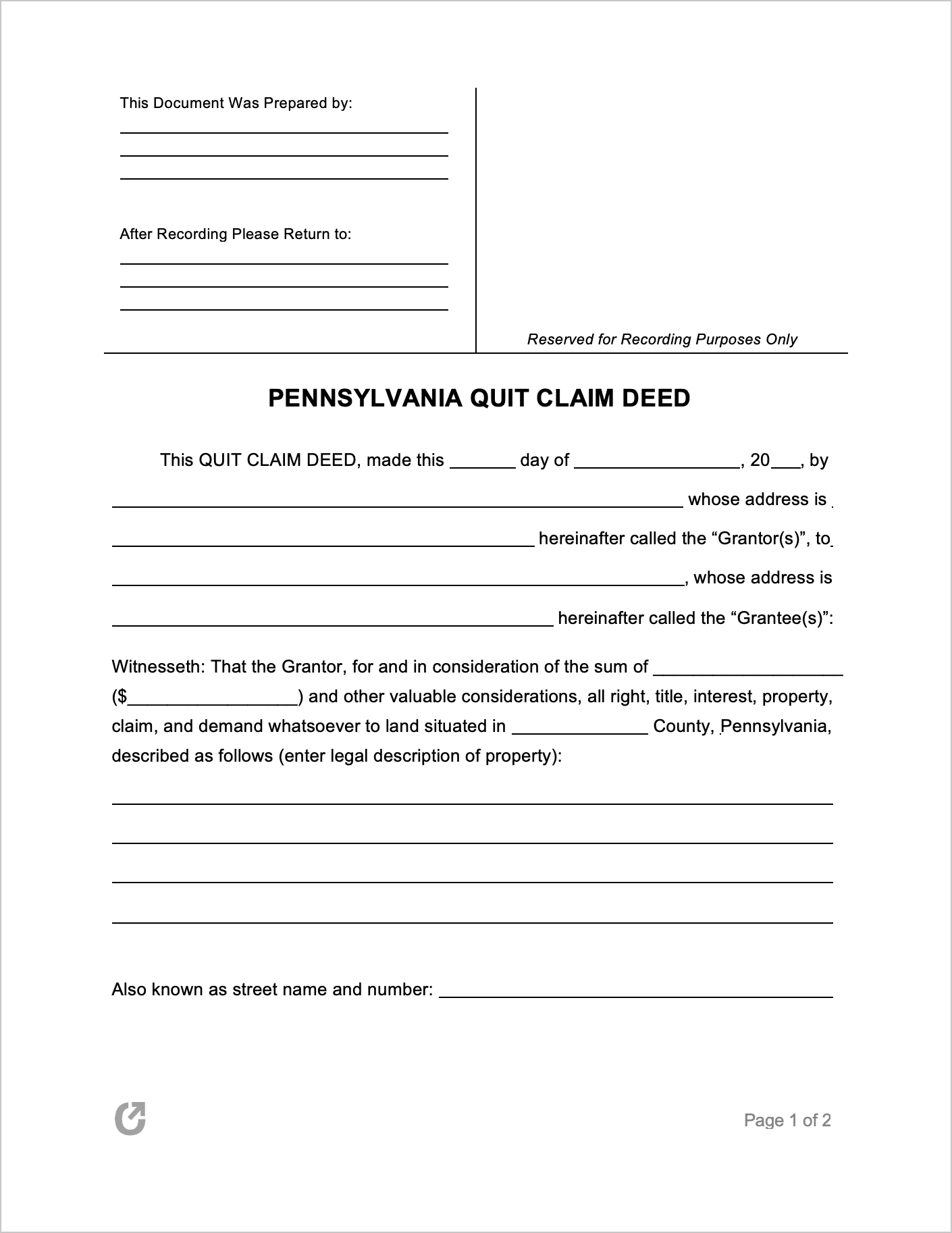

Pennsylvania Quit Claim Deed Form

The Pennsylvania Quit Claim Deed is a property document used for transferring ownership of real estate to a person the property owner knows personally and trusts (commonly family).

It allows a party called the “grantor” to enter into an arrangement whereby he or she conveys any interest (ownership) they hold over a dwelling to another party called the “grantee”. Because it is not possible for the deed- to confirm whether or not the grantor is the only party who holds interest in the dwelling, it is the responsibility of the grantee to confirm this beforehand.

Requirements

Uniform Parcel Identifier (UPI) Law (§ 21-10.1 and § 21-358): Certain counties in Pennsylvania uphold the “Uniform Parcel Identifier Law.” If applicable, the uniform parcel identifier MUST to be endorsed or included on the form.

Philadelphia County: Residents of Philadelphia County must file the Real Estate Transfer Tax Certification alongside the deed.

Download: Form 82-127 (Philadelphia Real Estate Transfer Tax).pdf

Signing Requirements (§ 21-351): Must be signed and acknowledged (by a Notary Public) by the Grantor(s).

Mandatory Forms

- Certificate of Residency – Per § 16-9781, it is a state law requirement that a Certificate of Residency be filed with the deed at the time of recording. This form is available for download on the homepage of each county.

- Statement of Value – In accordance with § 91.112, this form must be filed with the deed at the time of recording. Download: Realty Transfer Tax Statement of Value (Form REV-183 EX).pdf

- Transfer Tax – If the property is subject to transfer tax, the tax must be paid.

How to File

The completed deed must be filed in the Office for the Recording of Deeds in the county where the property is located. There are two (2) additional mandatory documents that must also be filed for the form to be accepted for recording (above).