Oklahoma Rental Lease Agreement Templates

Oklahoma rental lease agreements are contracts used for renting out property. Their duration usually extends twelve (12) months; however, the tenant and landlord can negotiate shorter or longer periods. Both parties must abide by the requirements listed in the signed document. The tenant is legally responsible for making consistent rental payments and following all mandated rules. Landlords can evict any person who violates these regulations.

Before signing the lease, landlords must screen tenants via a rental application to assure their credibility and reliability. In this process, they perform a background check, which ensures the individual has a good credit history and would make the payments as expected. It also confirms that the individual has no criminal record that might otherwise indicate they would damage the property or commit other unfavorable actions.

Types (6)

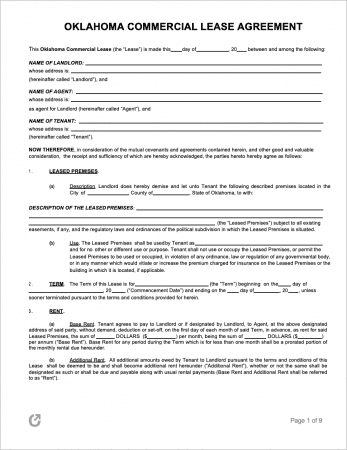

Commercial Lease Agreement – A full-service form for negotiating every possible topic pertaining to renting out property that will be used for business purposes.

Commercial Lease Agreement – A full-service form for negotiating every possible topic pertaining to renting out property that will be used for business purposes.

Download – Adobe PDF, Word (.docx)

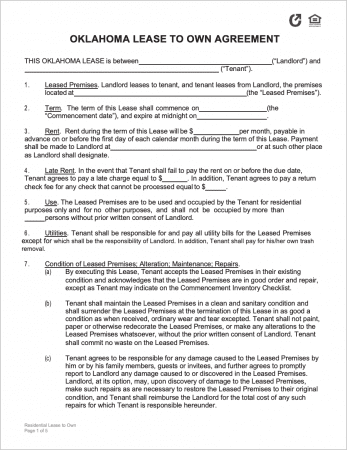

Lease to Own Agreement – A combination of a standard lease and a purchase agreement. Used for leasing out homes to tenants, while simultaneously giving them the option of purchasing the rental at the end of the rental period.

Lease to Own Agreement – A combination of a standard lease and a purchase agreement. Used for leasing out homes to tenants, while simultaneously giving them the option of purchasing the rental at the end of the rental period.

Download – Adobe PDF, Word (.docx)

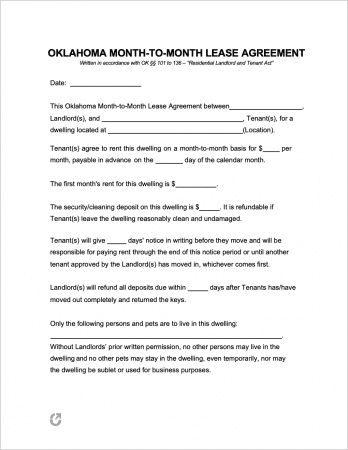

Month-to-Month Lease Agreement – Commonly used for vacation homes and other properties that would be impractical to lease on a yearly basis. Can be terminated by either party so long the appropriate notice is given (typically thirty (30) days).

Month-to-Month Lease Agreement – Commonly used for vacation homes and other properties that would be impractical to lease on a yearly basis. Can be terminated by either party so long the appropriate notice is given (typically thirty (30) days).

Download – Adobe PDF, Word (.docx)

Roommate Agreement – A document for establishing rental-wide rules that all roommates are obligated to follow (once they all sign the form).

Roommate Agreement – A document for establishing rental-wide rules that all roommates are obligated to follow (once they all sign the form).

Download – Adobe PDF, Word (.docx)

