Montana Rental Lease Agreement Templates

Download the Montana Rental Lease Agreements to permit lessees to occupy an available rental in exchange for consistent payments to the lessor (owner/manager of the property). Depending on the form chosen, the agreement can have a duration anywhere between one (1) to five (5) years, although any length of time can be negotiated. Once the contract is signed by all parties, the lessee and lessor are obligated to follow all obligations, responsibilities, and rules relating to the lease until the lease expires.

Types (6)

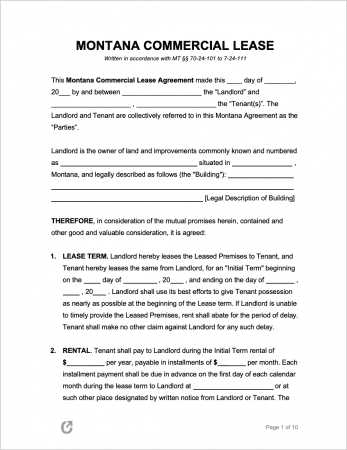

Commercial Lease Agreement – For leasing property solely for business use. Examples include retail establishments, restaurants, warehouses, offices, floors, and rooms.

Commercial Lease Agreement – For leasing property solely for business use. Examples include retail establishments, restaurants, warehouses, offices, floors, and rooms.

Download – Adobe PDF, Word (.docx)

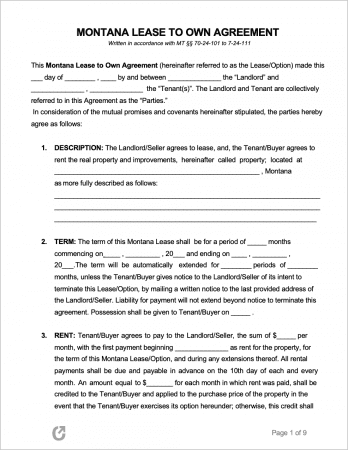

Lease to Own Agreement – Allows a person to rent a property as normal, but with the added ability to buy the rental unit/building/home at the end of the term. Common for residential homes.

Lease to Own Agreement – Allows a person to rent a property as normal, but with the added ability to buy the rental unit/building/home at the end of the term. Common for residential homes.

Download – Adobe PDF, Word (.docx)

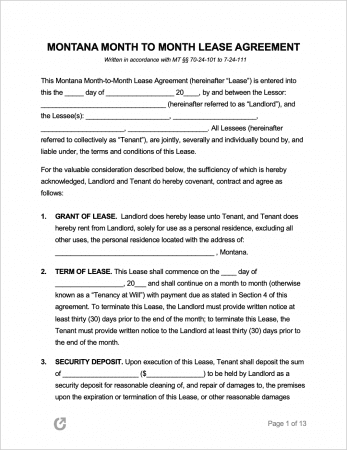

Month-to-Month Lease Agreement – Structured so that either the lessor or lessee can end the contract with thirty (30) days notice to the other party.

Month-to-Month Lease Agreement – Structured so that either the lessor or lessee can end the contract with thirty (30) days notice to the other party.

Download – Adobe PDF, Word (.docx)

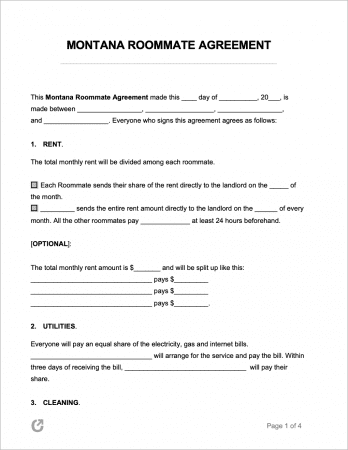

Roommate Agreement – Allows roommates to formulate an agreement about their individual and shared responsibilities in their rental unit.

Roommate Agreement – Allows roommates to formulate an agreement about their individual and shared responsibilities in their rental unit.

