Michigan Power of Attorney Forms

A Michigan power of attorney form is a type of estate planning document used for giving a person (an “attorney-in-fact”) the power to handle decisions on your behalf. The person that completes the form is known as the “principal” and can be anyone that is of adult age and lives in the state of Michigan. POAs generally come in two (2) types: durable and non-durable. If a POA was made durable, it means the principal wants the agent to keep their power in the case the principal becomes incapacitated, or mentally incompetent.

The principal may choose to elect an attorney-in-fact with a POA because:

- They don’t have the time to complete a certain task or tasks themselves;

- They lack expertise in the area they wish to assign power;

- They are out of the state or country and need certain task(s) completed; or

- They want to have a plan in place in the event they can’t make decisions on their own.

Types (6)

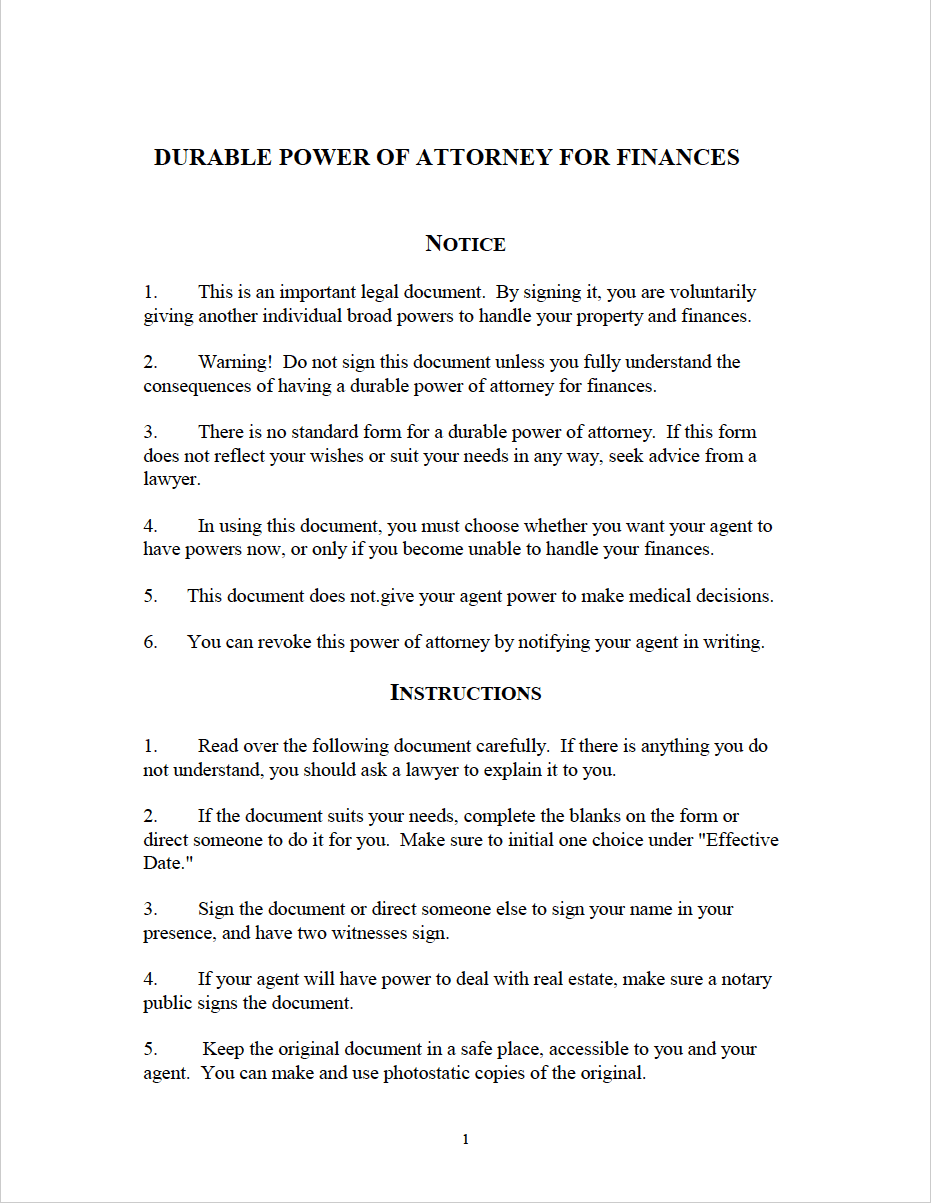

Durable Power of Attorney – Gives an agent power to handle financial decisions for the principal. Continues in effect regardless of the mental state of the principal.

Durable Power of Attorney – Gives an agent power to handle financial decisions for the principal. Continues in effect regardless of the mental state of the principal.

