Connecticut Rental Lease Agreement Templates

The Connecticut Lease Agreements are legal documents used for setting binding terms regarding the renting of a property. They are formed between a landlord and a tenant, who are both bound by the conditions included in the form. Once they record their signatures onto the document they are bound by the rules until the lease’s expiration (or until one party breaches the agreement). While each contract may vary according to the wishes of each party, contracts usually contain elements such as a description of the property, utilities, the term of the lease, and rent amount.

Types (6)

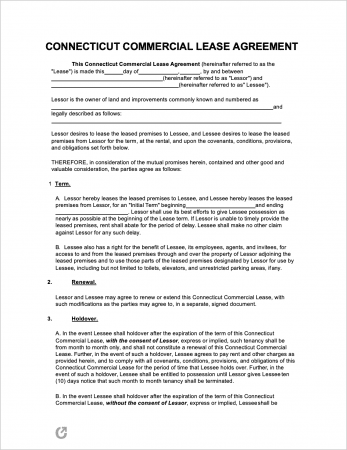

Commercial Lease Agreement – To be exclusively used for the renting of buildings, offices, warehouses, and rooms to business tenants.

Commercial Lease Agreement – To be exclusively used for the renting of buildings, offices, warehouses, and rooms to business tenants.

Download – Adobe PDF (.pdf), Word (.docx)

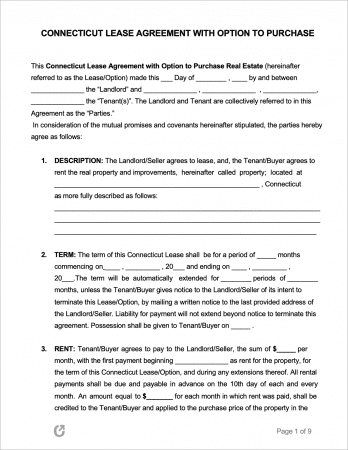

Lease to Own Agreement – An agreement that serves as both a lease and a purchase agreement. At the end of the lease, the tenants have the option (not the obligation) to purchase the rental.

Lease to Own Agreement – An agreement that serves as both a lease and a purchase agreement. At the end of the lease, the tenants have the option (not the obligation) to purchase the rental.

Download – Adobe PDF (.pdf), Word (.docx)

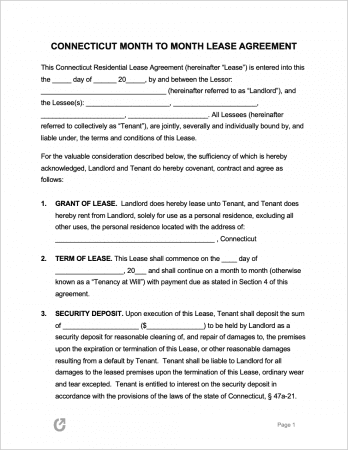

Month-to-Month Lease Agreement – An auto-renewing, short-term lease designed to provide flexibility to both landlords and tenants. Can be terminated with thirty (30) days of notice.

Month-to-Month Lease Agreement – An auto-renewing, short-term lease designed to provide flexibility to both landlords and tenants. Can be terminated with thirty (30) days of notice.

Download – Adobe PDF (.pdf), Word (.docx)

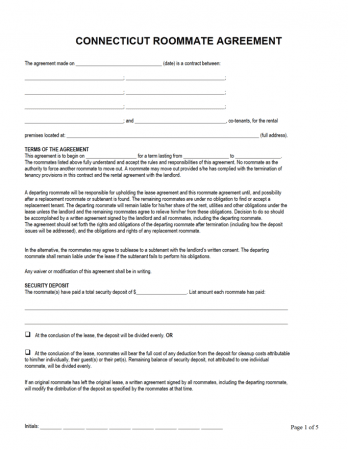

Roommate Agreement – Used for specifying the responsibilities of each roommate in a shared residence.

Roommate Agreement – Used for specifying the responsibilities of each roommate in a shared residence.

Download – Adobe PDF (.pdf)

