New York Power of Attorney Forms

The New York power of attorney forms includes nine (9) documents that allow a person of legal age (18 or older) to grant authority over financial, business, and/or medical-related decisions to a person they trust (their attorney-in-fact). The powers authorized to the attorney-in-fact can be permanent or temporary depending on the POA chosen. If the principal wants the form to remain in effect in the event they medically can no longer act for themselves (known as “incapacitation”), they should choose a durable form. This is commonly used when the principal wants to elect someone to handle decisions for the long-term. For simple one-off tasks (such as signing a form), a non-durable POA should be selected (such as a limited POA).

As stated by NY POA laws, a nominated attorney-in-fact “has a fiduciary relationship with the principal”. In other words, the person appointed has a legal and ethical responsibility to make decisions with the principal’s best interests in mind.

Types (6)

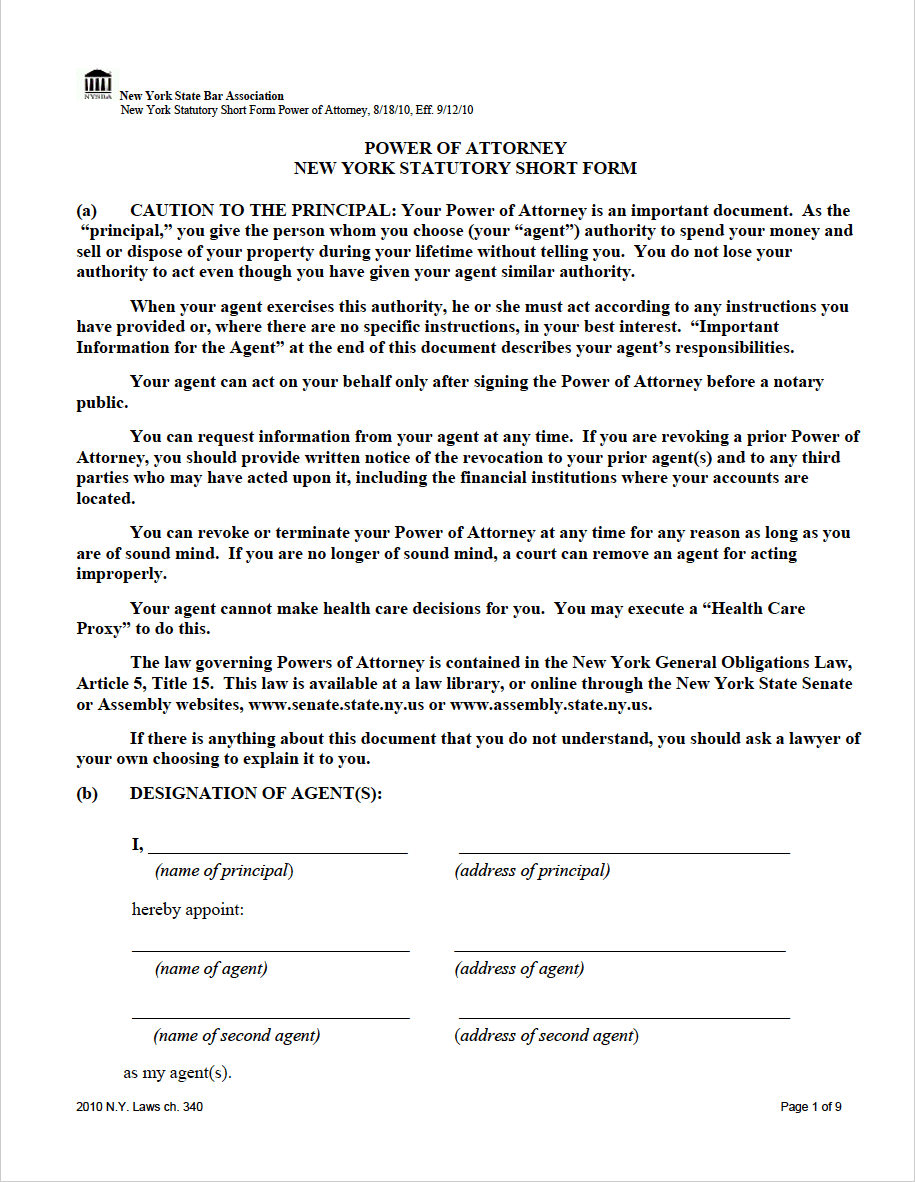

Durable Power of Attorney – Allows an agent to act on the principal’s behalf to manage their finances for a duration of time that begins when the POA is signed and remains in effect until the principal dies or they manually revoke the document.

Durable Power of Attorney – Allows an agent to act on the principal’s behalf to manage their finances for a duration of time that begins when the POA is signed and remains in effect until the principal dies or they manually revoke the document.