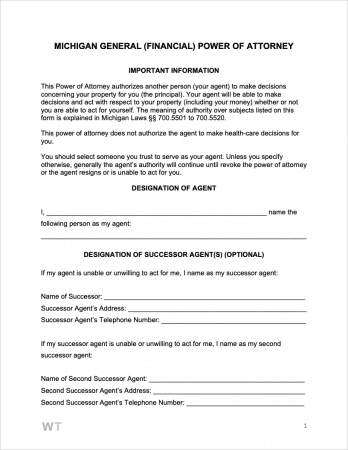

General (Financial) Power of Attorney – Structurally similar to a durable type of POA, with the exception that it is non-durable.

General (Financial) Power of Attorney – Structurally similar to a durable type of POA, with the exception that it is non-durable.

Limited (Special) Power of Attorney – Can be used for assigning anything to an agent. The most customizable type of POA.

Limited (Special) Power of Attorney – Can be used for assigning anything to an agent. The most customizable type of POA.

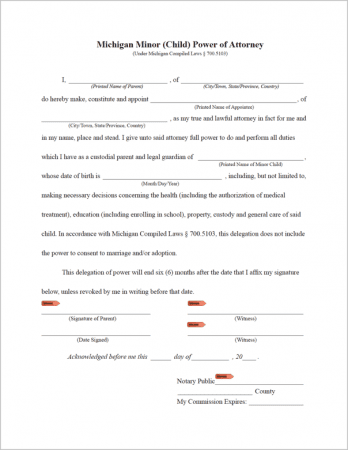

Minor Child Power of Attorney – Allows parents or guardians to assign another person to take care of their children.

Minor Child Power of Attorney – Allows parents or guardians to assign another person to take care of their children.

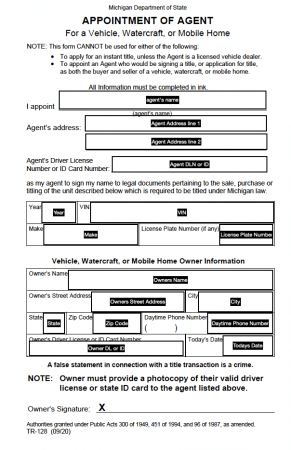

Motor Vehicle Power of Attorney (Form TR-128) – A state-official form for giving another person or entity the right to handle document preparation for their vehicle.

Motor Vehicle Power of Attorney (Form TR-128) – A state-official form for giving another person or entity the right to handle document preparation for their vehicle.

Download: PDF

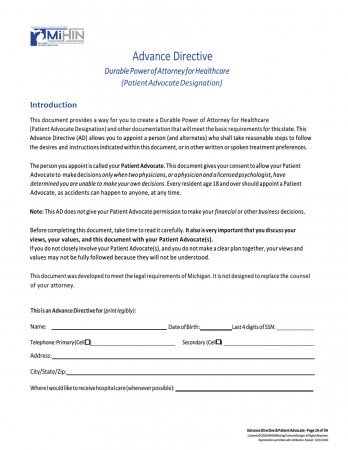

Patient Advocate Designation – In Michigan, a Medical POA is referred to as a “Patient Advocate Designation”. This form allows a party referred to as the “patient” to elect another party, referred to as the “patient advocate” to make health care decisions for the patient when they can communicate their own wishes.

Patient Advocate Designation – In Michigan, a Medical POA is referred to as a “Patient Advocate Designation”. This form allows a party referred to as the “patient” to elect another party, referred to as the “patient advocate” to make health care decisions for the patient when they can communicate their own wishes.

Download: PDF

Laws & Signing Requirements

- Michigan Power of Attorney Laws – Act 386, Part 5, “Estates and Protected Individuals Code”

- State Definition of a Durable Power of Attorney (§ 5501) – “a power of attorney by which a principal designates another as the principal’s attorney in fact in a writing that contains the words “This power of attorney is not affected by the principal’s subsequent disability or incapacity, or by the lapse of time”, or “This power of attorney is effective upon the disability or incapacity of the principal”, or similar words showing the principal’s intent that the authority conferred is exercisable notwithstanding the principal’s subsequent disability or incapacity and, unless the power states a termination time, notwithstanding the lapse of time since the execution of the instrument.”

- Signing Requirements

- General – No state requirements. Should be signed and notarized to ensure it is accepted by third parties.

- Durable Power of Attorney (§ 700-5501) – The form must be signed by the principal in the presence of two (2) witnesses, neither of whom can be the attorney-in-fact. The witnesses must also both sign the form. The form can also be notarized for additional proof.

- Designation of Patient Advocate / Medical Power of Attorney (§ 700.5506) – The law requires that the form is executed in the presence of and signed by two (2) witnesses.