Indiana Rental Lease Agreement Templates

The Indiana Rental Lease Agreements are contracts used to formalize an arrangement where a landlord leases a residential property to one (1) or more people. The agreements cover a wide range of topics that ensure both parties are clear on what they can and can’t do for the lease term. In Indiana, leases are governed by the state’s Landlord-Tenant laws (§§ 32-31).

Types (6)

Commercial Lease Agreement – A contract used for renting out land, property, and individual spaces to tenants who own a business or are planning on opening one in the property location.

Commercial Lease Agreement – A contract used for renting out land, property, and individual spaces to tenants who own a business or are planning on opening one in the property location.

Download – Adobe PDF, Word (.docx)

Lease to Own Agreement – Solves two (2) purposes: 1) leases a home or condominium to qualified tenants, and 2) establishes an agreed-upon purchase price for the property that the tenants can optionally decide to act on.

Lease to Own Agreement – Solves two (2) purposes: 1) leases a home or condominium to qualified tenants, and 2) establishes an agreed-upon purchase price for the property that the tenants can optionally decide to act on.

Download – Adobe PDF, Word (.docx)

Month-to-Month Lease Agreement – Differing from a typical long-term lease, this lease-type allows for a property to be rented in increments of thirty (30) days, allowing either party to terminate the agreement with one (1) month of notice.

Month-to-Month Lease Agreement – Differing from a typical long-term lease, this lease-type allows for a property to be rented in increments of thirty (30) days, allowing either party to terminate the agreement with one (1) month of notice.

Download – Adobe PDF, Word (.docx)

Roommate Agreement – Signed by roommates of a shared rental property that sets out guidelines and obligations each roommate is required to uphold.

Roommate Agreement – Signed by roommates of a shared rental property that sets out guidelines and obligations each roommate is required to uphold.

Download – Adobe PDF, Word (.docx)

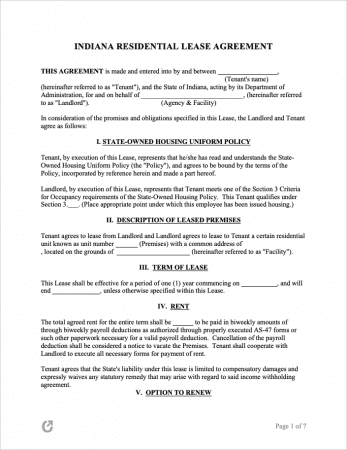

Standard Residential Lease Agreement – The basic lease form for renting individual units or entire properties in the state of Indiana.

Standard Residential Lease Agreement – The basic lease form for renting individual units or entire properties in the state of Indiana.

Download – Adobe PDF, Word (.docx)

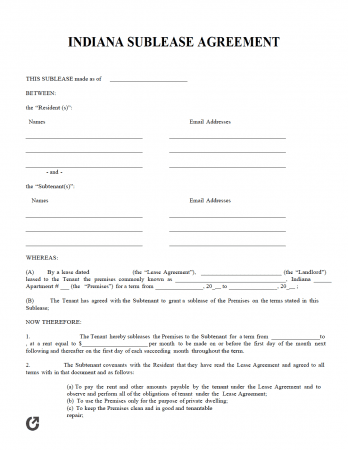

Sublease Agreement – Permits a tenant to rent out part or all of their rental unit to another party.

Sublease Agreement – Permits a tenant to rent out part or all of their rental unit to another party.

Download – Adobe PDF, Word (.docx)

What is an Indiana Lease Agreement?

An Indiana Lease Agreement is a legal document used in property management to lock-in tenants into paying rent for a leased property for an average duration of one (1) year. Each document needs to conform to relevant IN law in addition to complying with federal fair housing laws. Prior to signing a lease with a tenant, they should be screened using an Indiana-specific rental application.

State Laws & Guides

Laws: IN Code §§ 32-31 – “Landlord-Tenant Relations”

Landlord-Tenant Guides / Handbooks

When is Rent Due?