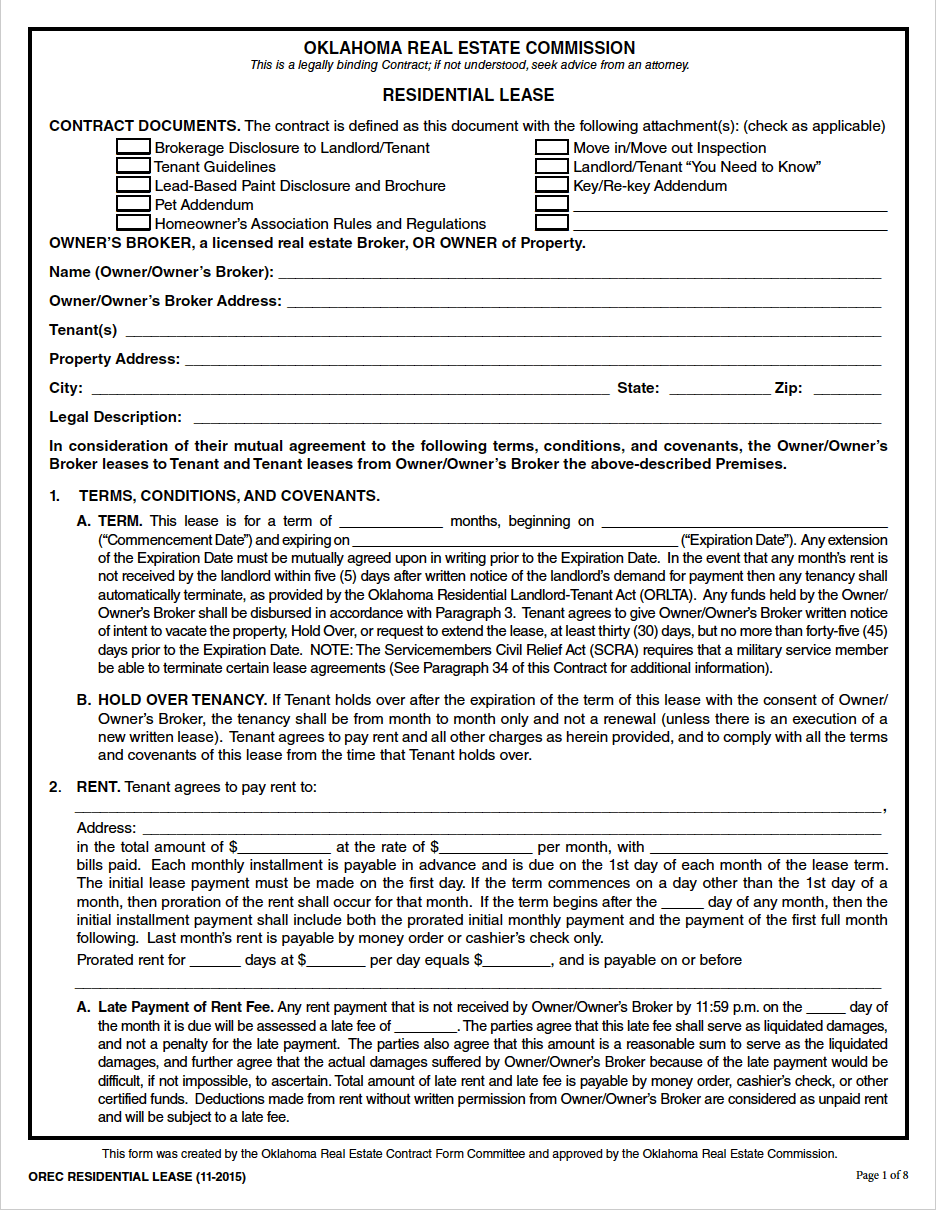

Standard Residential Lease Agreement – For renting homes, apartments, condos, rooms, and other livable property to tenants. Has a “standard” lease term of one (1) year.

Standard Residential Lease Agreement – For renting homes, apartments, condos, rooms, and other livable property to tenants. Has a “standard” lease term of one (1) year.

Download – Adobe PDF, Word (.docx)

Sublease Agreement – So long the landlord permits subleasing, the form allows a tenant to introduce another tenant to take over lease payments and live in the property in the original tenant’s absence.

Sublease Agreement – So long the landlord permits subleasing, the form allows a tenant to introduce another tenant to take over lease payments and live in the property in the original tenant’s absence.

Download – Adobe PDF, Word (.docx)

What is an Oklahoma Lease Agreement?

An Oklahoma Lease Agreement is a legal document used in property management for setting rules regarding the leasing of a residential or commercial property. A lease is signed after a landlord successfully approves of one (1) or more tenant(s) via a rental application.

State Laws & Guides

Laws: Title 41

Landlord-Tenant Guides / Handbooks

- Oklahoma Non-Residential/Residential Landlord & Tenant Act.pdf

- Oklahoma Landlord-Tenant Info Pamphlet.pdf

When is Rent Due?

