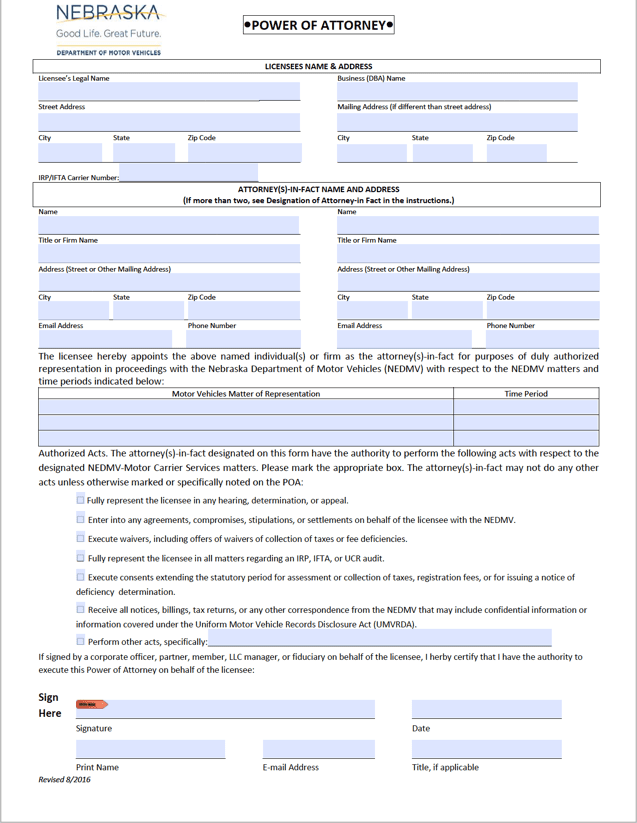

Nebraska Motor Vehicle Power of Attorney Form

A Nebraska motor vehicle power of attorney allows the person who created the document (the licensee) to appoint another person (the attorney-in-fact) to perform tasks relating to a vehicle. The licensee must include its name and mailing address if it is a business. Similarly, if the attorney-in-fact is a firm, they must enter the same information (i.e., its name and mailing address). The licensee can appoint more than one person as the attorney-in-fact. In this case, the licensee can include information for up to two (2) people in the form. If they wish to add another person, they must enter their name and personal details on a separate piece of paper and attach it to the document.

| Signing requirements: The designee must sign in a Notary Public’s presence. |

What is a Nebraska Motor Vehicle POA?

A Nebraska motor vehicle power of attorney assigns a person to manage an owner’s car obligations. The licensee and attorney-in-fact must discuss the assigned responsibilities and limitations of the form before signing. Wrongful decisions made on the attorney-in-fact’s behalf can result in a lawsuit or financial debt. Therefore, the person representing the licensee should know how to perform vehicle-related duties beforehand. The form allows the representative to sign documents for the owner, apply for a title and registration, pay fees or taxes, and receive confidential information about the vehicle.

For the Nebraska Department of Motor Vehicles (DMV) to recognize the form, the licensee must complete, sign, and submit it. Once received, the NEDMV files it in the licensee’s records, allowing the appointed attorney-in-fact to act on their behalf. The individual can: 1) scan and email it to mcs.web@nebraska.gov, 2) fax it to (402) 471-4024 or (402) 471-3920, or 3) mail it.

| Mailing Address: |

| Motor Carrier Services PO Box 94729 Lincoln, NE 68509-4729 |

Should I Complete a Motor Vehicle POA?

Individuals use motor vehicle power of attorney forms for car, truck, or van-related duties. They must select another type of document if the task does not involve the vehicle. For example, a durable or general power of attorney covers financial-related responsibilities, whereas a tax power of attorney allows for tax reviewing and filing.

Motor vehicle power of attorney forms accommodate one-time duties or tasks with an established deadline. Instead, durable and general power of attorney documents allow for long-term needs and operate under conditions where the owner dies or becomes incapacitated. Licensees can appoint new representatives whenever they wish to do so. However, they must complete and sign a revocation form to terminate the original copy.

How to Write

Download: PDF

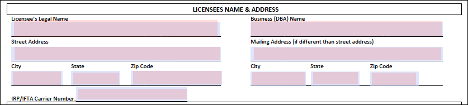

Step 1 – Licensee Name and Address

Write the licensee’s (grantor’s) name and address. If the licensee is a business, provide the business’s name and mailing address (if it’s different than the street address) and include the IRP / IFTA Carrier number.

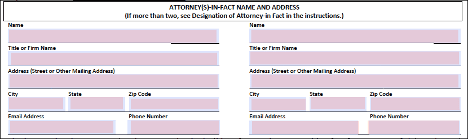

Step 2 – Attorney-in-Fact Designation

The form allows up to two agents to act on the licensee’s behalf. It requires the following information:

- Name(s)

- Title or firm name (if applicable)

- Address(es)

- Email address(es)

- Phone number(s)

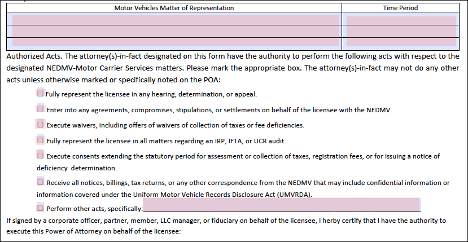

Step 3 – Acts Authorized

State the matter of representation and the period for which it will last. Pick the box next to each act the attorney-in-fact is authorized to perform.

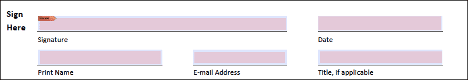

Step 4 – Signature and Notarization

Buyers and sellers must complete the last section before a Notary Public. Once there, the licensee will sign, date, print name, and provide an email address and title number (if applicable).