New Hampshire Power of Attorney Forms

A New Hampshire Power of Attorney (POA) is an estate planning form used for providing an agent or attorney-in-fact with the necessary documentation to allow them to carry out and/or communicate another person’s wishes.

An individual called the ‘agent’ can be given powers relating to finances, real estate, taxes, motor vehicles, healthcare, and more. Additionally, the ‘principal’ (the issuer) can decide to make the power of attorney expire on a certain date, continue indefinitely (until they die), or become active after a specific event (known as a “springing” POA).

Upon accepting their nomination as an attorney-in-fact, they are bound by NH law to make every decision with the principal’s best interests in mind, and only exercise power of the specific rights they have been given in the form.

Types (6)

| Ad. Directive | Durable | General | Limited | Minor | Vehicle |

Which Form is Right for Me? | |

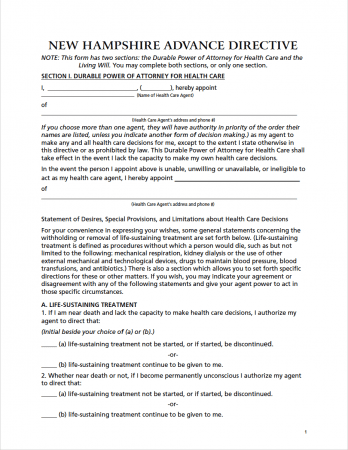

| Advance Directive | A contract that allows an individual to appoint an agent to enforce how they would like to be taken care of if they are on life support, are in a coma, and any other event in which the principal can’t communicate (but is still alive). |

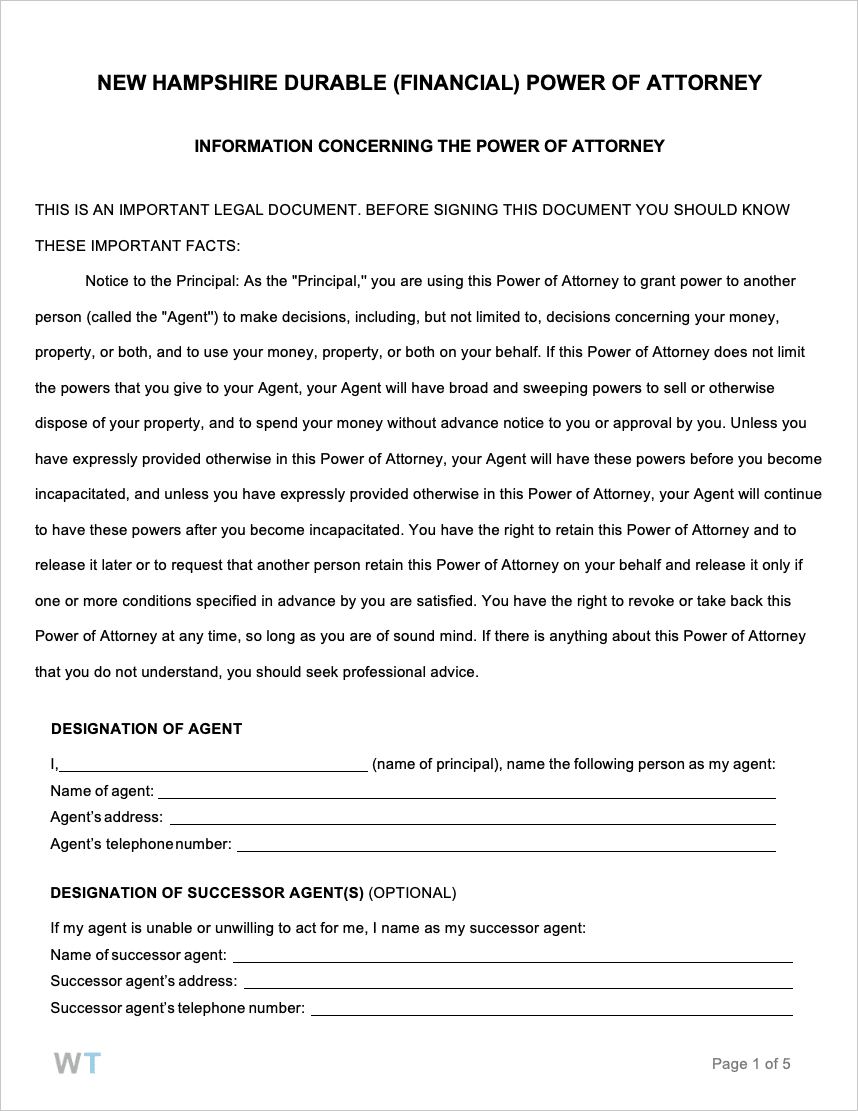

| Durable | Used for giving an agent sweeping powers regarding one’s finances, including banking, policies, investments, and more. Being durable, the form does NOT terminate if something were to happen to the principal, leaving them incapacitated. |

| General | Covers the same types of powers as a durable POA, with the major difference in that it is non-durable. In other words, it terminates on its own should the principal suffer an event that leaves them mentally incapacitated. |

| Limited | Restrains the decision making powers granted to an agent to a particular set of circumstances and/or for a specific amount of time. |

| Minor Child | Used by parents who will be leaving their child/children to assign a trusted caregiver. The caregiver will have temporary parental rights, allowing them to sign forms and other parental tasks. |

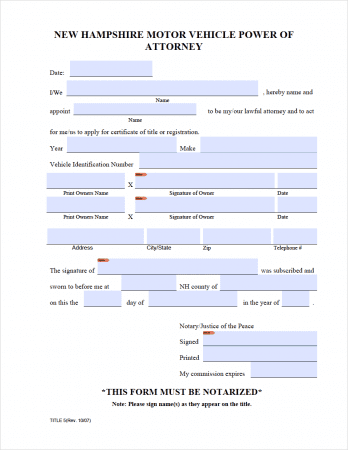

| Motor Vehicle | Provided by the state for giving another person the right to handle administrative tasks for a car, such as registering or signing over a title. |

Laws

- Statutes: Chapter 564-E & Chapter 137-J

- Agent’s duties: § 564-E:114

- Definition of Power of Attorney (§ 564-E:102(15)): “means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used.”

- Definition of Advance Directive (§ 137-J:2(I)): “means a directive allowing a person to give directions about future medical care or to designate another person to make medical decisions if he or she should lose the capacity to make health care decisions. The term “advance directives” shall include living wills and durable powers of attorney for health care.”

- Signing Requirements

- Durable Power of Attorney (§ 564-E:105(c)) – Notarized.

- Advance Directive / Medical Power of Attorney (§ 137-J:20) – Notarized OR signed by 2 witnesses.