Connecticut Power of Attorney Forms

A Connecticut power of attorney form is a form used for permitting a person (the agent) with the ability to act on behalf of another person (the principal). The forms all vary in the amount of power they assign. A limited POA, for example, limits the agent’s power to handling only a few tasks, and will terminate once the tasks have been completed. A general POA, on the other hand, can grant an agent with power over the principal’s entire finances, giving them the right to move money out of their financial accounts, purchase real estate, and much more.

Because of the power given, the principal should select an agent they personally know and trust, which can include family, close friends, or a professional (such as an attorney).

Types (6)

| Durable | General | Limited | Medical | Minor | Vehicle |

Which Form is Right for Me? | |

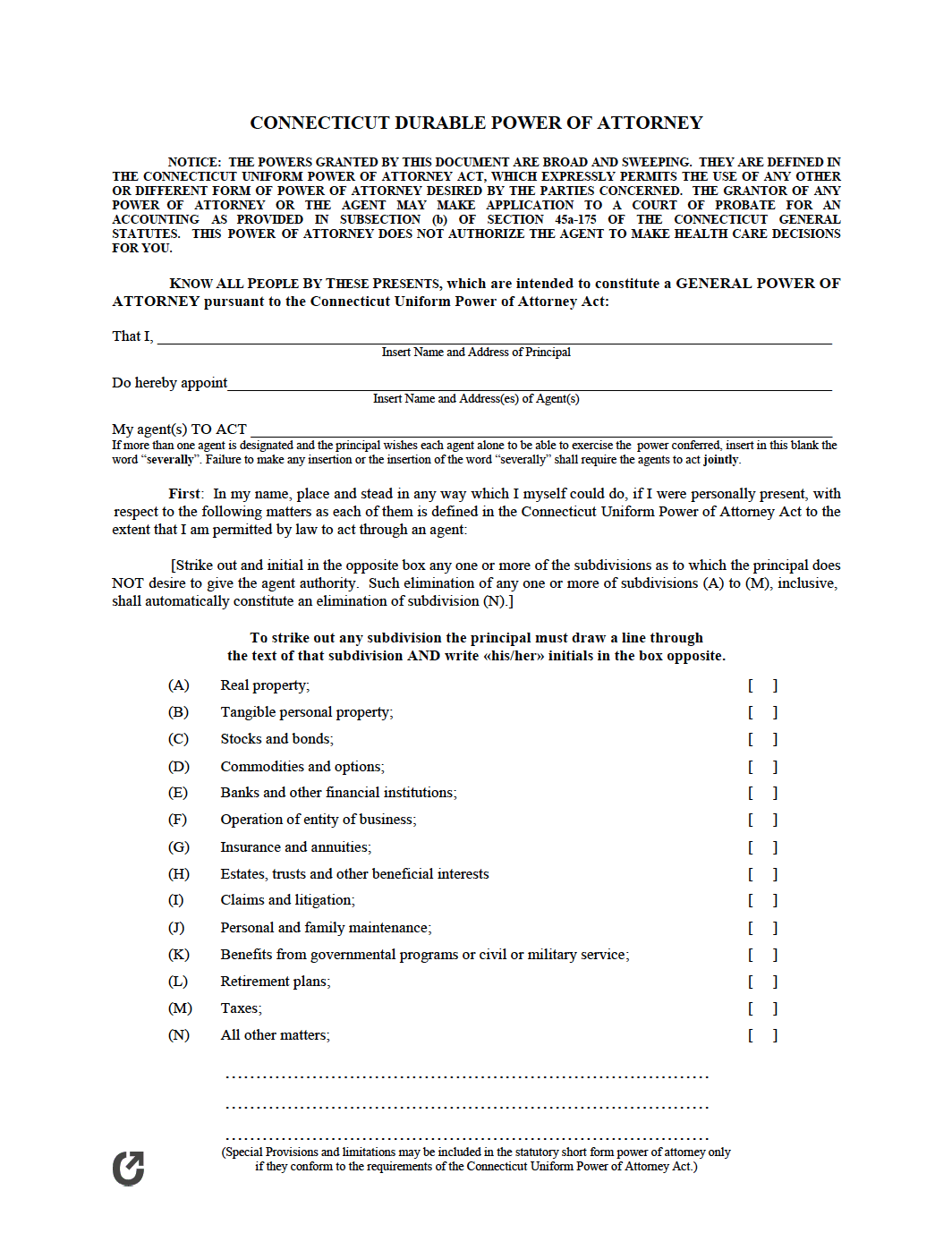

| Durable | The standard POA form. Used for ensuring one’s wishes (specific to finances) are carried out regardless of their state of mind or physical condition. |

| General | Used for granting financial decision-making powers to another person. Being non-durable, it will no longer remain active if the principal becomes incapacitated. |

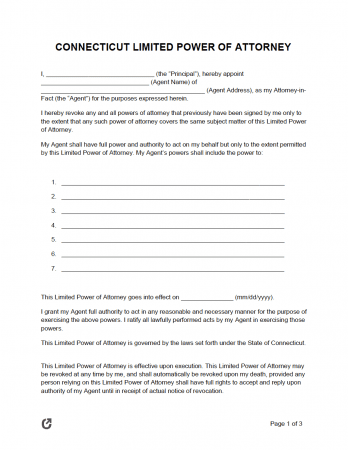

| Limited | A simple POA for specifying a single (or a few) one-off powers for the purpose of having an agent complete a specific set of tasks. |

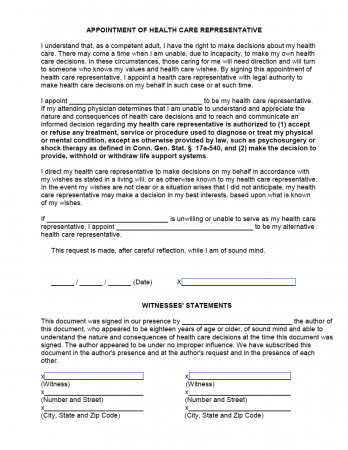

| Medical | A planning form used for specifying a person that will have the right to communicate one’s medical preferences to doctors and other providers should the patient no longer be able to do so themselves. If the principal dies, the form is revoked. |

| Minor Child | A form used by parents and guardians for nominating another individual to make parental decisions on their behalf for a limited amount of time (under 1 year). |

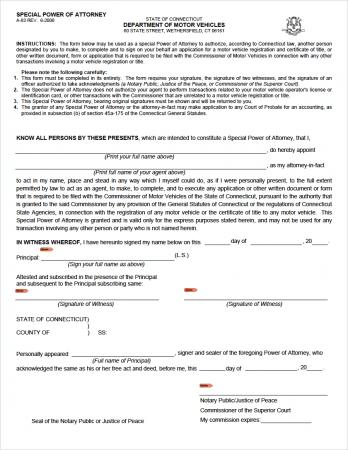

| Motor Vehicle | Authorizes a person to perform actions relating to a motor vehicle that is owned (or soon to be owned) by the principal. |

Laws & Signing Requirements

- Connecticut Power of Attorney Laws: Chapter 15c, “Uniform Power of Attorney Act”

- State Definition of Power of Attorney (§ 1-350a(7)): “means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used.”

- Signing Requirements (§ 1-350d): Must be 1) signed by the Principal, 2) notarized, and 3) signed by two (2) witnesses.