Florida Power of Attorney Forms

A Florida power of attorney form lets a person choose a delegate to act on their behalf in regards to their healthcare, finances, real estate, or business matters. The person selected (the “agent”) must understand the weight of their duties and will need to understand they are required by law to uphold the requirements contained in the document.

By selecting a “durable” form, the agent who is being granted with one (1) or more powers will keep their decision-making powers in the event the person completing the form (known as the “principal”) succumbs to a serious medical emergency that leaves them unable to make decisions on their own. The legal term used for describing the said medical situation is becoming “incapacitated.”

Types (6)

| Medical | Durable | General | Limited | Minor | Vehicle |

Which Form is Right for Me? | |

| Medical | Used for naming a person (health care surrogate) with the responsibility of communicating the principal’s wishes to medical professionals (e.g., doctors) when the principal cannot speak for themselves. The form is completed prior to the principal experiencing an emergency, and only goes into effect when the principal becomes incapacitated. |

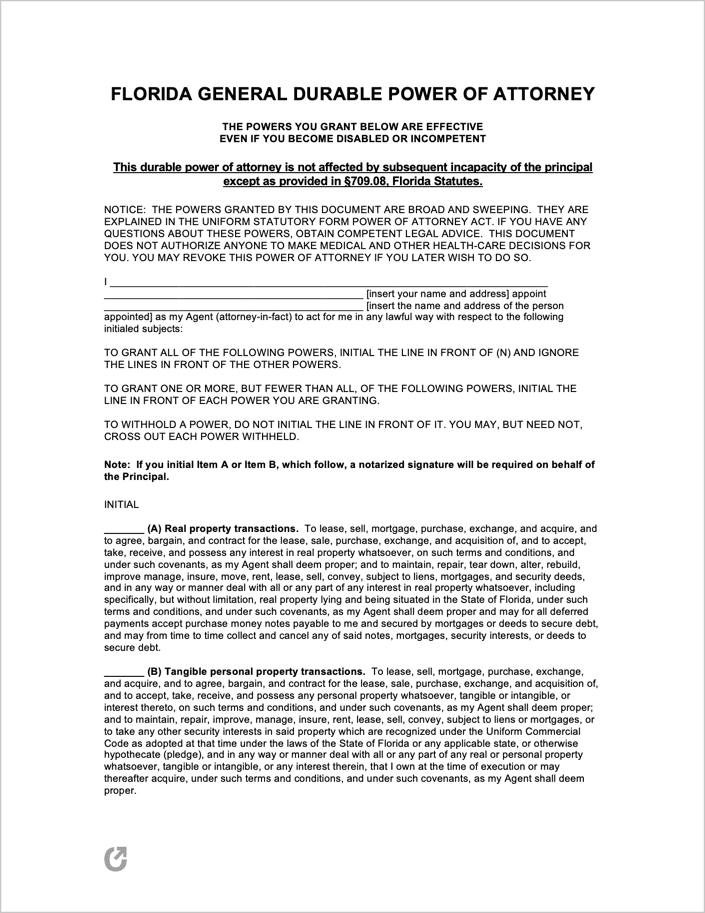

| Durable | For naming an agent that will have the power to handle one’s financial, estate, and any other related personal matters. Can be used for any non-medical related task. Being durable, the form remains in effect until the principal terminates it, or passes away. |

| General | Allows the person completing the form to elect an agent to oversee all (or some) of their financial matters. For granting the same powers as the durable type above, but is non-durable, meaning it will terminate should the person completing the form become incapacitated. |

| Limited | Used only for circumstances involving the transfer of a narrow, rather than a broad range of decision making powers from a principal to an agent. A non-durable form. |

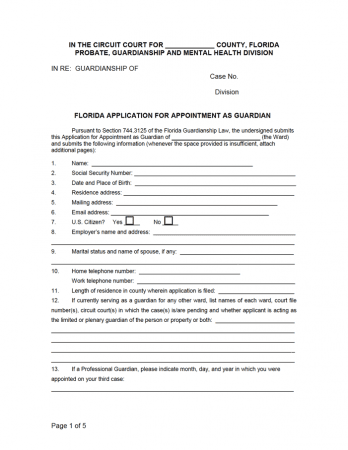

| Minor Child | A form used for transferring parental powers to a guardian (Ward). Parents who know of a trusted family member, friend, or other individual they wish to entrust the care of their child can request them to complete the petition and bring it before a county judge for approval. |

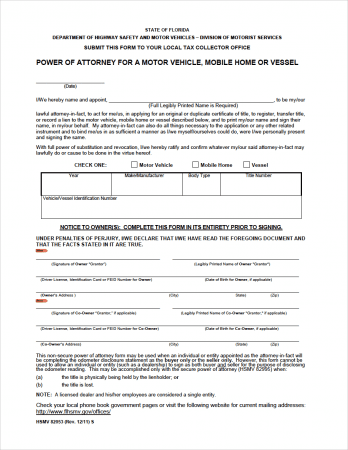

| Motor Vehicle (HSMV-82053) | A document provided by the Florida Division of Motorist Services to allow FL residents to grant decision-making power regarding a motor vehicle, vessel, or mobile home to another person. Can be used for allowing a person to buy, sell, register, and complete other actions on behalf of the person that completes the form. |