Per § 41-109, rent should be paid on the date the parties agreed to in the lease agreement. Unless otherwise stated by the contract, one (1) month’s rent must be paid at the beginning of each month for longer terms. For terms of one (1) month or less, the rent will be payable at the beginning of the term. There is no grace period offered by state law.

Landlord’s Access

Statutes: § 41-128

Emergency: In emergencies, the landlord has the right to enter the rental dwelling without giving prior notice to the tenant.

Non-Emergency: If the landlord wants to access the rental dwelling for a reason not classified as an emergency, they must provide the tenant with at least one (1) day’s notice of their intent to enter. Additionally, they can only enter the rental at “reasonable” times. Common reasons for entry include making necessary or agreed-upon repairs, decorations, alterations, or improvements, or inspecting the premises.

Landlord’s Duties

Oklahoma law § 41-118 states the duties of landlords as follows:

- With the exception of single-family residences, landlords must keep all common areas, facilities, and offerings safe to use, sanitary, and as clean as reasonable;

- Do whatever is necessary (repairs included) to ensure a tenant’s rental unit is in a livable condition;

- Not including single-family residences or situations in which the tenant’s handle their own utilities (independently monitored per unit), landlords have to ensure tenants have access to constant running water, and reasonable amounts of hot water and heat;

- Notwithstanding one (1) or two (2) family residences and situations where it is provided by the local government, landlords must provide tenants with a means of disposing their waste by providing receptacles (dumpsters) and arranging for it to be picked up regularly.

- Ensure tenants have access to safe and good-working plumbing, HVAC, appliances, elevators, and other systems as the rental contract provides.

Tenant’s Duties

Per § 41-127, tenants must uphold the following duties and obligations for the full term of the lease:

- Maintain their rental unit by keeping it clean and safe (as permittable);

- Refrain from engaging in criminal activity that threatens the health of occupants or disrupts other tenants’ enjoyment of the premises. Additionally, tenants cannot engage in drug-related criminal activity on or near the rental (or allow anyone personally known to them to commit similar actions).

- Do not destroy or alter any part of the rental;

- Use all appliances and offerings in the manner they’re meant to be used and keep them as clean as reasonable;

- Comply with all rules and regulations, so long they are in compliance with § 41-126;

- Throw away garbage safely and in a sanitary manner;

- Do not disturb neighboring tenants or allow any other person or pet (personally known by the tenant) to do so.

Required Disclosures

- Flooding Disclosure (§ 41-113a): If a landlord knows that the rental dwelling has been flooded within the past five (5) years, they must include such information prominently and in writing as part of any written rental agreements.

- Lead Paint Disclosure: If a landlord knows of any lead paint hazards present in their rental dwelling constructed before 1978, they must inform the tenant of them. Moreover, they are required to provide a government-issued pamphlet regarding the matter.

- Prior Methamphetamine Production Disclosure (§ 41-118(C)): If a landlord knows the rental dwelling (or any part of the premises) was used to manufacture methamphetamine “meth”, they must disclose this information to a prospective tenant prior to the start of the lease. Disclosure doesn’t have to be made if a contamination assessment determined that the level of contamination doesn’t exceed one-tenth of one microgram (0.1 mcg) per one hundred square centimeters (100 cm²) of surface within the dwelling unit or part of the premises.

- Names and Addresses (§ 41-116(A)): All landlords must disclose the names and addresses of a) any party who has the authority to manage the premises, b) the owner(s) of the premises, or c) the party who has the authority to act for and on their behalf. This must be disclosed prior to (or at the time of) the start of the lease.

Security Deposits

Statutes: § 41-115

Maximum: State law does not dictate how much a landlord can charge a tenant for a security deposit.

Returning to Tenant: The tenant must make a written demand for the return of the security deposit within six (6) months after the termination of the tenancy. If they do not, the deposit will revert to the landlord. The money covers the amount needed to maintain the escrow account that keeps the security deposit.

If the landlord plans to keep any portion of the security deposit, they must itemize any damages in a written statement. They must deliver the statement by mail and return the balance of the security deposit without interest to the tenant within thirty (30) days after the termination of tenancy, delivery of possession, and the written demand by the tenant.

Deposit Interest: Landlords do not have to collect and pay tenants any accrued interest on security deposits.

Uses of the Deposit: Deductions can be made to remedy the following:

- To pay for any unpaid rent; and

- To cover damages that resulted from the tenant(s) non-compliance with the written lease agreement, or Oklahoma’s landlord-tenant statutes.