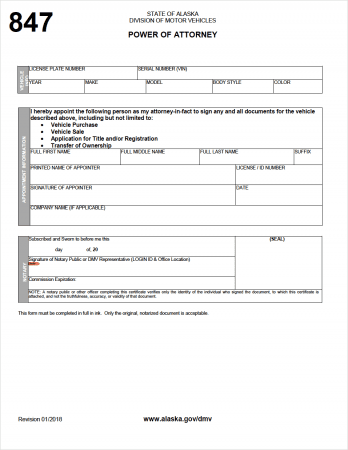

Alaska Power of Attorney Forms

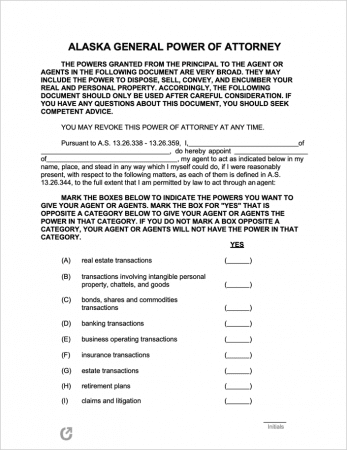

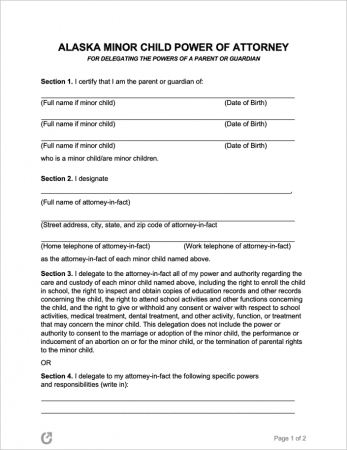

An Alaska power of attorney is a personal-use legal form that provides a specific person (the agent) with the legal authority to make decisions and/or handle tasks for another person (the principal). The form is completed by the principal, who can be any Alaska resident over the age of eighteen (18). Depending on the form selected, the agent can represent the principal in various situations, ranging from healthcare decisions, the managing or selling of a home, the filing of taxes, or the purchase or sale of a vehicle. The forms can be as broad or specific as desired, and if made “durable,” the document will stay in effect even if the principal were to become incapacitated, which is a medical term for no longer to able to communicate effectively.

Types (6)

| Durable | Healthcare | General | Limited | Minor | Vehicle |

Laws & Signing Requirements

- Alaska Power of Attorney Laws: AS §§ 13.26.001 – 13.26.410

- State Definition of Power of Attorney: No state definition.

- Signing Requirements: Signed by the grantor in the presence of a Notary Public.