Download – Adobe PDF, Word (.docx)

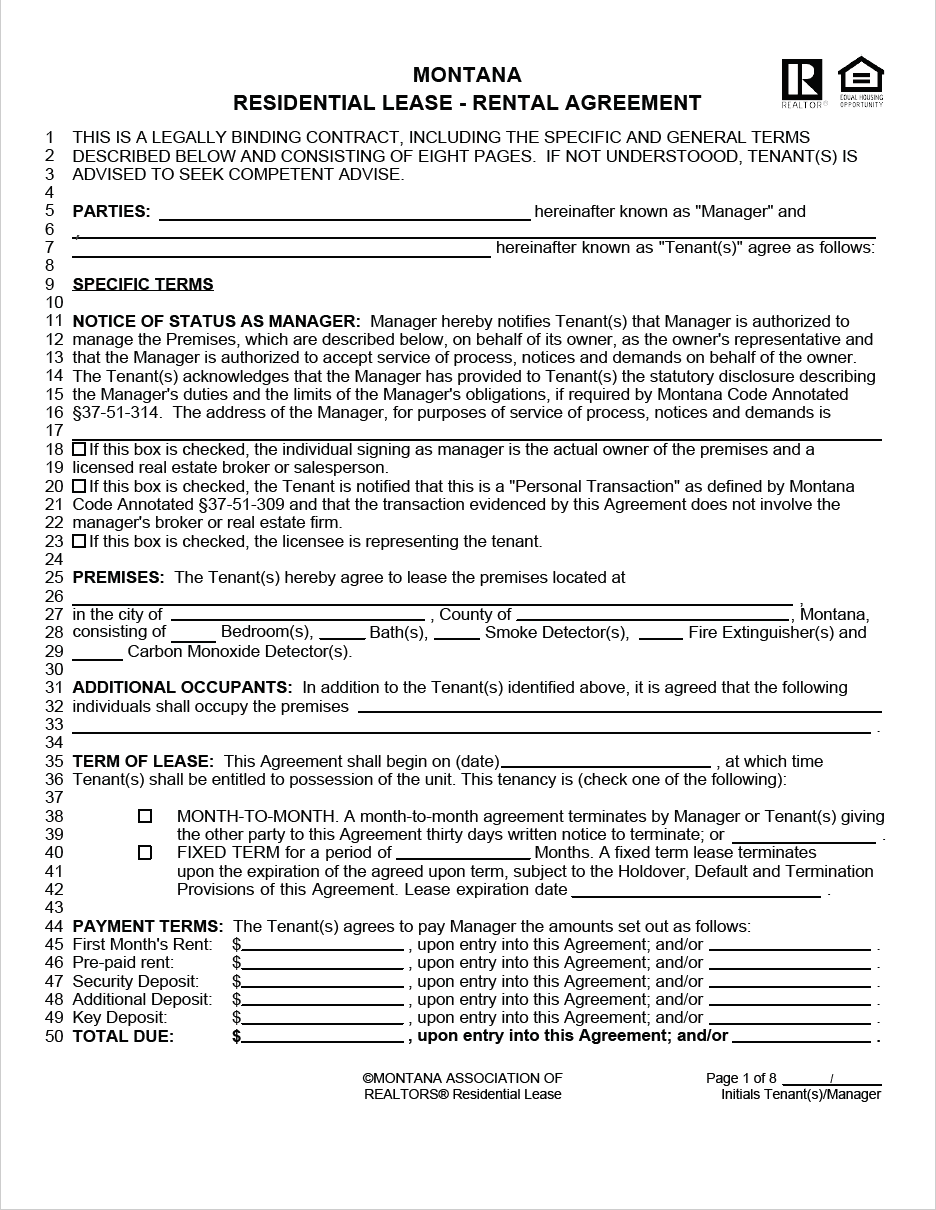

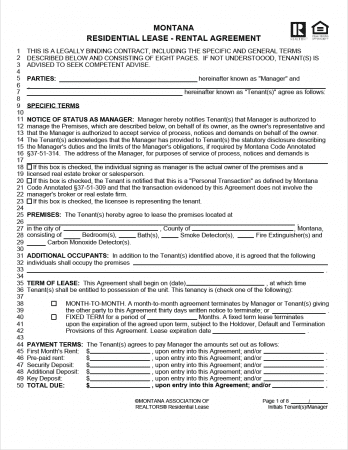

Standard Residential Lease Agreement – A typical lease agreement that contains all necessary state and local law provisions to lock lessee(s) into renting a property for a length of one (1) year.

Standard Residential Lease Agreement – A typical lease agreement that contains all necessary state and local law provisions to lock lessee(s) into renting a property for a length of one (1) year.

Download – Adobe PDF, Word (.docx)

Sublease Agreement – Allows a lessee (called the “sublandlord”) to rent out their currently-rented unit to another party (the subtenant) so long they receive permission from the landlord.

