Maine General (Financial) Power of Attorney Form

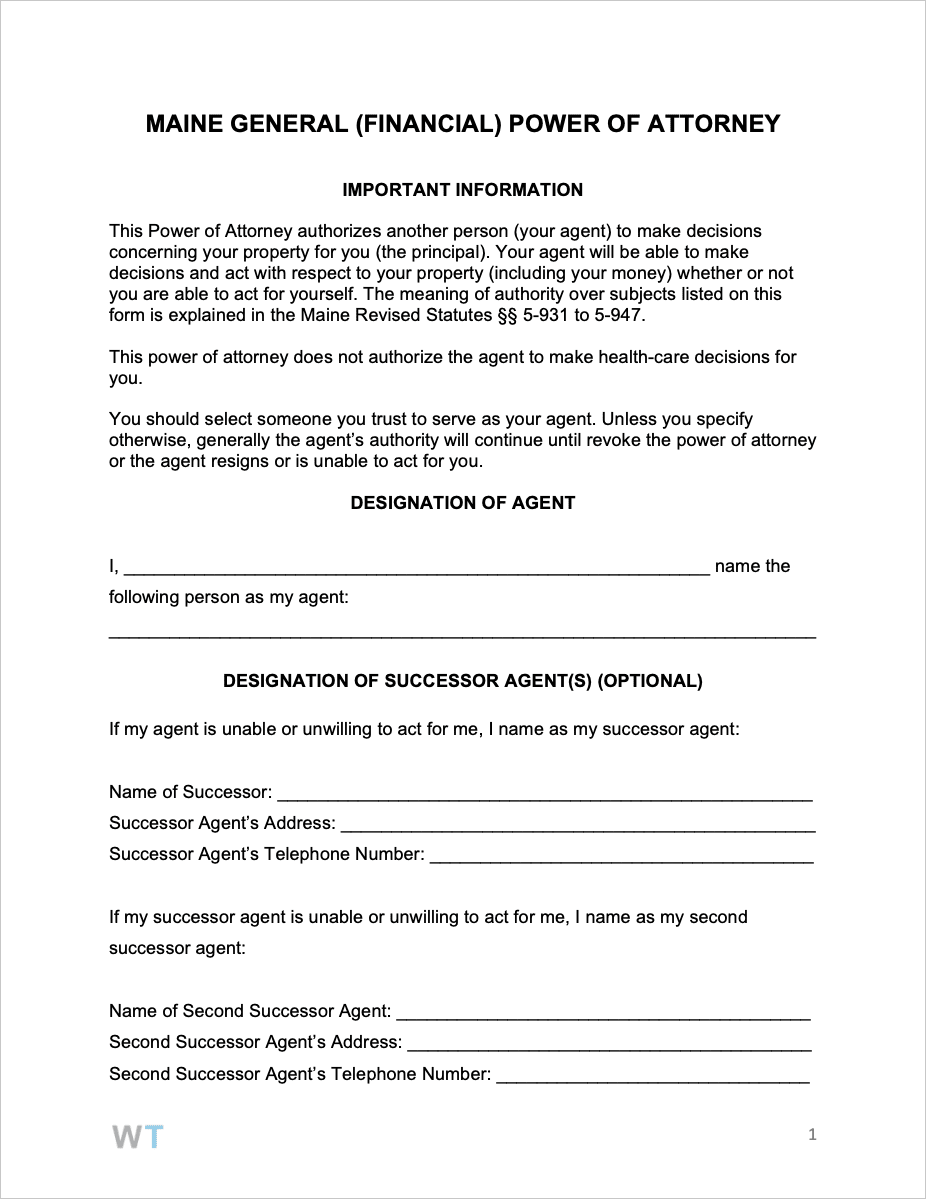

The Maine General (Financial) Power of Attorney is a financial-management tool used for issuing provisional rights over one’s assets to someone they choose (the “agent”). Depending on the exact powers selected with the form, this can range from business matters to asset management, and everything in between. The agent is prohibited from handling medical matters. Additionally, the principal (you) need to complete a separate POA for granting powers over a motor vehicle or tax-related topics.

When going about agent selection, the ball is completely in the principal’s court. Be it a trusted associate, family member, or spouse, what matters more than anything is that they are responsible and have a good understanding of what managing your finances entails. If at anytime, the agent pays for something that would otherwise be your responsibility, statute 5-912 establishes that the agent should be reimbursed for said expenses.

Note on the durability of the form: This is a non-durable power of attorney. This means it should not be used for long-term planning, as the agreement will be abolished should the principal be unable to convey decisions to those around them. If you want a form that continues to persist despite your health, choose the durable power of attorney form.

Laws: Title 18-C, Art. 5, Part 9

Terminating agent’s power: § 5-910

Signing requirements (§ 5-905(1)) – Once the form has been filled out in full, the principal will need to sign their name in view of a Notary Public.