There is no statute in IN state law specifying when rent is due. There is also no grace period included by state law. The lease agreement should specify the date rent is due as well as the conditions in which a grace period is offered if the landlord chooses to offer one.

Landlord’s Access

Emergency (IC 32-31-5-6(f)): Landlords are permitted by state law to enter a rental unit in emergencies so long the safety of the tenants or the property is threatened.

Non-Emergency (IC 32-31-5-6(g)): Tenants must be provided with reasonable written or oral notice of the landlord’s intent to enter. Entrance may only be made during reasonable times. Although no definition for “reasonable” is given by state law, typical notice is giving tenants a heads-up of at least twenty-four (24) hours and only entering during normal business hours.

Landlord’s Duties

As required by IC 32-31-8-5, landlords need to:

- Deliver the rental unit in accordance with the rental agreement and in a safe, clean, and habitable manner.

- Oblige with all applicable Indiana health and housing codes.

- Keep common areas clean and in good condition.

- Ensure the following systems/appliances are in good working condition (so long they are available to be used by tenants):

- Electrical, sanitary, and plumbing systems (need to provide hot and cold running water 24/7),

- HVAC systems (must be able to provide heat at all times),

- Elevators (if available to tenants), and

- Any other appliances or systems included in the rental contract.

Tenant’s Duties

Per IC 32-31-7-5, tenants have to comply with the following (in addition to requirements as stated in a lease):

- Comply with applicable local and state housing/health codes.

- Keep the rented unit as clean as reasonable.

- Use all provided appliances in systems in the manner they are meant to be used.

- Do not alter or damage any part of the rented dwelling.

- Comply with all rules and conditions in the signed lease.

- Ensure all smoke detector(s) are in good working order. If they contain batteries, it is the tenant’s responsibility to change them. If they are hardwired and need service, the tenant(s) need to inform the landlord via notice.

Required Disclosures

- Flooding Disclosure (IC 32-31-1-21): The landlord is required to disclose in the rental agreement that the structure is situated in a flood plain if the lowest floor of the structure where the rental dwelling is located, including the basement, is at or below the one hundred (100) year frequency flood elevation.

- Lead Paint Disclosure: In addition to providing a pamphlet on lead-based hazards, landlords of dwellings built before 1978 must inform tenants of any known lead paint hazards.

- Smoke Detectors (IC 32-31-5-7): Prior to (or during) the tenant’s move-in, the landlord needs to have the tenant(s) acknowledge (in writing) that the rental unit contains at least one (1) good-functioning smoke detector.

- Names and Addresses (IC 32-31-3-18): Landlords are required to disclose to tenants in writing at or before the lease begins the names and addresses of:

- An individual that resides in Indiana who is authorized to manage the dwelling unit, and

- as well as a person residing in Indiana who is reasonably accessible to the tenant and who is authorized to act as agent for the owner for purposes of service of process and receiving and receipting for notices and demands.

- Leases Longer than Three (3) Years (IC 32-31-2-1): If the landlord will be renting a unit for three (3) years or more, the landlord must record the lease at an applicable county recorder’s office located in the same county as the rental property (within 45 days of the lease’s signing).

Security Deposits

Maximum: State law does not cap the amount of money a landlord can demand as a security deposit.

Returning to Tenant (IC 32-31-3-12): Landlords must return deposits no more than forty-five (45) days after the termination of the lease agreement. If there are deductions made to the deposit they must be written in a list with the amount due next to each deduction.

Deposit Interest: No statute; interest does not need to be paid to tenants on deposits.

Uses of the Deposit: In accordance with state law, landlords can make deductions from tenant deposits for the following reasons:

- To remedy the accrument of unpaid rent;

- To pay for the fixing of damages to a rental unit caused by the tenant’s noncompliance with either state law or the lease; and

- To pay for any unpaid utility or sewer charges that the tenant was obligated to pay for per the lease agreement.