Download: PDF

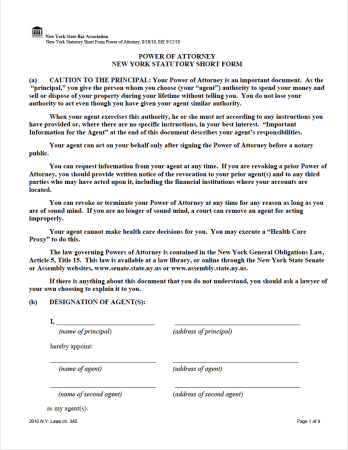

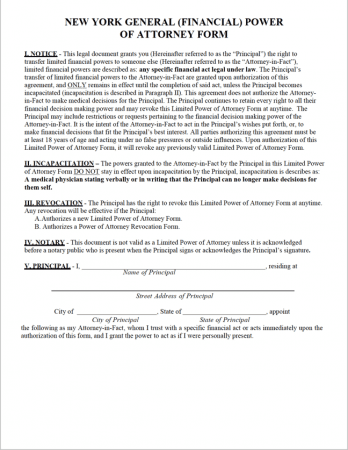

General (Financial) Power of Attorney – For granting encompassing powers over one’s financial affairs. The non-durable option to the durable form above.

General (Financial) Power of Attorney – For granting encompassing powers over one’s financial affairs. The non-durable option to the durable form above.

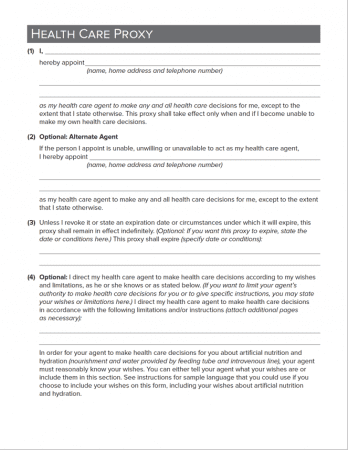

Health Care Proxy (Medical Power of Attorney) – A durable type of POA that entrusts a person with the right to make medical decisions in-line with the principal’s wishes. Must be signed by two (2) witnesses over the age of eighteen (18).

Health Care Proxy (Medical Power of Attorney) – A durable type of POA that entrusts a person with the right to make medical decisions in-line with the principal’s wishes. Must be signed by two (2) witnesses over the age of eighteen (18).

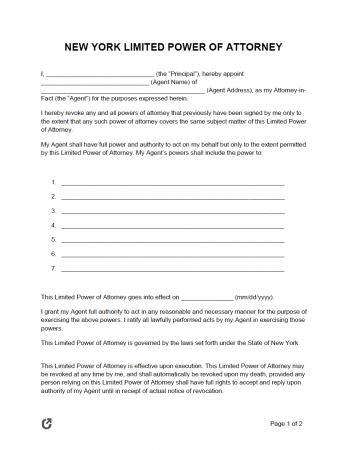

Limited (Special) Power of Attorney – A POA that allows the principal to specify any tasks or duties they wish.

Limited (Special) Power of Attorney – A POA that allows the principal to specify any tasks or duties they wish.

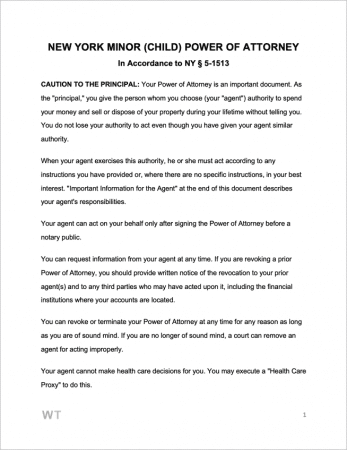

Minor Child Power of Attorney – Used by parents to provide a trusted adult with the rights to make parental decisions regarding their child or children.

Minor Child Power of Attorney – Used by parents to provide a trusted adult with the rights to make parental decisions regarding their child or children.

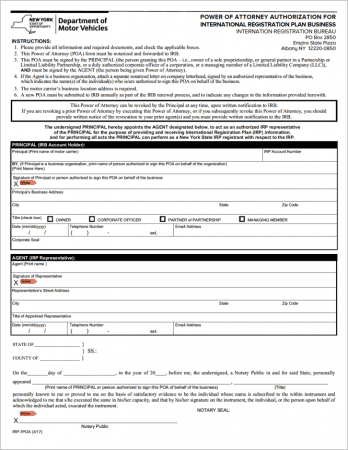

Motor Vehicle Power of Attorney (Form IRP-1POA) – The state of NY requires this form to be completed in order to allow a person to register, transfer someone’s motor vehicle.

Motor Vehicle Power of Attorney (Form IRP-1POA) – The state of NY requires this form to be completed in order to allow a person to register, transfer someone’s motor vehicle.

Download: PDF

Laws & Signing Requirements

- New York Power of Attorney Laws

- State Definition of Power of Attorney (§ 5-1501,(j)) – “means a written document, other than a document referred to in section 5-1501C of this title, by which a principal with capacity designates an agent to act on his or her behalf.”

- State Definition of Health Care Proxy (Medical Power of Attorney) (§ 2980(8)) – “means a document delegating the authority to make health care decisions, executed in accordance with the requirements of this article.”

- Signing Requirements