South Dakota Power of Attorney Forms

The South Dakota Power of Attorney Forms are used for giving a representative the right to handle broad or specific tasks on behalf of another person (the “principal”). The principal may tailor the document to fit their specific needs, so long as it remains compliant with relevant state laws. As stated by § 59-12-4, the principal must have their signature notarized in order for the POA to be considered valid.

Types (6)

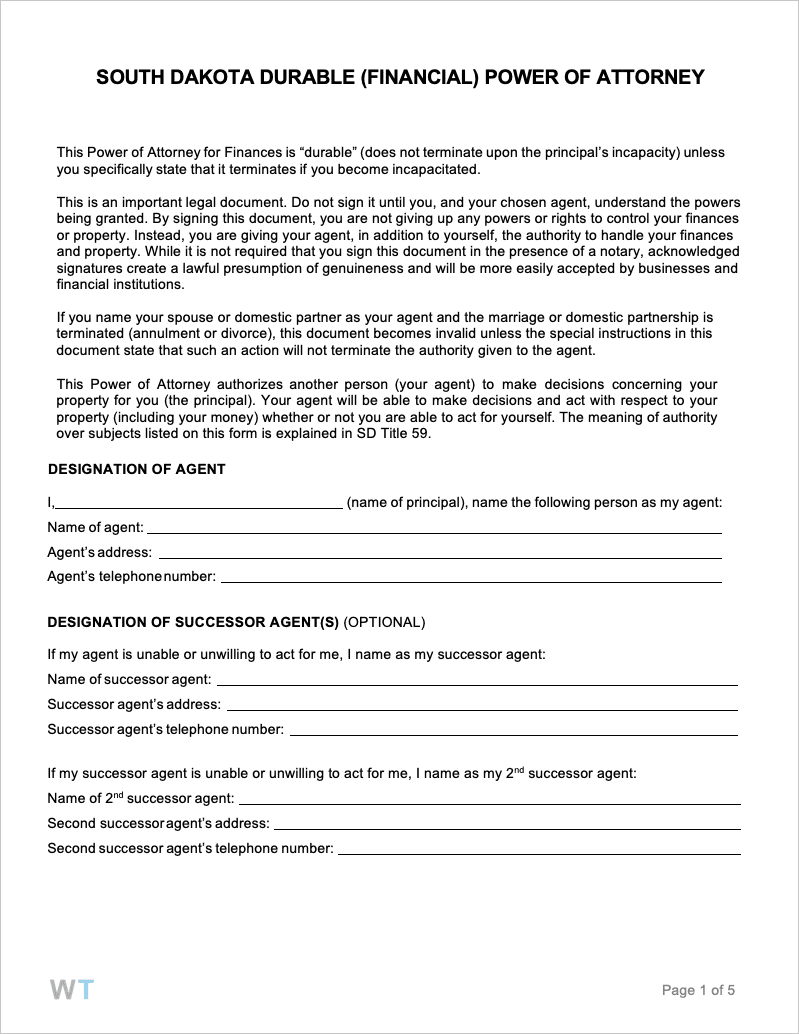

Durable Power of Attorney – For nominating an agent with the right to manage finances for the long-term. Being a durable contract, the attorney-in-fact retains their power regardless of the mental state of the principal. Durable laws: § 59-12-3.

Durable Power of Attorney – For nominating an agent with the right to manage finances for the long-term. Being a durable contract, the attorney-in-fact retains their power regardless of the mental state of the principal. Durable laws: § 59-12-3.

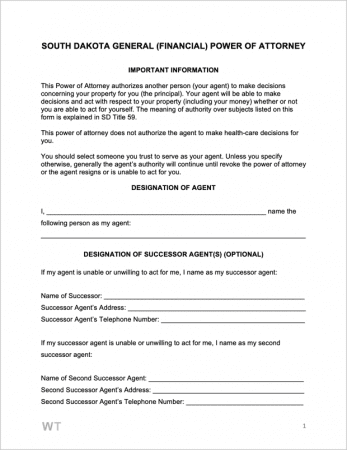

General (Financial) Power of Attorney – For providing a representative with blanket powers regarding finances (assets, bank accounts, etc.).

General (Financial) Power of Attorney – For providing a representative with blanket powers regarding finances (assets, bank accounts, etc.).

Limited (Special) Power of Attorney – For giving an agent highly-specific powers, such as signing a check, managing the sale of a property, and so on. Is NOT durable.

Limited (Special) Power of Attorney – For giving an agent highly-specific powers, such as signing a check, managing the sale of a property, and so on. Is NOT durable.

Medical Power of Attorney – For naming an agent (and successor agents), who communicate the principal’s healthcare wishes if (or when) they will be unable to themselves.

Medical Power of Attorney – For naming an agent (and successor agents), who communicate the principal’s healthcare wishes if (or when) they will be unable to themselves.

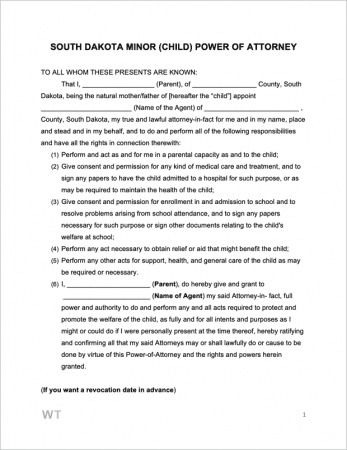

Minor Child Power of Attorney – Used by a parent or guardian for appointing an agent with the capabilities to take care of their children on their behalf. An individual POA needs to be completed for each child.

Minor Child Power of Attorney – Used by a parent or guardian for appointing an agent with the capabilities to take care of their children on their behalf. An individual POA needs to be completed for each child.

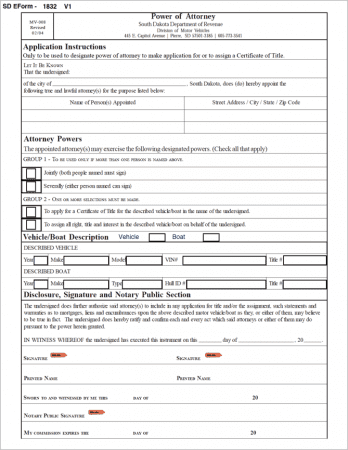

Motor Vehicle Power of Attorney (Form MV-008) – The South Dakota DMV requires this form to be completed in order for a person to sign documents (such as a registration).

Motor Vehicle Power of Attorney (Form MV-008) – The South Dakota DMV requires this form to be completed in order for a person to sign documents (such as a registration).

Download: PDF

Laws & Signing Requirements

- South Dakota Power of Attorney Laws – Title 59, Chapter 12

- Agent’s Duties – § 59-12-13

- Signing Requirements

- Durable Power of Attorney (§ 59-6-11) – Signed by the principal.

- Medical Power of Attorney (§ 59-7-2.1) – Signed by the principal + 2 witnesses OR notarized.