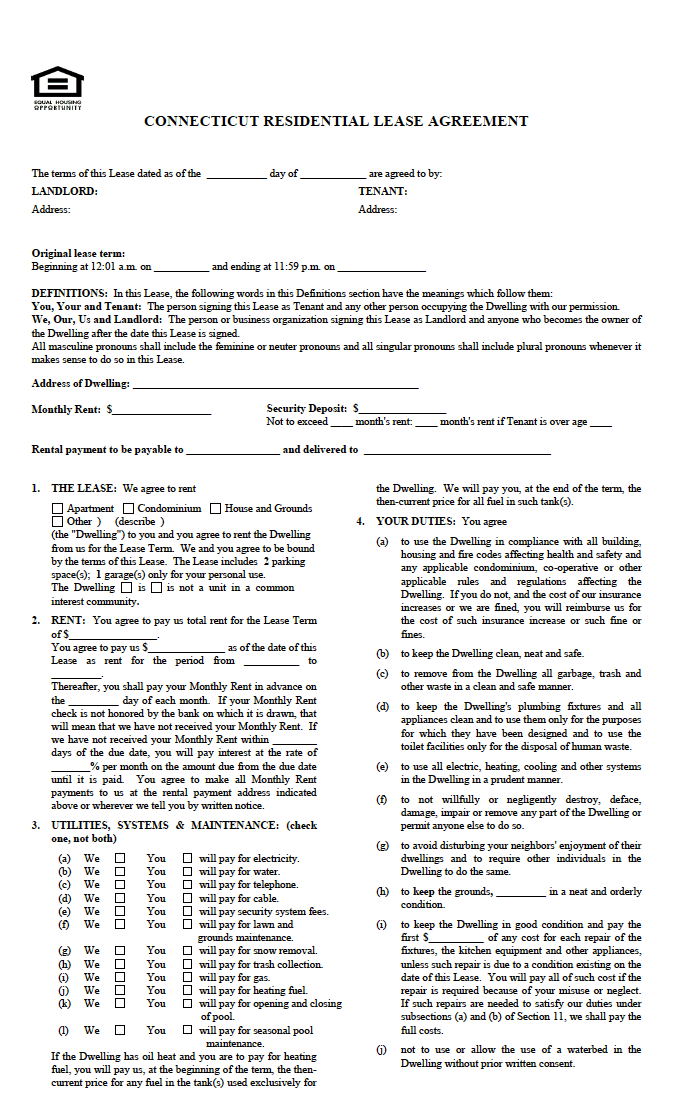

Standard Residential Lease Agreement – The most commonly used lease contract. Includes the rights and responsibilities of landlords and tenants.

Standard Residential Lease Agreement – The most commonly used lease contract. Includes the rights and responsibilities of landlords and tenants.

Download – Adobe PDF (.pdf), Word (.docx)

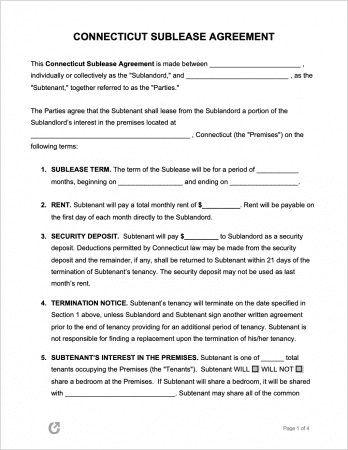

Sublease Agreement – A document signed between the original tenant of a leased property and a new tenant, for purpose of allowing the original tenant to vacate the rental.

Sublease Agreement – A document signed between the original tenant of a leased property and a new tenant, for purpose of allowing the original tenant to vacate the rental.

Download – Adobe PDF (.pdf), Word (.docx)

What is a Connecticut Lease Agreement?

A Connecticut Lease Agreement is a legal document that is used to set legal protections for both the landlord renting out a property and the tenant(s) living or working in the rental. To aid the process of finding an upstanding tenant, it is advisable that landlords use a rental application to vet tenants.

State Laws & Guides

Laws: Chapter 830 “Rules and Responsibilities of Landlord and Tenant”

Landlord-Tenant Guides / Handbooks

- Rights and Responsibilities of Landlords and Tenants in Connecticut.pdf

- “Moving Forward” – Connecticut Renters’ Guide.pdf

When is Rent Due?

In accordance with § 830-47a-3a, unless otherwise agreed, rent must be paid in equal monthly installments at the beginning of each month. For terms of one (1) month or less, rent is payable at the beginning of the term. There is a grace period of nine (9) days for fixed-term leases and four (4) days for one-week tenancies.

Landlord’s Access

- Emergency (§ 830-47a-16(b)): In cases of emergency, landlords do not need to acquire the consent of tenant(s) to enter into the occupied dwelling.

- Non-Emergency (§ 830-47a-16(d)): So long written or oral notice of their intent to enter is given, landlords may access the property for reasons including (but not limited to), inspecting the premises and making necessary or agreed to repairs, alterations, and/or improvements. Entry my only take place at reasonable times.

Required Disclosures

- Bed Bug Disclosure (§ 830-47a-7a-3(c)): Prior to the lease of a property, the landlord must inform the tenant if the property is currently infested with bed bugs. If the tenant requests further information, the landlord must disclose the last date the property was inspected and found free of bed bugs.

- Common Interest Community (§ 830-47a-3e): If the residence is located in a common-interest community, a disclosure must be attached to the rental contract.

- Fire Sprinkler Disclosure (§ 830-47a-3f(c)): The landlord must specify in the rental agreement as to whether or not there is a functioning fire sprinkler system in the property unit. If there is, the rental agreement should note the last date of its maintenance and inspection.

- Landlord Identity (§ 830-47a-6): Landlords or agents must identify themselves in writing and specify where the tenant may send notice.

- Lead Disclosure: All known lead paint hazards must be disclosed by landlords. Further to this, landlords are required to provide a tenant with an information pamphlet about the topic as an attachment to a written lease.

- Electronic Funds (§ 830-47a-4c): Landlords cannot limit tenants to paying rent and security deposits solely through electronic funds transfer. Per state law, “electronic funds transfer” means “any transfer of funds that is initiated through an electronic terminal, telephone or computer or magnetic tape so as to order, instruct or authorize a financial institution to debit or credit an account…”

Security Deposits

Maximum (§ 830-47a-21): For tenants aged sixty-two (62) years and older, a landlord may only be demand a maximum one (1) month’s rent. For tenants under sixty-two (62) years of age, a landlord may only demand two (2) months’ periodic rent, of which may be in addition to the current month’s rent.

Returning to Tenant (§ 830-47a-21): Tenants must receive their deposit back, including any accrued interest, within thirty (30) days of handing the premises back to the landlord or within fifteen (15) days of receiving the tenant’s forwarding address, whichever is later.

Deposit Interest (§ 830-47a-21(i)): Landlords are required by law to pay out interest in deposits in accordance with the rate set by the Federal Reserve Board Bulletin. Current CT rates can be found at the official state website. For 2020, the rate required to be paid by landlords is .15%. If the tenant is late on making a payment by ten (10) days or more, they lose their right to the interest (unless the landlord charges a late fee).

Uses of the Deposit (§ 830-47a-21): There are three (3) types of expenses landlords can deduct from security deposits for. These are:

- Pay for unpaid rent,

- Cover unpaid utility payments owed to the landlord by the tenant, and

- Remedy any damage to the dwelling caused by the tenant’s failure to comply with the lease.