North Carolina Power of Attorney Forms

A North Carolina Power of Attorney Form provides a person with the power to handle another’s decisions. The one assigning the power is known as the “principal” and the individual receiving it is known as the “agent” or “attorney-in-fact”. The principal can establish the agent to have powers regarding any area of their life, with those relating to financial or medical matters being the most common. If the principal is looking to create a POA that remains in effect regardless of their current health status, they should enact a durable power of attorney. The durable nature of the form means it is “tough” enough to remain in effect after the principal can no longer effectively communicate their needs (a term known as “incapacitation”). A principal will only use a durable form if they are looking to nominate a long-term agent. A non-durable POA, on the other hand, should be used for more specific and/or one-time requests, like signing a document or registering a car.

Types (6)

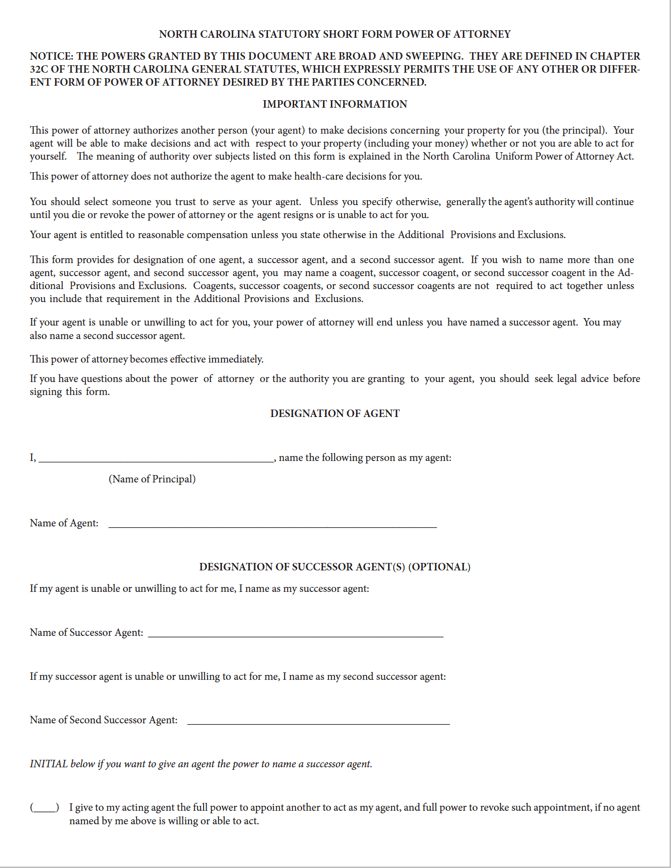

Durable Power of Attorney – Expressly permits an agent to represent the principal’s finances before and/or after they become incapacitated.

Durable Power of Attorney – Expressly permits an agent to represent the principal’s finances before and/or after they become incapacitated.

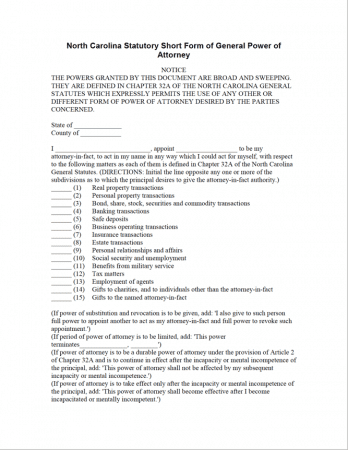

General (Financial) Power of Attorney – Grants broad and sweeping powers to an attorney-in-fact for powers regarding banking, investments, property, and any other monetary-related items. The non-durable option of the durable (financial) POA.

General (Financial) Power of Attorney – Grants broad and sweeping powers to an attorney-in-fact for powers regarding banking, investments, property, and any other monetary-related items. The non-durable option of the durable (financial) POA.

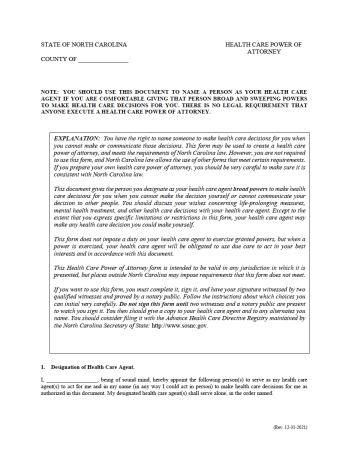

Health Care (Medical) Power of Attorney – Used for assigning a trusted person to oversee decisions made regarding their health. The document is springing, meaning it goes into effect after the principal is officially stated as incapacitated by a medical professional.

Health Care (Medical) Power of Attorney – Used for assigning a trusted person to oversee decisions made regarding their health. The document is springing, meaning it goes into effect after the principal is officially stated as incapacitated by a medical professional.

Limited (Special) Power of Attorney – A form that can be used to assign ANY powers to an agent. If none of the eight (8) other POA types apply to what the principal needs, this form should be used.

Limited (Special) Power of Attorney – A form that can be used to assign ANY powers to an agent. If none of the eight (8) other POA types apply to what the principal needs, this form should be used.

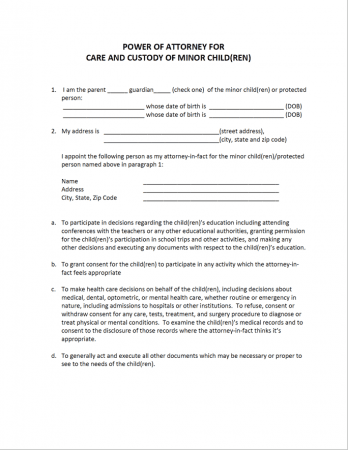

Minor Child Power of Attorney – Allows a parent or guardian a means of giving a person the right to take care of their children on their behalf while they are away. Commonly used by members of the armed forces while they are on deployment.

Minor Child Power of Attorney – Allows a parent or guardian a means of giving a person the right to take care of their children on their behalf while they are away. Commonly used by members of the armed forces while they are on deployment.

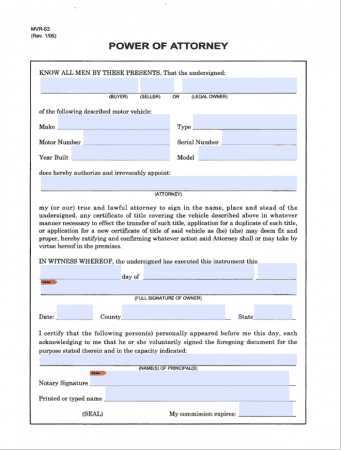

Motor Vehicle Power of Attorney (Form MVR-63) – An official document provided by the state. For assigning one-time powers for a car or truck.

Motor Vehicle Power of Attorney (Form MVR-63) – An official document provided by the state. For assigning one-time powers for a car or truck.

Download: PDF

Laws & Signing Requirements

- North Carolina Power of Attorney Laws – Chapter 32C and Chapter 32A, Article 3

- State Definition of Power of Attorney (§ 32C-1-102(9)) – “A writing or other record that grants authority to an agent to act in the place of the Principal, whether or not the term power of attorney is used.”

- Signing Requirements

- General / Durable Power of Attorney (§ 32C-1-105) – Must be notarized.

- Advance Directive / Medical Power of Attorney (§ 32A-16(3)) – Signed by 2 witnesses AND notarized.