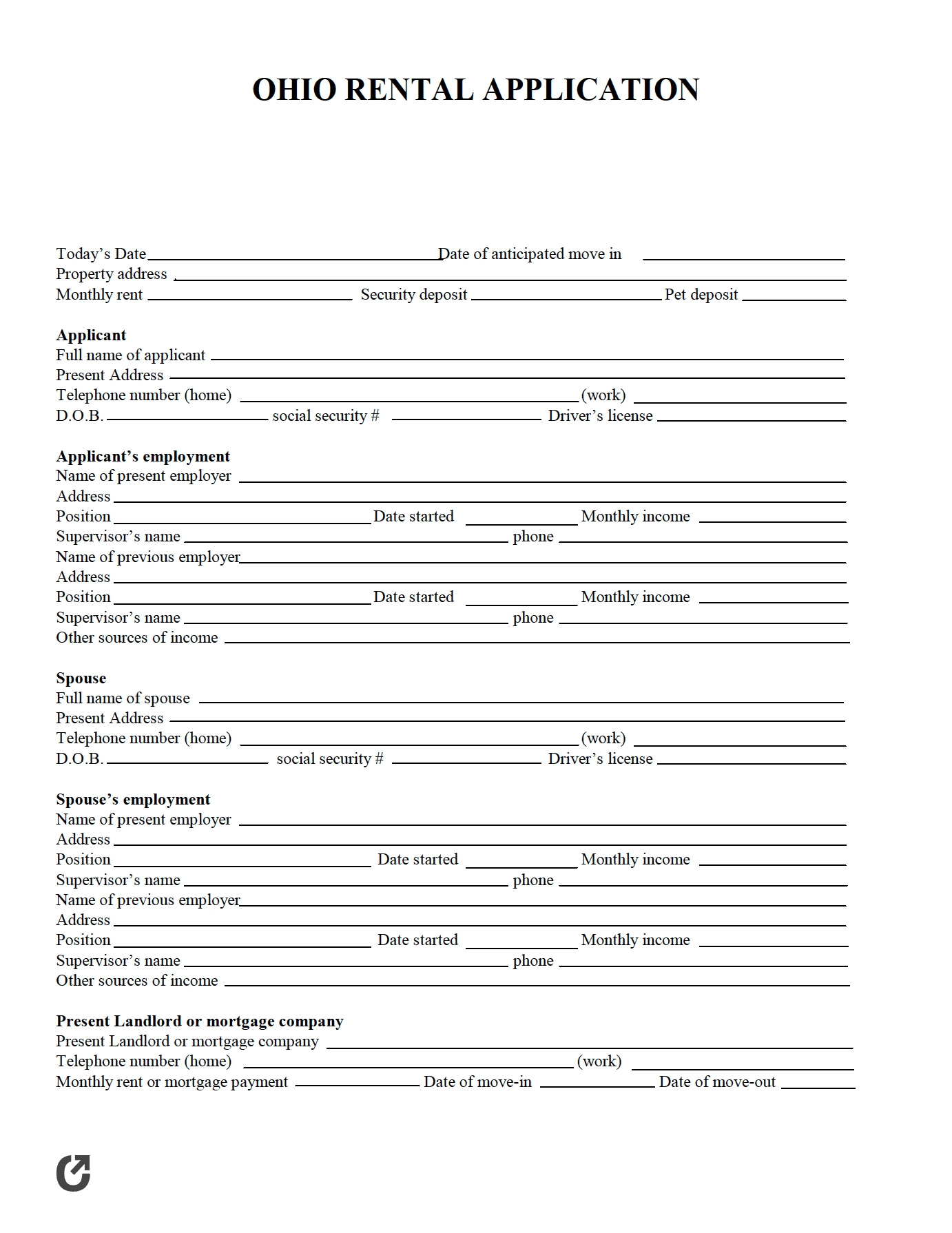

Ohio Rental Application

The Ohio Rental Application is a document used for gathering and organizing personal information on a tenant. It allows them to easily obtain information regarding matters such as their rental history, employment history, and credit history. With the completed application, the landlord will be able to identify any inputted information that is an immediate disqualifier for renting, as well as look for any information that is inconsistent with the background report(s). The form includes spaces for the applicant’s spouse, reducing the need to issue two (2) applications.

What is Included?

The form requires applicants to input the following information into the form:

- General Details: Property address, move-in date (if accepted), monthly rent, security deposit, and pet deposit (if any).

- Applicant Info: Full name, current address, work and personal phone number(s), DOB, SSN, and driver’s license number.

- Employment Info: Name of employer, address, position, salary, and start date.

- Spouse Info: Same as the main applicant.

- Current Landlord (or Mortgage) Details: Name, phone number, monthly rent (or payment), move-in and move-out dates.

- References: Space for two (2) references; requires the name, address, and phone number of each.

- Emergency Contact: Name of contact, relationship to applicant, and phone number.

- Occupants: Name(s) of other occupants (if any).

- Pets: Type of animal, breed, weight, and age.

- Vehicles: The make, model, and year of any vehicle(s) owned by the tenant or occupants. Provides spaces for two (2) vehicles.

- Credit / Criminal History: The applicant’s bank name, phone number, address, and checking account number.

- General Questions: Questions regarding crimes, eviction, bankruptcy, etc.

- Signatures: The signature of the applicant, spouse (if applicable), and the landlord (or the landlord’s agent).

State Laws

Maximum Application Fee: None; fees can be freely set by landlords.

Security Deposits (§ 5321.16): No maximum deposit set by state law. For deposits over $50 or one (1) months’ rent, landlords need to account for interest on the deposit at a rate of five percent (5%) per year. Interest needs to be paid out on a yearly basis. Deposits need to be returned to the tenant within thirty (30) days after the lease’s termination.