Ohio Rental Lease Agreement Templates

Ohio rental lease agreements are legally binding documents established between a landlord and a tenant, outlining the obligations concerning the rental of a residential unit or building. These agreements specify various aspects, including contact information, monthly rent, and rules about guests, pets, and other related matters. Tenants cannot terminate contracts without a valid reason, such as an uninhabitable rental unit; month-to-month leases are exempt.

Types (6)

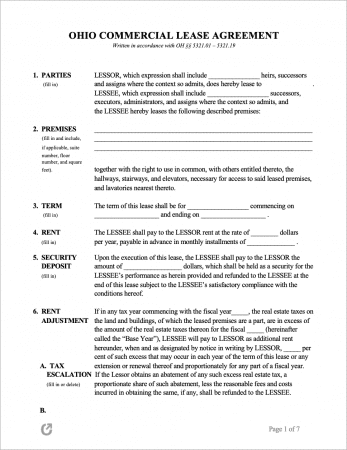

Commercial Lease Agreement – For leasing property to be used for retail, office, industrial, or food-related purposes. Not for leasing residential property.

Commercial Lease Agreement – For leasing property to be used for retail, office, industrial, or food-related purposes. Not for leasing residential property.

Download – PDF, Word (.docx)

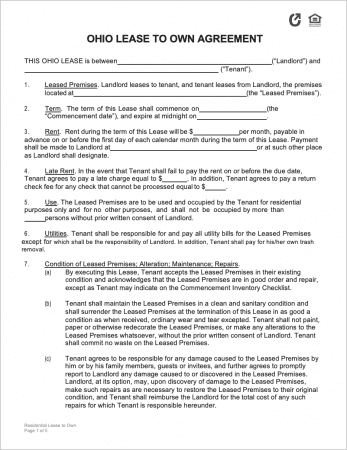

Lease to Own Agreement – A contract for selling a rental property (usually a home) to tenants after a leasing period of one year or more. Tenants generally enter this agreement with the intention of buying the property.

Lease to Own Agreement – A contract for selling a rental property (usually a home) to tenants after a leasing period of one year or more. Tenants generally enter this agreement with the intention of buying the property.

Download – PDF, Word (.docx)

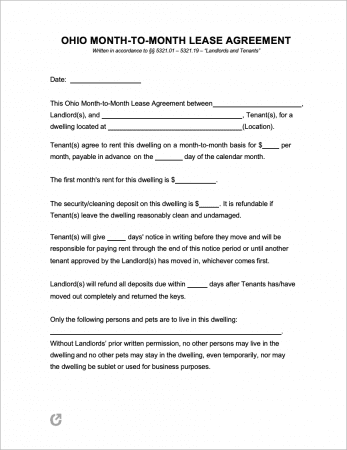

Month-to-Month Lease Agreement – A lease that renews each month automatically. Either party can legally end it with a thirty (30) day notice.

Month-to-Month Lease Agreement – A lease that renews each month automatically. Either party can legally end it with a thirty (30) day notice.

Download – PDF, Word (.docx)

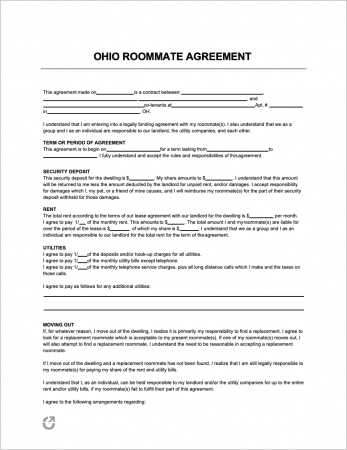

Roommate Agreement – Made between people sharing a single rental unit or common area. It covers rent, guests, rent-sharing, utilities, and more.

Roommate Agreement – Made between people sharing a single rental unit or common area. It covers rent, guests, rent-sharing, utilities, and more.

