Arkansas Power of Attorney Forms

An Arkansas power of attorney form lets a person select an “agent” to perform certain matters on their behalf, such as signing a document or moving money in their financial accounts. In order for the form to be completely effective, it must be signed and notarized. The agent (person receiving power) does not need to sign the document in order for it to be considered legitimate.

Types (6)

| Durable | General | Limited | Medical | Minor | Vehicle |

Which Form is Right for Me? | |

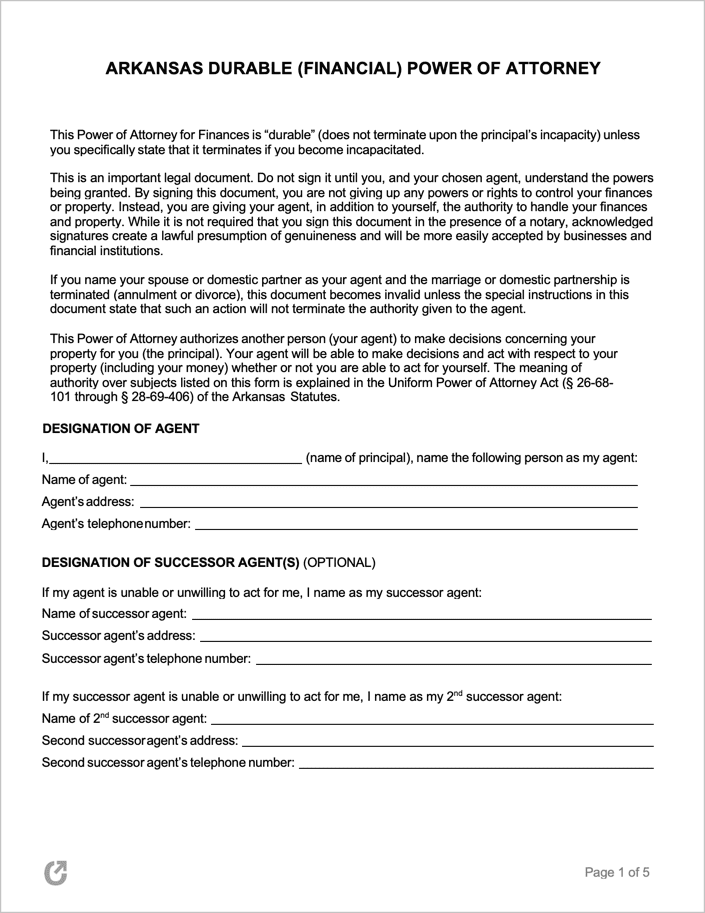

| Durable | An estate planning document that allows a person to put in place an “agent” that will have the power to handle their estate and finances should a medical emergency occur. Being durable, it will remain in effect regardless of the principal’s mental status. Only manual revocation or death can terminate the contract. |

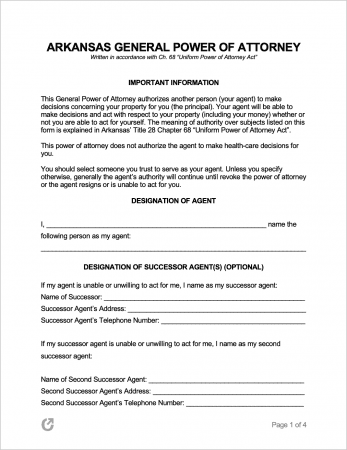

| General | For nominating a trusted person with the ability to handle one’s general finances. Once the form is completed, the agent can retain a copy and present it to banks and other institutions in order to complete tasks for the principal. |

| Limited | For providing an agent with specific duties to complete. Example use case: A person needs a trusted friend or family member to withdraw $1,000 from their bank account. |

| Medical | An important life planning form for designating a person with the right to communicate one’s medical preferences when the patient cannot do so themselves. |

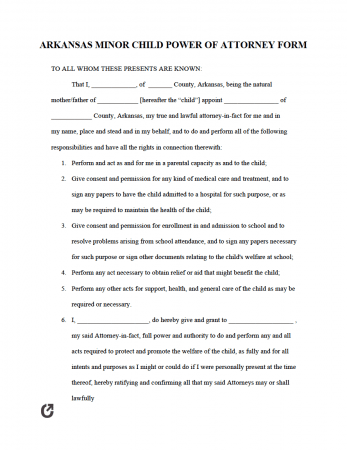

| Minor Child | A legal document that establishes the legal right for an individual to take care of another party’s child, in some capacity, when the parent(s) or guardian(s) are unable to do so. |

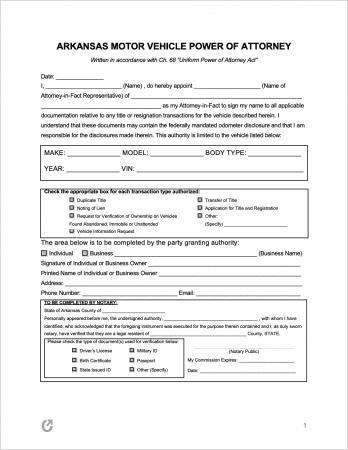

| Motor Vehicle | From repairing a car to selling it, this form makes it possible for an agent to act on the owner’s behalf in matters relating to their motor vehicle. |

Laws & Signing Requirements

- Laws: Title 28, Chapter 68, “Uniform Power of Attorney Act”

- State Definition of Power of Attorney (§ 28-68-102(7)): “means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used.”

- Signing Requirements (§ 26-68-105): All POAs must be signed by the Principal and notarized. Certain state-official POAs may require additional signatures.