Kentucky Power of Attorney Forms

Kentucky power of attorney forms provides a person (agent) with the authority to make decisions regarding financial or medical-related tasks on behalf of another person (principal).

For any matters not specifically mentioned in a POA, the principal should use a limited power of attorney, which lets the principal create any powers they wish.

Once signed, all the agent has to do is present the document to the applicable party (such as a bank or government office) to gain the necessary authorization to act for the principal.

Types (6)

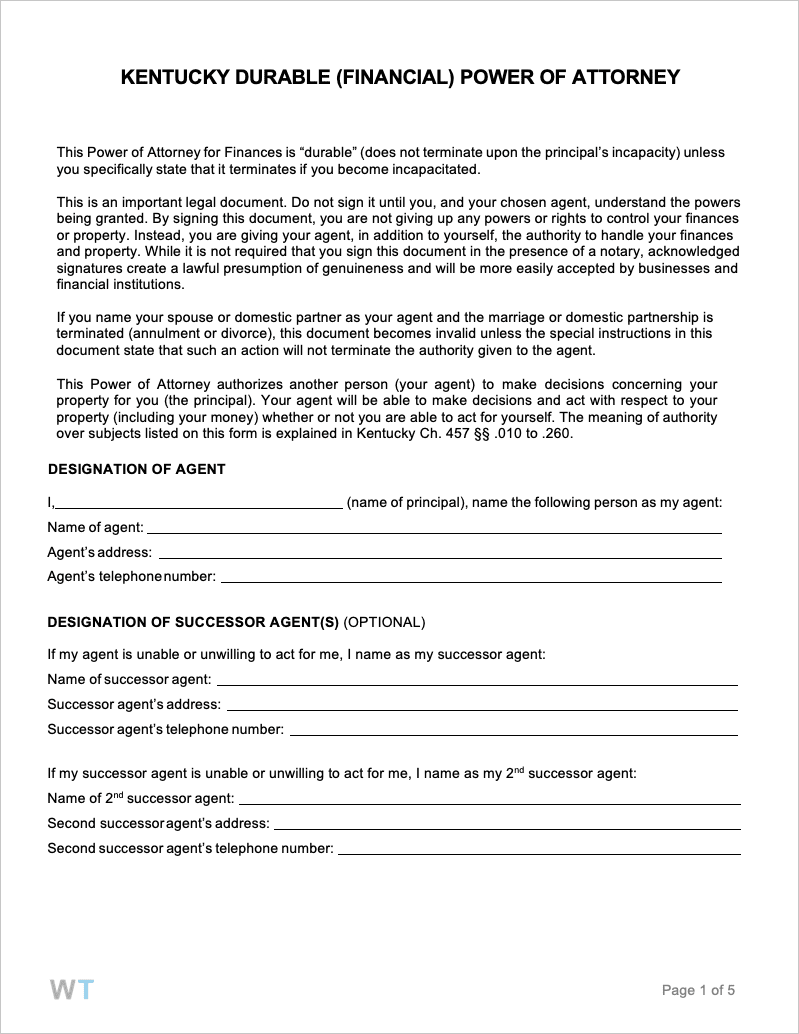

Grants decision-making power to the agent regardless of the mental state of the principal. Terminates upon the principal’s death.

General (Financial) Power of Attorney

General (Financial) Power of Attorney

A non-durable POA that provides the agent with far-reaching powers regarding the principal’s finances, estate, investments, and more.

Limited (Special) Power of Attorney

Limited (Special) Power of Attorney

For situations where the principal only needs one (1) or a few tasks handled. The form terminates once all task(s) have been completed.

Living Will Directive (Medical POA)

Living Will Directive (Medical POA)

Empowers an agent with the right to communicate important healthcare decisions to medical professionals when the principal can’t on their own.

Download: PDF

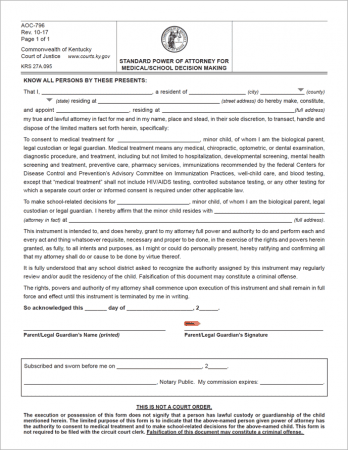

Minor Child Power of Attorney (AOC-796)

Minor Child Power of Attorney (AOC-796)

Gives a person or couple the right to temporarily take over parental duties when the parents cannot do so themselves.

Motor Vehicle Power of Attorney (TC-96-336)

Motor Vehicle Power of Attorney (TC-96-336)

Completed by the owner of a motor vehicle to give another person the ability to conduct a title transfer, odometer disclosure, and other DMV-related tasks.