Download – PDF, Word (.docx)

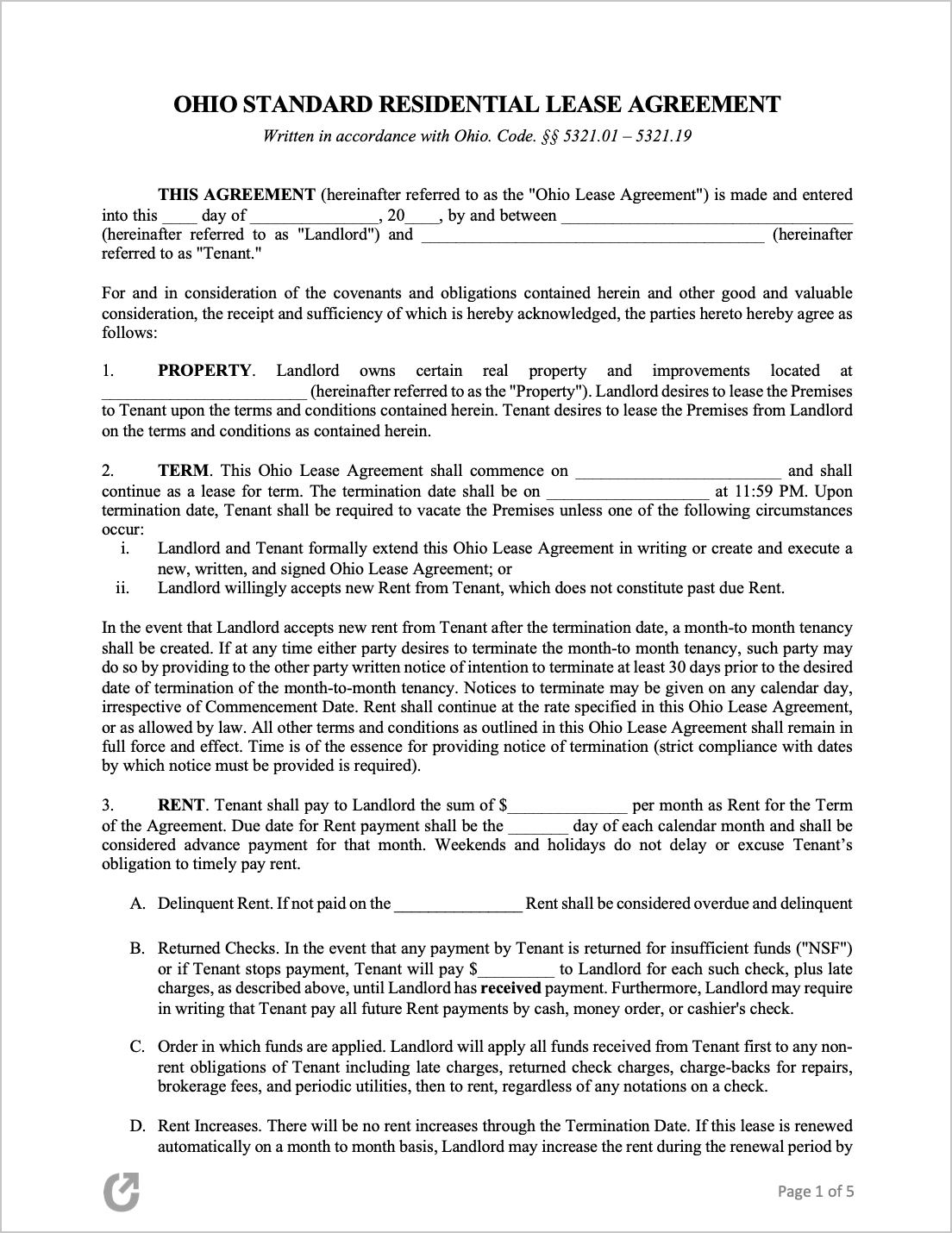

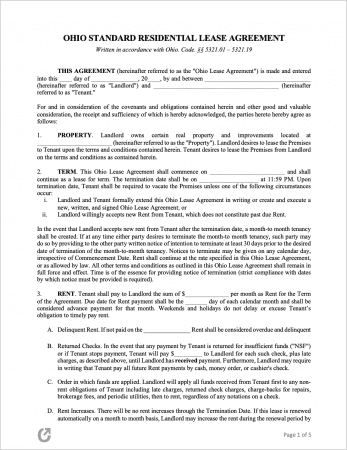

Standard Residential Lease Agreement – For creating rental contracts, usually lasting one year (both parties can negotiate duration).