Sublease Agreement – Allows a lessee (called the “sublandlord”) to rent out their currently-rented unit to another party (the subtenant) so long they receive permission from the landlord.

Download – Adobe PDF, Word (.docx)

What is a Montana Lease Agreement?

A Montana Lease Agreement is a legal document that is drafted and signed by landlords and tenants to establish rules and obligations pertaining to the rental of residential or commercial property. A lease agreement is one of the last steps in the property-management process, often coming after a landlord has successfully screened a tenant through the use of a rental application.

Laws

- Ch. 24 (“Residential Landlord and Tenant Act of 1977”)

- Ch. 25 (“Residential Tenants’ Security Deposits”)

Landlord-Tenant Guides / Handbooks

When is Rent Due?

Per § 70-24-201(2), the tenant must pay rent in equal monthly installments at the start of every month. However, if the rental term is one (1) month or less, the tenant must pay rent at the start of the term. There is no grace period offered by state law.

Landlord’s Access

Emergency (§ 70-24-312(2)): Landlords may enter the rental dwelling without prior consent from tenants in emergency circumstances.

Non-Emergency (§ 70-24-312(2)): Landlords may only enter at reasonable times and are required to give at least twenty (24) hours’ notice of their intent to enter. They can only enter to inspect the rental, conduct repairs, make alterations/improvements, or show the unit to prospective renters.

Landlord’s Duties

In accordance with § 70-24-303, landlords must comply with the following:

- Comply with all building / housing codes that apply to the health and safety of the tenants (in buildings/units that were constructed after 1977);

- Do not allow a situation where a tenant or other person(s) engages in an activity on the premises to create a potential for the rental to damaged or destroyed, or a situation where neighboring tenants could be injured;

- Landlords must make any and all repairs to ensure the rental is worthy for living in.

- Keep all common clean and safe;

- Keep all plumbing and electrical systems in safe and good working order;

- Allow for safe and efficient waste removal, unless otherwise specified in the lease;

- Supply constant running water and hot water between October 1 and May 1;

- Install both a carbon monoxide detector and an approved smoke detector.

Tenant’s Duties

- Follow all building code related to health and safety;

- Keep their rental unit clean and safe;

- Throw away trash safely and in a sanitary manner;

- Keep plumbing and other related fixtures clean;

- Use the premises and all included appliances and systems in the manner in which they are meant to be used; and

- Do not disturb other tenants;

Required Disclosures

- Lead Paint Disclosure: As per federal law, if a landlord has knowledge of any lead paint hazards in their rental property built before 1978, they must disclose this fact to tenants. In addition, they must provide tenants with a copy of a pamphlet about the topic.

- Names and Addresses (§ 70-24-301): At or before the commencement of the tenancy, the names and addresses of the landlord and anyone authorized to act on their behalf must be disclosed.

- Mold Disclosure (§ 70-16-703): If a landlord has knowledge of the presence of mold in the building, they must disclose this to tenants prior to signing a lease. The landlord must also disclose if a building has been tested for mold, and provide a copy of the results of that test.

- Statement about Condition of Rental Dwelling (§ 70-25-206): Landlords who require tenants to provide a security deposit must provide each tenant with a separate written statement attached to the lease that details the present condition of the unit.

Security Deposits

Maximum: There is no maximum security deposit amount dictated by Montana state law.

Returning to Tenant (§ 70-25-202(1)): In cases where there is no damage to the rental dwelling, no cleaning required, and no unpaid rent or utilities, landlords must return the security deposit within ten (10) days. They must do so by mailing it to the new address provided by the tenant, or to the tenant’s last-known address if no new address was provided.

In cases where there is any rent due, any damages, or cleaning charges, the landlord must provide tenants with a written list detailing these expenses within thirty (30) days of the termination of a tenancy, or within thirty (30) days of a surrender and acceptance of the premises.

Deposit Interest: No state statute; property managers do not have to collect interest from tenants’ deposits.

Uses of the Deposit (§ 70-25-201): Per state law, landlords can make the following deductions from a tenant’s security deposit:

- Unpaid rent,

- Late fees,

- Utilities,

- Fees (penalities) due from conditions included in the lease,

Cleaning charges cannot be deducted from the deposit unless it is clear the cleaning required is due to the tenant’s negligence. Furthermore, no deductions can take place until a written notice has been provided to the tenant specifying exactly what needs to be cleaned and the method in which it needs to be cleaned. Once the tenant(s) receive the notice, they have twenty-four (24) hours to complete all cleaning.