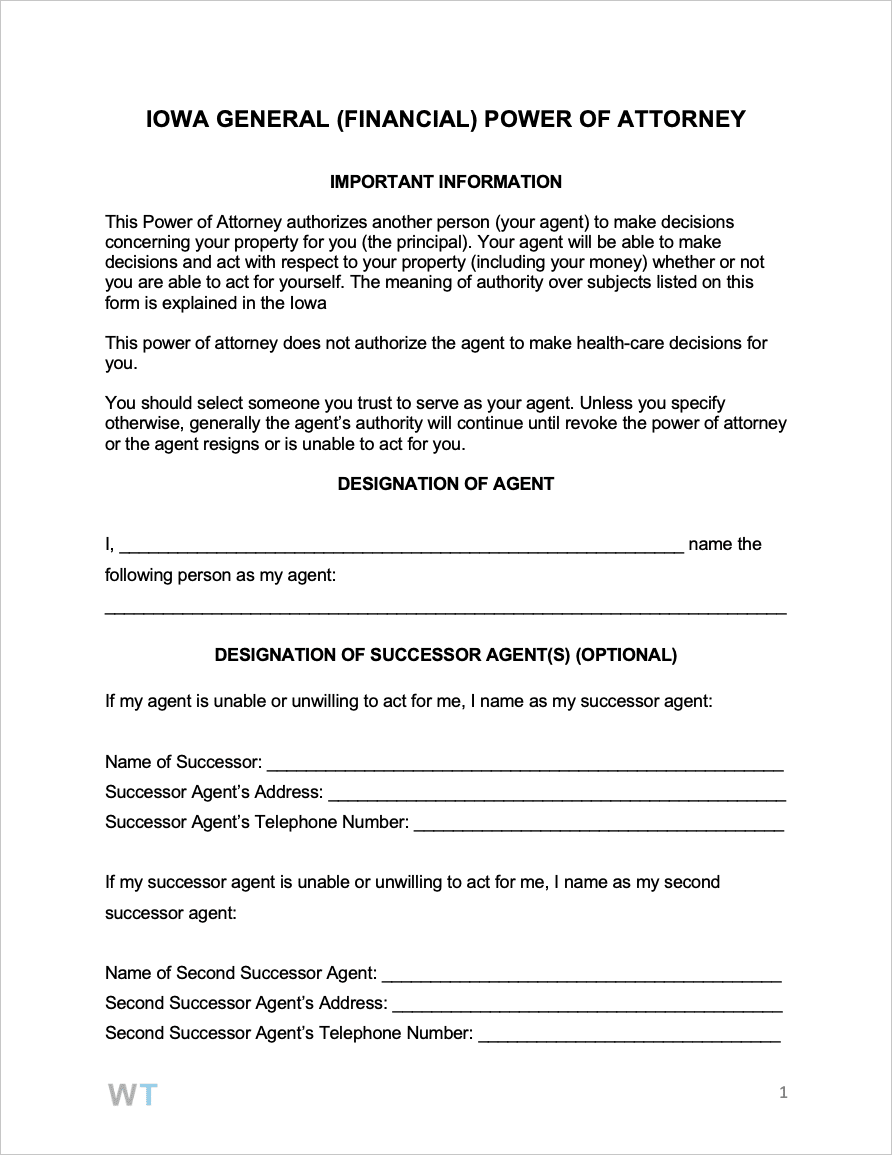

The Iowa General (Financial) Power of Attorney fulfills one’s need to bestow asset management permissions to a person they trust. Completing the form is straightforward, and involves the principal speaking with their close friends and family to identify someone that would make a good agent. Then, they complete the form by entering their contact information (as well as the agent), listing the power(s) the agent will have, and then finally signing the document in front of a certified Notary.

There are two (2) general types of financial POA forms; durable and general, with this one (general) being the less permanent version. Where they differ is in how the agent can exercise their power. With a durable POA, the agent keeps their powers regardless of the health of the principal. This is useful if the principal wants to make sure their finances are taken care of regardless of what happens to themself. However, for those just looking to give an agent power for a short amount of time, it is not needed.

OVERVIEW

|

Laws: Title XV, Ch. 633B

Signing requirements (§ 633B.105): Either a Notary Public or other authorized individual must acknowledge the Principal’s signature upon the General POA document.