Standard Residential Lease Agreement – For creating rental contracts, usually lasting one year (both parties can negotiate duration).

Download – PDF, Word (.docx), Rich Text

Sublease Agreement – An agreement describing the conditions for a tenant to lease their part of a rental property to another tenant. Usually, the landlord’s consent is required beforehand.

Sublease Agreement – An agreement describing the conditions for a tenant to lease their part of a rental property to another tenant. Usually, the landlord’s consent is required beforehand.

Download – PDF, Word (.docx)

What is an Ohio Lease Agreement?

An Ohio lease agreement imposes legal requirements on both the landlord and tenant, effective for the lease’s duration or until premature termination. Although not mandatory, landlords should require potential tenants to complete a rental application before signing a lease.

Laws & Guides

- Chapter 5321 – “Landlords and Tenants”

- Chapter 5323 – “Residential Rental Property”

- Ohio Landlord-Tenant Handbook.pdf

- Landlord-Tenant Law Guide.pdf

- Fair Housing Guide for Landlords.pdf

When is Rent Due?

Ohio state law does not specify rent due dates; therefore, the lease agreement should clearly state when rent is due. Additionally, the state does not provide a grace period for tenants.

Landlord’s Access

Emergency (§ 5321.04(8)): Landlords do not have to provide prior notice in emergencies.

Non-Emergency (§ 5321.04(8)): In non-emergency situations, landlords must provide “reasonable notice” (presumed as 24 hours) and enter at reasonable times.

Landlord’s Duties

As stated by section 5321.04, landlords are required by law to comply with the following:

- Meet the requirements of all applicable building and housing codes;

- Make any and all repairs to the rental unit (and common areas) in order to keep it safe and in a habitable state;

- Unless it is an emergency (or is impractical to do so), landlords must provide tenants with a minimum of a twenty-four (24) hour notice prior to entering the premises;

- For rental contracts that cover four (4) or more dwelling units, landlords must provide tenants with receptacles that allow them a means of safely disposing their trash;

- Ensure all appliances, systems (HVAC, elevators, etc.), and electrical equipment is both functioning and safe.

- Provide tenants with constant running water and “reasonable” amounts of hot water at all times, including heat (unless the building/unit is not required to have heat, per state law).

Tenant’s Duties

Section 5321.05 requires tenants to uphold the following duties for the lease term:

- Throw away trash and other rubbish in a manner that is sanitary, safe, and clean;

- Ensure applicable state and local health/safety codes are abided by;

- Keep their rental unit clean and sanitary (as feasible);

- Use all electrical and plumbing fixtures/appliances in the manner they are meant to be used, and keep them as clean as reasonable.

- Refrain from negligibly or purposefully damage or destroy any part of the rental (furniture/appliances included). Also applies to any permitted guests of the tenant.

- Treat other tenants well, and do not disturb their right to the peaceful enjoyment of their rental and the surrounding premises.

Required Disclosures

- Disclosure to the County Auditor (§ 5323.02): The landlord must file certain disclosures with the property’s county auditor, such as their name, address, and telephone number.

- Lead Paint Disclosure: Landlords must comply with federal law by disclosing lead paint hazards in the property to tenants and providing an informational brochure on the topic. This law only applies to properties built before 1978.

- Names and Addresses: Written rental agreements should include the landlord’s name, address, and agent’s information if they have one.

Security Deposits

- Maximum:There are no statutes governing maximum security deposits.

- Returning to Tenant (§ 5321.16(B)): Landlords must reimburse security deposits within thirty (30) days after the rental agreement’s termination and delivery of possession. If the tenant caused damages, the landlord must provide a written notice detailing the issues and the amount due.

- Deposit Interest (§ 5321.16(A)): Security deposits over $50 or one month’s rent must bear an interest of 5% per year on the excess amount, applicable to leases lasting six months or longer.

- Uses of the Deposit (§ 5321.16(B)): Security deposit deductions can cover unpaid rent and any damages resulting from tenant noncompliance (§ 5321.05).